Q2 Growth Slowdown

Considering the Value of New Drug Pipeline

Approach from a Mid- to Long-Term Perspective

[Asia Economy Reporter Minji Lee] Hansoh Pharmaceutical is expected to show a sluggish stock performance for the time being due to a slowdown in growth caused by the Chinese government's large-scale drug procurement (price reduction) policy.

Looking at Hansoh Pharmaceutical's stock price trend on the 21st, it has plummeted about 23% from 62.98 yuan to 48.46 yuan over the past month. This is analyzed to reflect concerns over margin decline and increased new drug development costs due to the strengthening of the price reduction policy.

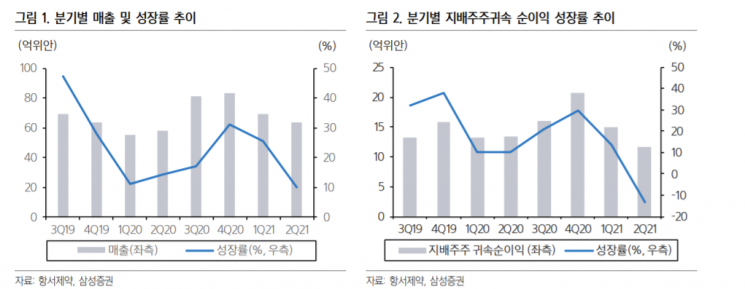

Hansoh Pharmaceutical's second-quarter sales amounted to 6.37 billion yuan, up 10.1% year-on-year. Operating profit was 1.43 billion yuan, down 13% from a year earlier. Net profit attributable to controlling interests recorded 1.17 billion yuan, a 13% decrease. New drug sales increased by 44% to 5.21 billion yuan, but total sales fell short of market expectations. Jaeyoung Jang, a researcher at NH Investment & Securities, said, “For the first time since the fourth quarter, quarterly operating profit and net profit attributable to controlling shareholders decreased compared to the previous year,” adding, “Sales growth slowed due to price reductions for new drugs and generics.” Looking at quarterly sales growth rates, it slowed from 25.4% in the first quarter to 10% in the second quarter compared to the previous year.

The reason for the sluggish total sales is the price reduction policy and the poor performance of camrelizumab. Since November last year, sales of six drugs listed on the Chinese national drug joint procurement list decreased by 57% in the first half of this year compared to the second half of last year. Meanwhile, selling expenses, research and development costs, and financial expenses increased by 11%, 20%, and 71% year-on-year, respectively, causing the operating profit margin to fall by about 6.8% from last year to 22.4%.

The blockbuster new drug camrelizumab, included in the Chinese national medical insurance list at the end of last year, saw its price drop by 85% from 19,800 yuan to 2,828 yuan per 200mg vial on March 1 due to price negotiations for drugs listed under medical insurance. The timing of medical insurance price application varies by region in China, affecting sales volume, and camrelizumab's sales showed a declining trend compared to the second half of last year.

From the second half of the year, the impact of the Chinese government's price reduction policy is expected to increase. The Chinese government has been implementing the price reduction policy since the end of 2018 and conducted a total of five bidding rounds by June this year. Among Hansoh Pharmaceutical's generic drugs, 28 items participated in the bidding, with 18 winning bids, resulting in an average price reduction of 72.6%. Sunmyung Hwang, a researcher at Samsung Securities, analyzed, “In the fifth national drug bulk procurement held in June, eight varieties were bid, and six drugs including the anticancer drug oxaliplatin were awarded. Their sales proportions were 9.2% and 7.1% based on last year and the first quarter of this year, respectively,” adding, “This will affect performance in the fourth quarter of this year and next year.”

However, the strengthened new drug development capability is a positive aspect. Research and development expenses in the first half of the year increased by 38.5% year-on-year to 2.58 billion yuan, accounting for 19.4% of sales. More than 240 clinical trials are underway domestically and internationally. Researcher Hwang explained, “Besides the eight innovative drugs already marketed, including camrelizumab, NDA (New Drug Application) submissions have been completed for anticancer CDK4/6 inhibitors and diabetes treatments SGLT-2/DPP-4, with approval expected within the next year,” adding, “Phase 3 clinical trials for multiple new drug substances such as PD-L1, AR inhibitors, and IL17 are ongoing, indicating a well-established mid- to long-term growth portfolio.”

For the time being, stock prices are expected to be affected by declining profit margins due to the price reduction policy. The preference within the healthcare sector has also declined amid the pharmaceutical industry's slowing earnings growth trend, and the market capitalization ranking has fallen from first place. Researcher Jaeyoung Jang said, “A mid- to long-term perspective is necessary,” adding, “Depending on future clinical trial results, the value of the company's pipeline could be highlighted.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.