[Asia Economy Reporter Jeong Hyunjin] An analysis revealed that over the past 10 years, the labor income tax and social insurance premiums (excluding industrial accident insurance) borne by companies and workers have increased by 52.1%. The gap between the amounts paid by companies and the actual income received by workers has widened over the decade.

On the 17th, the Korea Economic Research Institute under the Federation of Korean Industries analyzed the Ministry of Employment and Labor's monthly average wage statistics for companies with over 300 employees from 2010 to last year. The results showed that labor income tax and social insurance premiums deducted from wages paid by companies increased from 920,000 KRW in 2010 to 1,400,000 KRW last year, a 52.1% rise.

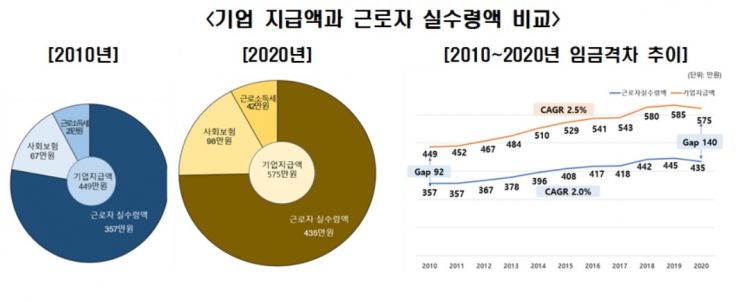

In terms of amounts, in 2010, when a company paid a wage of 4,490,000 KRW, the worker received 3,570,000 KRW after deducting social insurance premiums of 670,000 KRW and labor income tax of 250,000 KRW, totaling 920,000 KRW. Last year, when a company paid 5,750,000 KRW, the worker received 4,350,000 KRW after deducting social insurance premiums of 980,000 KRW and labor income tax of 420,000 KRW, totaling 1,400,000 KRW.

The Korea Economic Research Institute analyzed that the burden of social insurance premiums and labor income tax is increasing more steeply than wage growth. While the worker's actual income increased from 3,570,000 KRW in 2010 to 4,350,000 KRW in 2020, an average annual increase of 2.0%, labor income tax increased by an average of 5.3% per year, and national pension, health, and employment insurance premiums increased by 2.4%, 5.0%, and 7.2% respectively, showing a faster rise.

Specifically, the national pension rate remained unchanged at 9% of wages over the 10 years, but contributions increased with wage rises, going from 370,000 KRW in 2010 to 470,000 KRW in 2020, an average annual increase of 2.4%. Health insurance premiums, including long-term care insurance, increased due to rising medical expenses from aging, expanded coverage, and increased medical fees, and contributions rose with wage increases from 240,000 KRW in 2010 to 390,000 KRW in 2020, an average annual increase of 5.0%. Employment insurance premiums also increased from 60,000 KRW in 2010 to 120,000 KRW in 2020, an average annual increase of 7.2%, due to rate hikes and wage increases.

The Korea Economic Research Institute emphasized that to raise real wages, the introduction of an income tax inflation indexation system and social insurance reform are necessary. The income tax inflation indexation system automatically adjusts labor income tax brackets, rates, and various deductions in line with inflation and is implemented in countries such as the United States, the United Kingdom, Australia, and Canada. Looking at the consumer price index trend over the past 10 years, the inflation rate increased from a consumer price index of 81 in 2010 to 105 in 2020, an average annual increase of 1.5%, while labor income tax rose from 250,000 KRW in 2010 to 420,000 KRW in 2020, an average annual increase of 5.3%. Thus, workers bear the dual burden of rising prices and increasing labor income tax.

Choo Kwang-ho, head of the Economic Policy Office at the Korea Economic Research Institute, said, "The average annual increase rate of wages paid by companies is 2.5%, about 1.7 times higher than the inflation rate of 1.5%, but because the burden of labor income tax and social insurance premiums deducted in the middle has increased more significantly, workers' perceived income has not increased much." He added, "Reducing corporate burdens through inflation-indexed tax systems and social insurance reform and increasing workers' real income can help stabilize workers' livelihoods and revitalize domestic consumption."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)