'Yeongkkeul Method' Trending in Finance and Office Worker Communities

Direct Examination Shows It Is Mostly Feasible

Cases Where Husband Is Homeowner and Wife Is Tenant

Experts Criticize "Market Distortion Due to Successive Regulations"

[Asia Economy Reporter Song Seung-seop] Seong Ji-hwan (34, pseudonym), who lives in Seoul, recently fully withdrew his retirement pension, which he had saved about 40 million won. Although he had 180 million won in savings, deposits, and liquidated stock and Bitcoin accounts, and additionally took out a credit loan of up to 80 million won, it was still far from enough to buy a house. Seong said, "My income is not low, but the loan path is blocked, so there is no way," adding, "I want to find a loan method, even from secondary financial institutions or P2P, to buy my own home in a high-priced area (a slang term for expensive housing areas)."

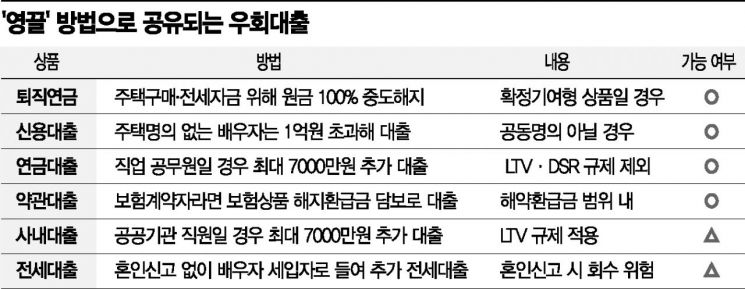

Real demand buyers, whose money flow has been blocked by the financial authorities' all-out loan regulations, are seeking detours. In investment and office worker communities, methods of 영끌 (pulling together all resources, including borrowing to the limit) that cross the line between legal and illegal are openly posted. Critics point out that the government regulates while the market evades, causing various contradictions and controversies.

On the 25th, a post discussing loans not regulated by the government became a hot topic on an office worker community site. Users expressed concerns, saying, "People frequently withdraw their retirement pensions early to 영끌," and "If the government amends the Employee Retirement Benefit Security Act or adds conditions, won't this method be blocked?" The retirement pension, prepared to guarantee the public's old-age life, has become a representative 영끌 means.

According to checks through financial institutions, although early withdrawal of retirement pensions is generally known to be difficult, it is possible if certain reasons and conditions are met. A typical example is a defined contribution (DC) retirement pension subscriber who is a non-homeowner purchasing a house in their name or bearing the cost of jeonse (long-term deposit lease) or deposit. Despite the downside of having to return the tax deduction benefits received due to unstable old age, people withdraw the pension because the increase in house prices is seen as much more beneficial. However, while retirement pension collateral loans are theoretically possible, most commercial bank counters reject them.

According to the '2021 Housing Finance Research' published by the Korea Housing Finance Corporation in April, as of 2019, 72,830 people withdrew 2.7758 trillion won early. This is 2 to 3 times the number and amount compared to 2015, when 28,080 people withdrew 964.8 billion won early. Especially, looking at the reasons for early withdrawal, 52% were for house purchase and residential lease purposes, with people in their 30s, who have significant housing real demand, accounting for about 50%. Choi Kyung-jin of the Housing Finance Research Institute said, "With the rise in jeonse and housing prices combined with the COVID-19 situation, the scale of early withdrawal of retirement pensions is expected to increase, especially among those in their 30s," adding, "Since this may lead to a decrease in retirement assets in the future, appropriate alternatives for easing early withdrawal need to be prepared."

Methods to secure additional credit loans through spouses are also being shared. Since the end of last year, if a credit loan exceeding 100 million won is taken for house purchase in regulated areas, regulations such as recall follow, but an additional credit loan is possible for a spouse without ownership. Dual-income couples can avoid recall agreement regulations, but since it is practically difficult to check whether a house is purchased per household, it is not separately regulated. Therefore, it is common for the higher-income spouse to take out a loan exceeding 100 million won to supplement house purchase funds, while the lower-income spouse borrows money within the 100 million won limit.

There are also many recommendations to use policy loans if you are an insurance policyholder. Policy loans are loan products that borrow money using the surrender value of an insurance product as collateral. Although it varies by insurance company and product, it is generally possible to borrow 50-95% of the surrender value. Interest rates are generally determined between 2.3% and 9.9%. As long as insurance premiums are paid, repayment can be made freely within the period, and the loan term corresponds to the maturity date of the insurance contract. For pension insurance, repayment must be completed before the pension starts.

In some cases, people who have not registered their marriage or who have divorced take their spouse as a tenant. In this case, the legally 'unrelated' spouse can obtain a jeonse loan as a tenant. Although there is a risk of recall upon marriage registration, it is secretly used because it can secure funds amounting to hundreds of millions of won.

Civil servants and public enterprise employees are considering pension loans and in-house loans. Civil servant pension loans can be up to 70 million won, and they are exempt from Loan-to-Value (LTV) and Debt Service Ratio (DSR) regulations. Recently, among public institution employees, controversy arose over reverse discrimination as the in-house loan limit was restricted to 70 million won and LTV was applied.

Experts point out that this situation is the result of the government piling on regulations whenever problems arise. Professor Kim Dae-jong of Sejong University's Department of Business Administration criticized, "Market regulation inevitably causes distortions," adding, "Since the government failed to control housing prices and implemented regulations, demanders are pulling money from here and there."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.