High Insurance Premiums and Potential for Increased Financial Losses Upon Early Termination

[Asia Economy Reporter Park Sun-mi]Mr. Kim Seung-hwan (alias) canceled his average whole life insurance policy, which had a death benefit of 100 million KRW and a monthly premium of 450,000 KRW (10-year payment), before six years had passed since enrollment, and re-enrolled in an increasing whole life insurance policy where the death benefit rises annually. As a result, he had to bear a financial loss of 24.98 million KRW due to the cancellation of the existing contract, his monthly premium increased to 710,000 KRW, and the payment period doubled.

On the 25th, the Financial Supervisory Service announced that there has been an increase in cases where consumers are encouraged to subscribe to increasing whole life insurance without sufficient explanation or to cancel existing whole life insurance and switch to increasing whole life insurance, urging consumers to exercise special caution.

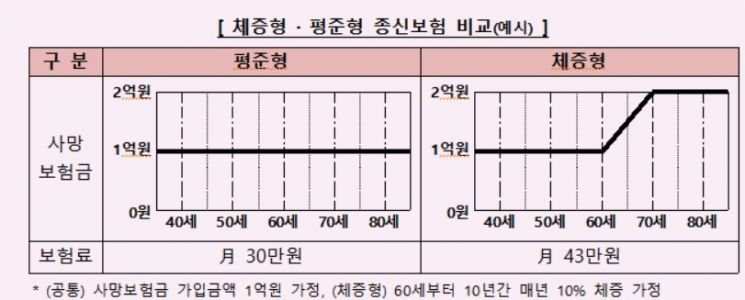

Increasing whole life insurance is a type of whole life insurance where the death benefit increases after a certain period following enrollment, unlike level whole life insurance where the death benefit remains the same throughout the term. However, since the increase in the death benefit is reflected in the premium, the premium is more expensive than that of level whole life insurance, and it is mainly sold as non-surrender or low-surrender type, which can lead to greater financial losses if canceled early.

Despite the overall downturn in the life insurance and whole life insurance market, the sales proportion of increasing whole life insurance products continues to rise. In the first quarter of this year, increasing whole life insurance accounted for about 22.2% of all new whole life insurance contracts, up 5.3 percentage points from 16.9% the previous year.

Although the sales proportion of increasing whole life insurance is growing, when recommending enrollment, only the aspect that "the death benefit increases annually" is emphasized, and guidance on the policyholder’s premium burden due to the increase in the death benefit is insufficient. In particular, when canceling existing whole life insurance and switching to a new increasing whole life insurance policy, there is often insufficient explanation regarding the possibility of losses from canceling the existing contract and comparisons between cancellation and new contracts, resulting in increased consumer damage.

A Financial Supervisory Service official stated, "When canceling existing whole life insurance and switching to increasing whole life insurance, financial and non-financial disadvantages may occur, so agents should provide a comparative explanation of the pros and cons of the new and old contracts," adding, "We plan to strengthen monitoring of complaints related to incomplete sales of increasing whole life insurance and guide insurance companies to enhance their internal control functions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.