K-OTC Listed Companies' Market Cap Surpasses '22 Trillion'... Average Daily Trading Volume Also Rising

Seoul Exchange MAU Soars 920% in Six Months... "New Inflows Increase with Coupang Listing"

Expanding Startup Ecosystem Behind Growth... VC Investment Exceeds '3 Trillion' in First Half

[Asia Economy Reporter Junhyung Lee] #Kim Minseong (29, pseudonym), a second-year office worker, has been gradually buying shares of unicorn companies (unlisted companies valued at over 1 trillion KRW) that he has been keeping an eye on. This is because he experienced the 'rocket growth' of startups through the initial public offering (IPO) of the e-commerce company Coupang earlier this year. For him, who could not even dare to apply for public offering shares due to fierce competition, over-the-counter (OTC) stocks (unlisted stocks) became an excellent alternative. Kim said, "Using an application (app) that trades OTC stocks, I found trading unlisted stocks easier than I thought," adding, "I judged that investing in growing startups would be more profitable than buying listed stocks."

As the domestic startup ecosystem rapidly expands, investors are flocking to OTC exchanges that trade unlisted stocks. Money circulating in the market is flowing into unlisted stocks following real estate, stocks, and cryptocurrencies. There are also forecasts that unlisted startups will establish themselves as new investment destinations for retail investors, supported by the second venture boom.

K-OTC Average Daily Trading Value '6.5 Billion KRW'... Users Also Surge

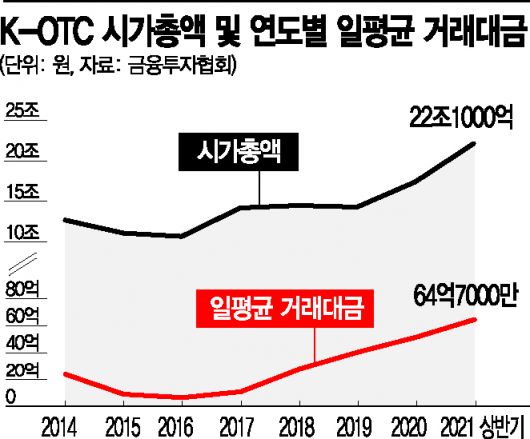

According to the Korea Financial Investment Association on the 6th, the market capitalization of companies registered in the K-OTC market, an OTC stock market operated by the association, reached 22.1 trillion KRW as of the end of the first half of this year. This is a 27% increase from 17.4 trillion KRW at the end of last year in just six months. The market capitalization of the K-OTC market remained around 14 trillion KRW from 2017 to 2019, then jumped to 17 trillion KRW last year. The average daily trading value is also increasing. The average daily trading value of the K-OTC market rose from 2.77 billion KRW in 2018 to 4.03 billion KRW in 2019, 5.15 billion KRW in 2020, and reached 6.47 billion KRW in the first half of this year.

OTC stock trading is also increasing outside of K-OTC. According to the unlisted stock trading platform 'Seoul Exchange Unlisted,' the monthly active users (MAU) of the app last month reached 291,093, a 920% surge compared to 28,538 in January, when the service was launched. During the same period, the OTC stock trading volume on the platform increased 2.7 times. A representative of Seoul Exchange Unlisted explained, "Interest in startups has increased significantly following Coupang's listing in New York, leading to a sharp rise in users," adding, "In May and June, issues such as the second half's public offerings of KakaoBank and others acted as factors attracting new users."

The growth of another OTC exchange, 'Securities Plus Unlisted,' was also remarkable. According to Securities Plus Unlisted, the app's cumulative downloads reached about 900,000 last month, increasing by more than 200,000 from about 700,000 the previous month. The cumulative number of registered users surpassed 500,000 in April this year and exceeded 650,000 last month.

Startup Ecosystem 'Rapid Expansion'... VC Investment of 3 Trillion KRW in First Half

The background for investors turning their eyes to unlisted companies is the recently rapidly growing startup ecosystem. In fact, hundreds of billions of won are pouring into early-stage startup investments such as Series A, and the corporate value of startups on a growth trajectory is rising significantly every year. Numerous unicorn companies with valuations in the trillions of KRW, such as Yanolja and Market Kurly, have emerged. According to the Korea Venture Capital Association (KVCA), domestic VC investments in the first half of this year amounted to 3.073 trillion KRW, an 85.6% increase compared to 1.6554 trillion KRW in the same period last year. During the same period, the number of startups receiving VC investments increased by 38.6%, from 841 to 1,166 companies.

OTC exchanges have lowered entry barriers to attract general investors. These platforms have improved convenience in trading through mobile apps, changing the perception that OTC stock trading requires large assets and specialized knowledge. They have also enhanced trading stability and reliability through services linked with securities firms.

Along with the enthusiasm of the second venture boom, OTC stocks are expected to establish themselves as a 'new financial technology tool.' Professor Hong Kihoon of Hongik University's Department of Business Administration said, "As long as there is demand, OTC exchanges have enough potential to emerge as new investment platforms like cryptocurrency exchanges," but added, "However, there is a risk that market volatility could increase due to investors with strong speculative motives."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)