Burden of Prolonged Suspension Due to Social Distancing

Jung Eun-bo Director's 'Market Communication' Shift

Schedule Reduction... Impact on Second Half Inspection Timeline

[Asia Economy Reporter Oh Hyung-gil] The Financial Supervisory Service (FSS) is rapidly conducting comprehensive inspections that had been suspended due to the resurgence of COVID-19.

Although the government's Level 4 social distancing measures, which were the reason for halting the inspections, have not yet been lifted, it is understood that the financial authorities judged that further delays would only burden both the authorities and the institutions involved. This move is also seen as an intention to promptly complete the inspections originally scheduled amid anticipated changes in the direction of financial supervision following the inauguration of the new FSS Governor, Jeong Eun-bo.

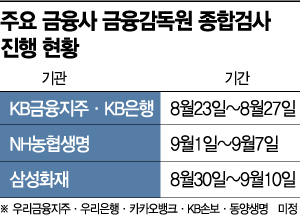

According to financial authorities and the financial sector on the 27th, the FSS recently notified Samsung Fire & Marine Insurance that it will conduct an on-site comprehensive inspection for two weeks from the 30th of this month to the 10th of next month.

For NH Nonghyup Life Insurance, an on-site inspection is scheduled for one week starting September 1. Additionally, on-site inspections for KB Financial Group and KB Bank began on the 23rd and are expected to conclude on the same day.

The FSS had started comprehensive inspections of these financial companies since June but suspended the on-site inspections due to the difficulty of continuing them amid the escalation to Level 4 social distancing caused by the resurgence of COVID-19.

Although inspections have resumed, it is known that the scale and schedule of on-site inspections have been significantly reduced considering quarantine guidelines. A representative of a financial institution subject to inspection said, "Only the minimum essential personnel are coming on-site," adding, "Accordingly, the relevant departments plan to select the necessary personnel to undergo the inspection."

Comprehensive inspections, which thoroughly examine the overall operations and financial status of financial institutions, typically involve more than 20 inspectors residing at the financial institution for at least 2 to 3 weeks, reviewing all areas from governance and internal controls to soundness, consumer protection, personnel, and budgeting.

According to the FSS's inspection operation plan announced in February this year, the core areas of comprehensive inspections for banks and holding companies are ▲consumer protection ▲internal control and governance ▲soundness.

Originally, these inspections were supposed to be completed in July, but the schedule has been postponed to after September, making it uncertain whether inspections will proceed in the second half of the year. The financial sector has pointed to Woori Financial Group, Woori Bank, Kakao Bank, Tongyang Life Insurance, and KB Insurance as potential inspection targets.

Since it takes 2 to 3 months from data submission through preliminary inspection to the main inspection, it is practically impossible to complete the schedule by the end of the year, and there are concerns that inspections may be postponed until next year.

The FSS had announced plans for large-scale comprehensive inspections this year. The plan was to conduct comprehensive inspections on a total of 16 institutions: 2 banks, 3 financial holding companies, 4 securities firms, 4 insurance companies, 1 asset management company, 1 specialized credit finance company, and 1 mutual finance company. This was the largest number of targets since the inspections were reinstated in 2018.

There is also an interpretation that the reduction in comprehensive inspections is not solely due to COVID-19. It is pointed out that the supervisory authorities' stance is changing following Governor Jeong's inauguration, who emphasized 'communication with the market' and 'support over regulation.' Some speculate that comprehensive inspections might be abolished to differentiate from the approach of former Governor Yoon Seok-won, who reinstated them.

Governor Jeong said upon his inauguration on the 6th, "We will operate 'preemptive supervision' and 'post-supervision' in harmony," adding, "Relying solely on post-supervision sanctions makes it difficult to gain cooperation from the financial sector and ultimately weakens consumer protection."

Financial Services Commission Chairman nominee Ko Seung-beom also evaluated the reinstatement of FSS comprehensive inspections, saying, "It deepened the supervisory authorities' understanding of systemic issues within companies and induced financial companies' self-regulatory efforts to establish sound management and governance," while also acknowledging concerns about the increased inspection burden on financial companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)