Top 5 Major Banks See Over 2,600 Employees Leave in First Half of This Year

Double Last Year's Total Layoffs, Accounting for 30% of 8,000 from 10 Years Ago

Reduced Recruitment Scale and Earlier Voluntary Retirement Age

[Asia Economy Reporter Kim Jin-ho] Bank clerks, once known as the epitome of "white-collar (knowledge workers)," are disappearing. The wave of rapid changes accelerated by COVID-19, including branch closures and the rise of non-face-to-face banking, has relentlessly threatened jobs. In the first half of this year alone, the number of employees who left the five major commercial banks reached one-third of the total decrease over the past decade (about 8,000 people).

The sharp decline in bank employees due to digitalization is also completely shaking the concept of a "banker." Banks, which in the past simply sought financial experts, are now focusing all their efforts on recruiting and nurturing digital talent. Banks are becoming IT companies. However, there are also concerns that this rapid change requires supplementary measures for the "disadvantaged groups."

Bankers, once called the "God's workplace," face unprecedented harsh winds

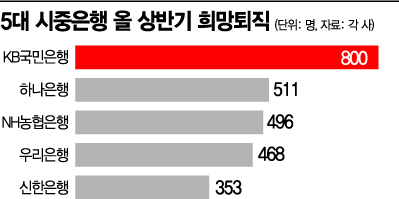

According to the financial sector on the 4th, a total of 2,628 employees left the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NongHyup?in the first half of this year.

The bank with the highest number of departures was Kookmin Bank, with about 800 people. This was followed by Hana (511), NongHyup (496), Woori (468), and Shinhan (353). This figure is about twice the total employee decrease of 1,480 last year.

The direct causes are analyzed to be a significant reduction in large-scale public recruitment and an expansion of voluntary retirement offers targeting relatively young employees, such as those in their 30s and 40s.

Among the five major commercial banks, NongHyup Bank was the only one to conduct large-scale public recruitment (about 340 people) in the first half of this year. The other banks either held small-scale recruitment limited to IT fields or did not recruit at all. While major banks plan to conduct large-scale recruitment in the second half of the year, the scale and schedule have not yet been finalized due to the spread of COVID-19 and the acceleration of digital transformation.

On the other hand, the age group targeted for voluntary retirement is steadily decreasing. Hana Bank recently offered voluntary retirement to employees aged 40 or older with more than 15 years of service. Shinhan Bank unusually conducted two rounds of voluntary retirement in the first half of this year alone.

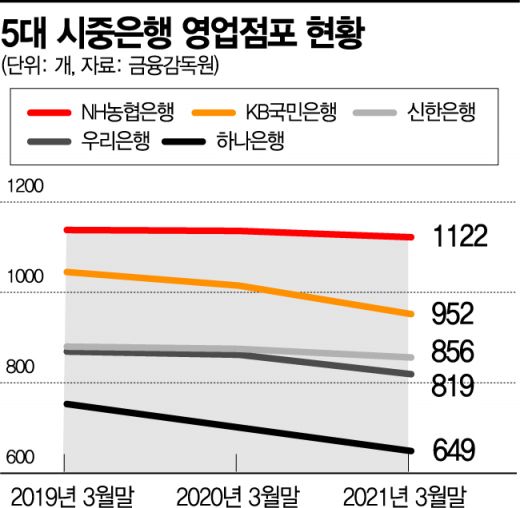

The number of employees leaving banks is expected to accelerate further in the second half of this year. As non-face-to-face banking becomes routine and branch closures accelerate, bank employees will inevitably have fewer places to stand. According to the Bank of Korea, financial transactions through internet banking account for nearly 80% of all transactions, while transactions through counters account for only 15%. According to the Financial Supervisory Service, as of the end of March this year, the number of branches of the five major commercial banks was 4,398, down 191 from a year earlier. This is about twice the decrease of 96 from March 2019 to March 2020. In particular, these banks plan to consolidate more than 100 additional branches in the second half of this year alone.

Banks focusing on developers instead of traditional bankers

Although banks are downsizing through large-scale voluntary retirement, they are more active than anyone else in securing digital talent. This is the result of banks, forced to consider survival due to the emergence of big tech (large information and communication companies) and fintech (finance + technology) companies, prioritizing platformization like IT companies.

In fact, major commercial banks have been reluctant to conduct large-scale public recruitment in recent years but have kept the door wide open for frequent recruitment in IT positions. Kookmin Bank hired about 200 new and experienced employees in the IT and data sectors in the first half of this year. Shinhan Bank and Hana Bank are also conducting "pinpoint recruitment," selectively hiring only digital talent on an ongoing basis.

To compensate for the deep-rooted drawbacks of exclusivism, the banking sector has recently put effort into recruiting digital and IT executives. Data strategy and ICT executives at Kookmin Bank, Woori Financial Group, and Shinhan Bank come from IT companies and academia.

Digital acceleration is rewriting the concept of a banker. In the past, bankers were usually humanities graduates who mainly handled face-to-face customer service at counters, but nowadays, it is possible for bankers never to leave the branch even once until retirement. A deputy manager at a commercial bank said, "I feel a sense of drastic change." When he first entered the bank about ten years ago, having financial certifications was a big advantage, but young people entering now prioritize digital skills such as coding (writing programs using computer languages) over financial knowledge.

Existing employees are also being prioritized for a "digital mindset." Digitalization is not only an issue in the banking sector but across all industries, making it difficult to secure excellent talent.

Woori Bank will implement a digital specialty selection system from the second half of this year for clerks, assistant managers, and managers working in headquarters departments. Employees will choose one of five specialties?digital/IT planning, non-face-to-face channel marketing, big data, artificial intelligence (AI), or IT development/management?and be nurtured as experts in that field.

The issue of digital exclusion caused by rapid changes in banks is identified as a challenge to be solved. While the reduction of bank employees and branches due to structural improvements is understandable, it is pointed out that measures for disadvantaged groups such as the elderly and disabled must be implemented simultaneously.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.