Increase in Pre-Subscription Amid Soaring Apartment Prices in the Seoul Metropolitan Area

Expansion to Public Land Private Housing and Public Development

However, Short-Term Move-In Supply Remains the Same, 'Josam-mosa' Situation

Concerns Over Delayed Move-Ins Due to Urban Development Causing False Hope

The government's decision on the 25th to add 101,000 units to the pre-sale quota is due to the recent acceleration of apartment price increases to record highs, especially in the metropolitan area. Since it takes at least five years or more for supply from new land designations or public developments to be completed and occupied, the immediate effect on stabilizing housing prices is limited. Therefore, the intention is to alleviate short-term supply-demand anxiety by selecting prospective residents through pre-sale applications 2 to 3 years before the main sale.

However, pre-sale applications only bring forward the reservation period for moving into new apartments whose construction timing is uncertain; they do not actually increase the planned supply volume itself. Because of this, there are criticisms in the market calling it a 'shell game.' Especially, given strong opposition from residents to public developments and the uncertain participation of private developers in pre-sale applications, unilaterally announcing an increase in supply volume is seen as a risky move.

Pre-sale quota increased by 101,000 units... alleviating short-term supply-demand anxiety

The most notable feature of this pre-sale expansion plan is that the target has been expanded from public sales to private sales. Starting from the second half of this year, 87,000 units will be supplied early through private sales. The system is improved so that if a private developer receives public land from land development agencies such as LH and prepares only the architectural design, pre-sale applications can be made. Considering that it usually takes about two months from land supply to architectural design, the application timing is advanced by 2 to 3 years compared to before.

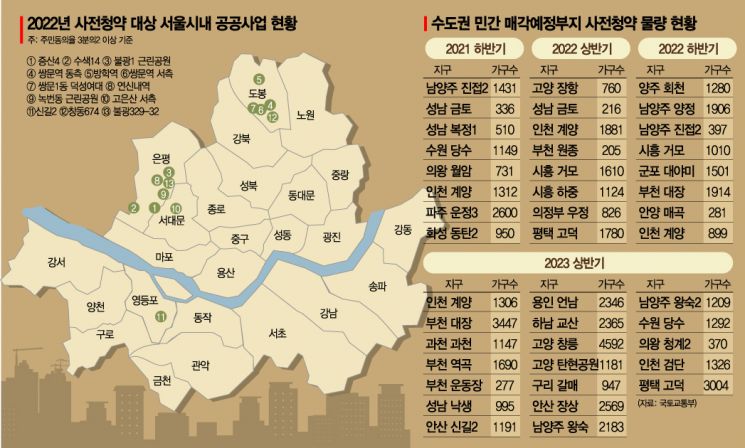

Adding to this, by expanding the application to public-led redevelopment projects such as urban public housing complex projects and residential regeneration innovation districts, an additional 14,000 units will be added, making the total new pre-sale target volume 101,000 units. Including the existing 62,000 public sale units, the total pre-sale volume supplied by the first half of 2024 will increase to 163,000 units. Of these, 133,000 units are in the metropolitan area alone. Analysts say the absolute volume itself is not insignificant.

Private pre-sale applications will also follow the same process as existing pre-sales, where the estimated sale price is disclosed at the time of application, and selection is based on income and asset criteria at that time. Applicants must maintain a no-homeownership status until the main sale and can give up their status at any time. The difference is that if selected, the applicant cannot use their subscription savings account for other general applications. If the pre-sale winning status is given up, the account is restored, but unlike existing pre-sales, applicants cannot freely apply again. Also, if the applicant is under a re-winning restriction, they cannot apply for pre-sale.

Increase expected in mid-to-large sized pre-sale units

With the implementation of private pre-sale applications, the number of brand apartments in mid-to-large sizes, which are preferred by buyers, is expected to increase. In public sale pre-sales, units between 60㎡ and 85㎡ account for 62.1%, and those over 85㎡ only 4.2%, but in private sales, 60㎡ to 85㎡ units make up 73%, and those over 85㎡ account for 16.8%.

Additionally, the government plans to introduce pre-sale applications to urban complex projects and residential regeneration innovation districts announced in the 2·4 measures, supplying 14,000 units from the second half of next year. Once the district designation is made in the project areas such as urban complex projects, pre-sale applications will be conducted within 18 months, followed by the main sale and construction one year later. According to this plan, the time to sale will be shortened by 11 to 12 years compared to general redevelopment projects.

The Ministry of Land, Infrastructure and Transport explained, "Pre-sale applications will be implemented from the second half of next year in 13 candidate sites in Seoul where more than two-thirds of residents' consent has been obtained, enabling district designation."

May only increase false hopes... private incentives also insufficient

However, there are many concerns about the expansion of pre-sale applications. Especially for urban public housing complex projects and the 3rd New Towns, where additional pre-sale units have been added, the project schedules are still uncertain, raising criticism that it will only increase indefinite 'false hopes' for low-income households without homes. The 3rd New Towns have not yet completed land compensation, and urban complex projects are still in early stages, so selecting residents already is considered premature.

Increasing pre-sale applications requires participation from private developers, but it is questionable whether the entire supply volume can be secured. The government plans to supply public land to private developers on the condition that pre-sale applications are conducted within six months, and companies holding already sold land will receive incentives for other public land supplies if they conduct pre-sale applications within six months.

Lee Eun-hyung, senior researcher at the Korea Construction Policy Institute, said, "Since there was a policy to decide the sale price within a certain range at the main sale after pre-sale applications, private companies have little incentive to participate in pre-sale applications during a period of rising housing prices like now," adding, "Incentives at the level of guaranteeing public land if pre-sale applications are conducted will be necessary."

Lee also said, "Applying pre-sale applications to the 2·4 measures is not something that should be pushed recklessly," and "Since there are many stakeholders involved in ownership of land and buildings, if the entire land is not secured, pre-sale applications are unlikely to proceed smoothly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)