Intense Loan Regulations Amid Worst Jeonse Crisis

Direct Hit to Homeless and Genuine Buyers Unavoidable

Housing Stability at Risk, Let Alone Homeownership

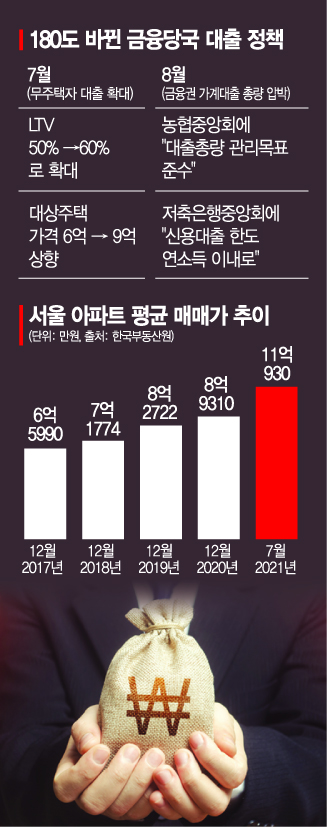

The government is tightening the flow of money in the market by pulling out the card of suspending mortgage loans and jeonse deposit loans amid the rapidly increasing household debt, plunging the real estate market into chaos. This is a policy move completely opposite to the one just a month ago, when the government eased loan regulations to lower the barriers for home purchases by non-homeowners with genuine demand. Amid soaring house prices due to policy failures, criticism is spreading that the zigzag policies of the government have left the brunt of the damage on non-homeowner low-income citizens.

◇Government reverses eased loans for genuine demand within a month= From the 1st of last month, the government implemented measures to ease loan regulations such as the Loan-to-Value ratio (LTV) for mortgage loans for low-income and genuine demand borrowers, in line with the household debt management plan. The preferential LTV margin for genuine demand borrowers was expanded from the current 10 percentage points to up to 20 percentage points. The income criteria were also raised from a combined couple income of 80 million KRW or less to 90 million KRW or less (for first-time buyers, from 90 million KRW or less to 100 million KRW or less). The price criteria were eased from 600 million KRW or less to 900 million KRW or less in speculative and overheated speculation areas, and from 500 million KRW or less to 800 million KRW or less in regulated areas.

However, non-homeowner genuine demand borrowers have found it difficult to obtain loans from commercial banks at least until the end of this year. This is because banks have effectively closed their loan windows amid continuous and strong demands from financial authorities to strictly manage the household loan growth rate.

With household loans such as jeonse deposit loans and mortgage loans being abruptly blocked, not only market demanders but also experts have fallen into panic. The government is accused of devastating the housing market by loosening regulations for genuine demand borrowers and then suddenly blocking loans.

◇Where can one afford jeonse prices even with combined annual income?= The problem is that the government's high-intensity measure of suspending loans came amid the worst jeonse crisis. Seoul apartment jeonse prices rose to levels seen right after the new lease law was implemented in July last year, recording the highest increase rate in about a year. According to the Korea Real Estate Board, in the fourth week of July (as of the 26th), Seoul apartment jeonse prices rose by 0.16%, an increase from the previous week's 0.15%. This is the highest increase rate in about a year since the first week of August last year (0.17%), right after the new lease law was enacted. Jeonse prices in the metropolitan area also rose to the highest level in 6 years and 3 months, indicating an extreme jeonse shortage.

Ko Joon-seok, adjunct professor at Dongguk University Law School, said, "If the current jeonse market were stable, it would be fine, but loan regulations in such an unstable jeonse market inevitably hurt genuine demand borrowers." He pointed out that as the impact of the comprehensive real estate tax continues, there is a growing tendency to convert jeonse contracts into monthly rent to pass on taxes, which is rapidly reducing the jeonse supply.

Professor Ko said, "The decrease in jeonse supply raises jeonse prices, and genuine demand borrowers who find it difficult to secure jeonse housing are reluctantly shifting to purchase demand," adding, "But if loans are also blocked, they have no options at all." He said, "Non-homeowners may have to live temporarily with their parents or in-laws, or even buy a tent and endure hardship outdoors," and added, "I cannot understand the government's policy direction at all."

◇Spreading fear of downward residential mobility= By simultaneously regulating mortgage loans and jeonse deposit loans, non-homeowner low-income citizens are immediately exposed to serious housing insecurity. If the suspension of mortgage loans expands, securing a home in key metropolitan areas, whether through pre-sale or purchase, would require tens of millions of won in personal capital. This is unthinkable for young adults with limited disposable funds. Ultimately, only the 'gold spoon' class who can receive parental support or a small number of cash-rich individuals can buy homes.

More seriously, tenants who cannot afford the sharply rising jeonse prices across regions over the past two years are being forced to move to outskirts. If jeonse deposit loans become impossible, salaried workers realistically have no way to cover the tens of millions of won increased deposits.

There are also warnings that mortgage loans could threaten the livelihoods of low-income citizens. Shim Kyo-eon, professor of real estate at Konkuk University, said, "While some demand is for purchasing homes with mortgage loans, nearly half are livelihood loans." He added, "It's not about buying a house with a house as collateral; many use loans to save their chicken restaurants or cover tuition fees," warning, "Low-income citizens whose incomes have disappeared due to COVID-19 will face even greater difficulties if loans are blocked."

Professor Ko said, "It is natural for the number of houses and total loans to increase accordingly," adding, "Even if the total loan amount increases, if the delinquency rate remains unchanged as it is now, it can be considered healthy lending." He further said, "Regulating solely based on total loan amounts without considering delinquency rates is tantamount to pushing non-homeowners onto the streets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)