[Asia Economy Reporter Lee Seon-ae] The Growth Enterprise Analysis Team at Kiwoom Securities has identified promising categories for August, including software companies leading digital transformation (DT), secondary battery equipment and parts companies expected to undergo rerating, and mobile parts companies anticipated to benefit from the growth of the electric vehicle and autonomous driving industries.

On the 7th, Kiwoom Securities' Growth Enterprise Analysis Team highlighted MRO, the No.1 domestic purchasing SCM company, and WantedLab, which is aiming to increase domestic market share and expand overseas based on the proactive launch of its matching platform, as the most notable software companies. Both companies are scheduled to be listed on the KOSDAQ market in August. Among equipment and parts companies, which have been less spotlighted compared to secondary battery material companies, Shinsung Delta Tech was suggested as a company with rerating potential. Additionally, companies such as Optrontec and MCNEX, which can achieve new growth by expanding automotive electronics sales during the growth phase of the electric vehicle and autonomous driving industries, overcoming the growth limitations of the smartphone industry, are also considered worthy of attention.

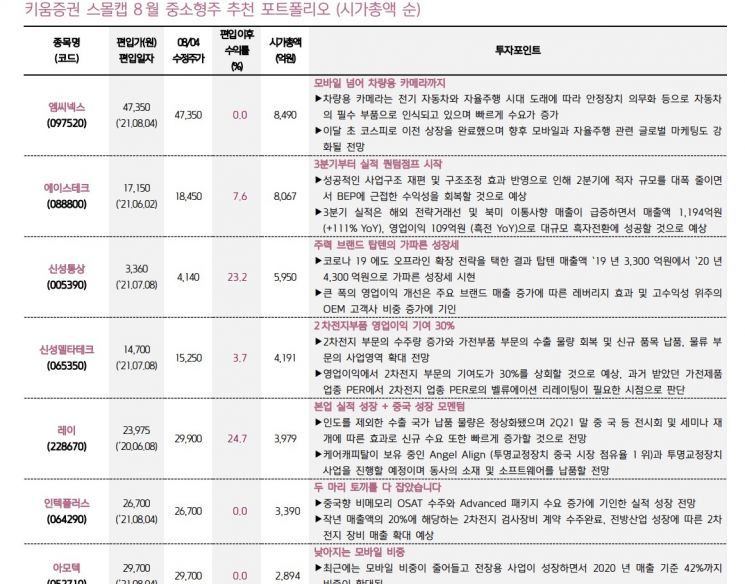

The Growth Enterprise Analysis Team at Kiwoom Securities stated, "For August, the top small and mid-cap picks are MRO, Shinsung Delta Tech, and Optrontec, with Ace Tech and Shinsung Tongsang as stocks of interest."

The promising categories suggested by Kiwoom Securities' Growth Enterprise Analysis Team in July included health functional foods, expected to maintain high interest and industry growth even in the post-COVID era; mobile parts, expected to improve performance and reverse sentiment based on the momentum of new foldable models and new iPhone releases in the second half; and medical devices, which have emerged as a key export industry. Notably, the average return of the K-medical device top picks?Ostem Implant (+23.5%), JC's Medical (+43.5%), and Life Semantics (+40.4%)?was +35.8%. The July top picks included Cosmax NBT, BH, and Ostem Implant, with Ace Tech and Shinsung Tongsang as stocks of interest. The average return of the small and mid-cap recommended portfolio from the publication date of the July monthly report to the day before was +10.5%, significantly outperforming the KOSDAQ market return of -0.5% during the same period.

When establishing small and mid-cap investment strategies from August onward, considerations should include the impact on related small and mid-cap stocks of rebounds in representative companies by sector that experienced price and duration adjustments in the first half, as well as the large-scale IPO relay effect of off-market leading companies by sector, which is unprecedented in the second half. If Samsung Electronics' stock price continues a strong rebound trend from August, focusing on companies related to business units such as the mobile parts sector and 5G communication equipment sector, where performance contributions can significantly increase in the second half compared to the first half, is expected to be advantageous for maximizing returns.

Similarly, in the secondary battery sector, if major material companies experienced rapid stock price increases previously, strategies targeting undervalued parts and equipment companies during the rebound of leading companies within the sector or the listing of off-market leading companies preparing for IPOs in the second half are expected to be beneficial.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)