Analysis of 2.4 Million Individual Stock Accounts at NH Investment & Securities from January to July

Accounts with Lower Turnover Rates Show Relatively Higher Returns

Female Returns at 2.9% Significantly Outperform Male Returns at 0.7%

'Short-Term Traders' Among Men in Their 20s Are the Only Group with Negative Returns

Men with Overconfidence Show the Lowest Returns: "Reflection on Investment Strategies"

[Asia Economy Reporter Lee Seon-ae] #Have individual investors made money amid the stock market boom continuing from last year into this year? 'Stock investment' has established itself as a new culture across all generations, including the millennial and Generation Z (MZ generation). According to six major securities firms last year (NH Investment & Securities, Mirae Asset Daewoo, KB Securities, Korea Investment & Securities, Kiwoom Securities, Yuanta Securities), approximately 7.23 million new accounts were created at these firms last year, nearly tripling compared to about 2.6 million in 2019. During the same period, the KOSPI rose about 30% (in 2020), allowing not only existing investors but also so-called 'Joorini' (a portmanteau of 'stock' and 'child' referring to stock market beginners) who entered the stock market for the first time to earn profits through stock price increases. However, this year’s market is challenging. Since the first half of the year, the KOSPI has struggled to surpass previous highs, experiencing corrections after rises. Recently, there have even been comments that the market approached 'panic selling,' creating widespread fear. Various investment communities are filled with complaints about daily losses increasing by tens of millions of won and loss rates entering the -30% range. In the second half of the year, with the added issue of the U.S. Federal Reserve's tapering (asset purchase reduction), the 'ant investors’ accounts' face even greater threats.

NH Investment & Securities analyzed accounts invested in by individuals this year to examine investment strategies, comparing the turnover rate with the returns of individuals who tend to focus on short-term capital gains. Historically, the reason individual investors’ returns have been lower than those of foreigners or institutions is believed to be their trading behavior of repeated buying and selling rather than buying at low points and holding stocks steadily.

Among 'day traders' who frequently bought and sold stocks, 20-something males showed lower returns, whereas females who held stocks steadily after buying once had relatively higher returns. Teenagers, heavily influenced by their parents, also showed high returns, with the most stable investment tendencies across all age groups.

◆The higher the turnover rate, the lower the returns= According to NH Investment & Securities on the 24th, an analysis of about 2.4 million accounts that traded stocks from January to July this year showed that accounts with lower turnover rates recorded relatively higher returns. Turnover rate (defined as 100% when buying and selling stocks equal to the principal amount of 100 each) is an indicator of how actively stocks were traded over a certain period. Accounts with the lowest turnover rate segment, below 50%, had an average return of about 4%, the highest among all groups, while accounts with turnover rates above 1000% saw average returns turn negative. This data proves that individuals who bought and sold their investment principal more than ten times over seven months generally incurred losses.

Looking at returns by turnover rate segments, the 0-50% turnover segment recorded a return of 3.8%. The 50-100% segment had a return of 3.3%, and the 100-500% segment showed 3.7%. Returns decreased as turnover rates increased. The 500-1000% segment recorded 0.8%, and beyond that, returns were negative. The 1000-5000% segment had -13.8%, and the 5000%+ segment recorded -29.5%.

However, accounts with turnover rates below 500%, which had higher returns, accounted for about 80% of all accounts, with those between 100% and 200% making up the largest share at 18%. Accounts with turnover rates above 1000%, where returns turned negative, accounted for only about 10% of the total.

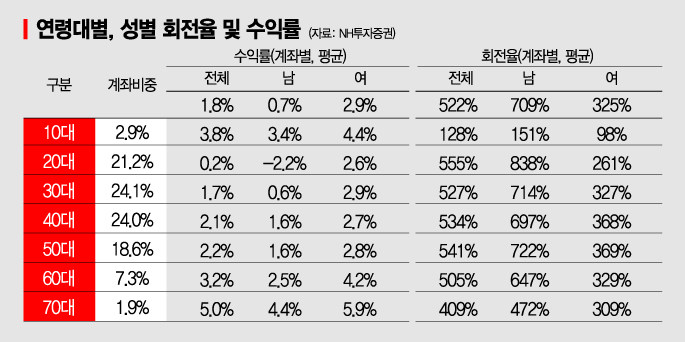

◆Men have higher turnover rates and lower returns than women, especially pronounced in the MZ generation= There was a clear gap in turnover rates and returns by gender and age group. On average, men had turnover rates more than twice as high as women (men: 709%, women: 325%), while women’s average returns were significantly higher at 2.9% compared to men’s 0.7%. This indicates that women, who tend to have a more stable investment style, earn profits through value investing, unlike men who tend to be more aggressive.

In the stock market, a new term 'Women Buffett' (a combination of 'woman' and the legendary investor Warren Buffett) has even emerged. Securities experts analyze that men tend to overestimate their abilities and trade more frequently. Professors Brad Barber of UC Davis and Terrance Odean of UC Berkeley examined 35,000 households’ stock accounts over six years from 1991 and concluded that men who believed they could predict stock prices traded more frequently than women and ultimately earned lower investment returns.

By generation, 20-something males showed the most aggressive investment tendencies. Their turnover rate was 838%, the highest among all age groups, and their average return was the only negative one at -2.2%. Among age groups, teenagers showed the most stable investment tendencies. Their turnover rate was 128%, lower than that of those in their 70s (409%), and their returns were the second highest at 3.8%. Since last year, minor accounts have increased significantly due to gifts, public offering investments, and parents’ efforts to educate their children on financial management. For this reason, many accounts are believed to invest in companies expected to grow long-term and hold onto them.

◆Long-term investment in value stocks VS short-term response with leverage and inverse ETFs= Differences in stock selection were notable depending on turnover rates. In the relatively low turnover segment (below 1000%), the most traded stocks were Samsung Electronics, Samsung Electronics Preferred Shares, Kakao, Hyundai Motor, etc. This suggests trading based on companies expected to grow or currently considered top-tier. Conversely, in the segment with turnover rates exceeding 5000%, the most traded stocks were ETFs like KODEX Leverage and KODEX Futures Inverse 2X, which move approximately twice (or -2 times) the market direction. The negative returns in high turnover accounts are attributed to concentrated investments in highly volatile stocks.

Due to recent market corrections, experts recommend individual investors reconsider their trading methods. Regarding this, Pyeon Deuk-hyun, head of the Asset Management Strategy Department at NH Investment & Securities, advised, “It is almost impossible for individuals to predict market directions or individual stock movements accurately, yet sometimes they mistakenly believe they can. However, once they trade, they quickly realize their mistakes, so it is necessary to acknowledge one’s limits promptly and change one’s trading patterns.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)