Discussion Forum of Sojusung Special Committee on the 19th

'Wealth Income Tax' Kim Nakhoe "Difficult to Pay Over 60% of Median Income"

'Minimum Income Guarantee System' Oh Geonho "Must Be 100% to Support Low-Income Groups"

Unified Voices Saying "Different Outcome" on 'Universal Basic Income'

'Basic Income System' Yoo Jongsung "Carbon and Land Tax Social Reform Upon Introduction"

[Sejong=Asia Economy Reporter Moon Chaeseok] Discussions on improving income security systems such as the basic income system, negative income tax (NIT), and minimum income guarantee have ignited. All three systems require significant fiscal restructuring and, furthermore, discussions on tax increases. The presenters drew a line by stating that the basic income system, which is based on the principle of 'universal payment to all citizens,' differs in nature from the other two, and debated whether the payment standard should be set at 60% or 100% of the median income. The NIT system is premised on payments up to 60% of the median income, while the minimum income guarantee is based on payments up to 100%.

On the afternoon of the 19th, at the Seoul Global Center in Jongno-gu, Seoul, Kim Nakhoe, advisor at the law firm Yulchon and former Commissioner of the Korea Customs Service; Oh Geonho, policy committee chairman of the Welfare State We Make; and Yoo Jongseong, professor at Gachon University, attended a debate hosted by the Presidential Committee on Income-Led Growth titled 'Basic Income? Negative Income Tax? Minimum Income Guarantee?' and engaged in discussions on the direction of income security system reform.

Maintaining Welfare System Framework vs. Major Revisions

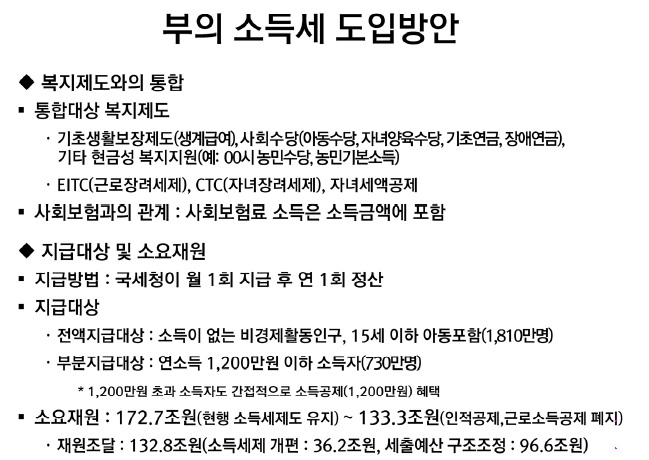

Presentation material by former Commissioner of Korea Customs Service Kim Nakhoe. 'Introduction Plan for Net Income Tax (NIT) on Wealth'. (Source=Sojusung Special Committee)

Presentation material by former Commissioner of Korea Customs Service Kim Nakhoe. 'Introduction Plan for Net Income Tax (NIT) on Wealth'. (Source=Sojusung Special Committee)

The NIT system proposed by former Commissioner Kim involves integrating existing welfare systems such as livelihood benefits and the Earned Income Tax Credit (EITC), then collecting a negative income tax and redistributing it according to principles. Welfare system reform is essential.

The core idea is to set the negative income tax rate at 50% and provide individuals with no income 60% of the median income (KRW 500,000 per month, KRW 300,000 for those under 18). For example, based on an annual income of KRW 12 million, those earning less receive subsidies, and those earning more pay taxes. For someone with zero income, the taxable base is -KRW 12 million. Multiplying by the 50% tax rate results in a tax of -KRW 6 million, meaning they receive KRW 6 million from the state.

Former Commissioner Kim also presented specific funding scenarios, estimating that maintaining the current income tax system would cost KRW 172.7 trillion, while abolishing personal and earned income deductions would cost KRW 133.3 trillion.

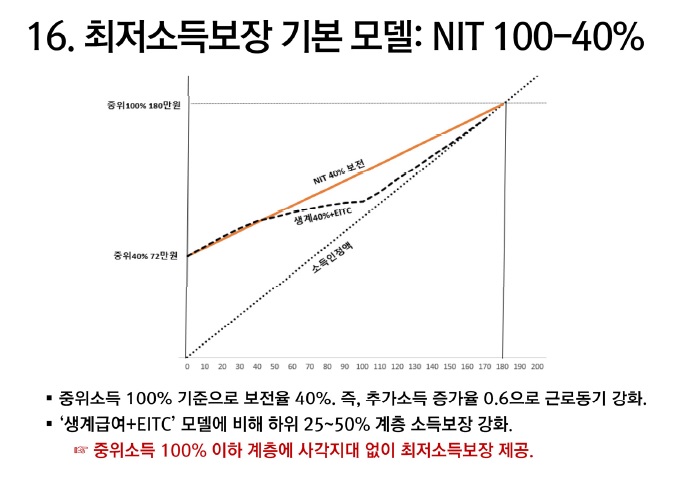

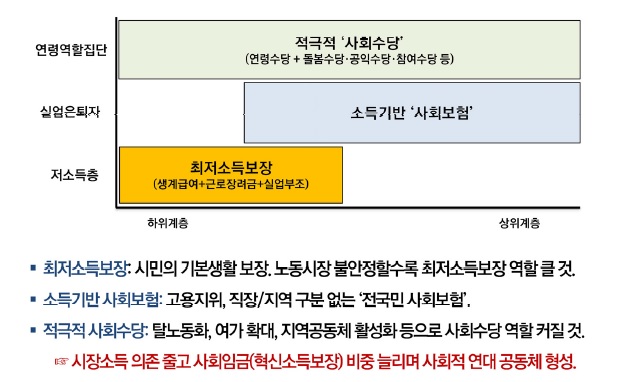

In the minimum income guarantee system proposed by Chairman Oh, the existing cash welfare framework is largely maintained. However, the income support for those earning up to 100% of the median income (about half the population) is increased. The payment standard is raised from 30% to 40% of the median income. For example, the monthly amount for a single-person household, currently about KRW 550,000 at 30% of the median income, would be increased to KRW 720,000 (40% of the median income).

Controversy Over Payment Standards: 60% vs. 100% of Median Income

O Geon-ho, Policy Committee Chair of the Creating a Welfare State, presents the 'Introduction Plan for the Minimum Income Guarantee System'. (Source: Sojusung Special Committee)

O Geon-ho, Policy Committee Chair of the Creating a Welfare State, presents the 'Introduction Plan for the Minimum Income Guarantee System'. (Source: Sojusung Special Committee)

Former Commissioner Kim expressed the opinion that Chairman Oh's range for setting the median income is too broad. Kim said, "If the current standard of 50% of median income is raised to 100%, although welfare blind spots may decrease, funding issues will arise. For a single-person household, the annual payment target would be KRW 22 million, and for a four-person household, KRW 48 to 50 million. Is it not excessive for a household earning KRW 50 million annually to receive livelihood benefits?"

Chairman Oh argued that the payment standard should be expanded to 100% of the median income to reduce welfare blind spots. Oh said, "This plan supports the lower-income groups more precisely than basic income and guarantees higher income to the lower classes than NIT. Applying NIT would strongly restructure the existing welfare system, but the actual guarantee to the lower classes would not be significant."

Agreement on the Need for Government Reorganization Centered on the National Tax Service... Tax Increase Inevitable

O Geon-ho, Policy Committee Chair of the Creating a Welfare State, presents the "Introduction Plan for the Minimum Income Guarantee System." (Source: Sojusung Special Committee)

O Geon-ho, Policy Committee Chair of the Creating a Welfare State, presents the "Introduction Plan for the Minimum Income Guarantee System." (Source: Sojusung Special Committee)

Former Commissioner Kim and Chairman Oh agreed that combining tax administration and welfare administration, strong fiscal restructuring, and discussions on tax increases are indispensable. In particular, Kim emphasized the long-term need to introduce the 'integrated social insurance collection' system pursued during the Participatory Government era. This means transferring the authority to collect social insurance premiums, such as health insurance premiums, from the National Health Insurance Service to tax authorities like the National Tax Service. However, Kim did not directly mention the need for tax increases during the system's introduction process.

Kim stated, "To introduce NIT, it is essential to restructure the budget to secure resources as much as possible. However, if necessary, future discussions may be needed on whether to draw additional resources through carbon taxes, property taxes, or land taxes." Chairman Oh said, "Fundamentally, all these tax systems operate based on the tax system, and the intention is to significantly increase guarantees compared to now. The minimum income guarantee system naturally requires revenue expansion, and discussions on tax increases and social consensus are necessary for its introduction."

'Universal Payment' Basic Income System Is "Different in Nature"… Some Opinions Say "Implementation Is Social Reform"

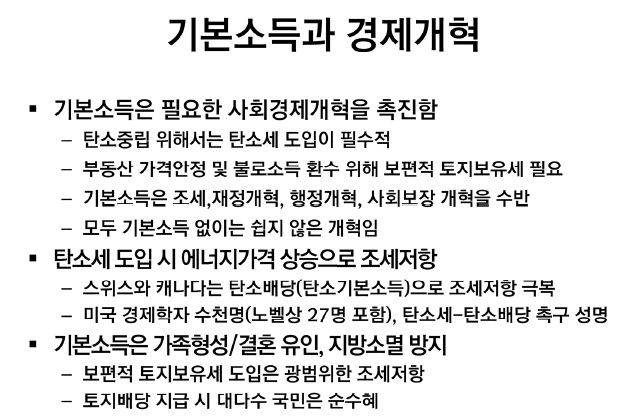

Professor Yoo Jong-seong of Gachon University presents 'Universal Basic Income Implementation Plan'. (Source: Sojusung Special Committee)

Professor Yoo Jong-seong of Gachon University presents 'Universal Basic Income Implementation Plan'. (Source: Sojusung Special Committee)

Former Commissioner Kim and Chairman Oh drew a line by stating that the basic income system differs in nature from NIT and the minimum income guarantee because it is universally paid to all citizens.

Professor Yoo, who presented on the introduction of the basic income system at the debate, argued that there is sufficient room to introduce the basic income system, citing Korea's tax burden rate of 25.2%, which is lower than the OECD average of 33.7%. He claimed that by reforming tax increases and fiscal expenditure structures, up to 10% of the gross domestic product (GDP) could be secured as basic income resources.

Furthermore, he argued that the introduction of the basic income system could enable social reforms such as carbon neutrality, recovery of unearned income from real estate, and incentives for marriage. Professor Yoo said, "The basic income system involves reforms in taxation, finance, administration, and social security, so its introduction would promote carbon neutrality through carbon tax implementation and recovery of unearned income through universal land holding tax. Although applying a universal land holding tax during the system's introduction may face widespread tax resistance, if land dividends are paid, the majority of citizens could be net beneficiaries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.