Discussion to Resume Soon Centered on the Korea Federation of Banks

Reflecting the Stance That Big Tech and Fintech Cannot Be Subordinated

[Asia Economy Reporter Kiho Sung] The banking sector, including commercial banks and savings banks, has ultimately decided to create an independent refinancing loan (loan switching) joint platform. This reflects the stance that they cannot be subordinated to big tech and fintech on the refinancing loan platform, and detailed discussions are expected to continue going forward.

According to the financial sector on the 4th, banks centered around the Korea Federation of Banks are expected to soon resume discussions on the establishment of a public refinancing loan platform, which had been suspended since June.

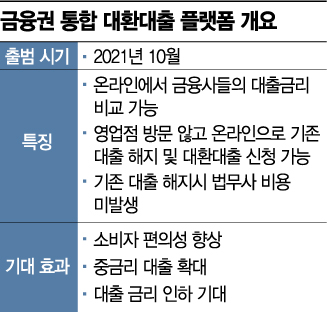

The refinancing loan platform is a service that allows financial consumers to compare loan interest rates from various financial institutions such as banks and insurance companies at a glance on mobile applications (apps) and switch to places with lower interest rates. It is one of the key projects created by financial authorities with the purpose of making it easy to switch "all household loans" and reducing the interest burden on ordinary citizens.

The banking sector had already shown independent movements by inquiring to the Financial Services Commission about the establishment of a refinancing loan platform for banks in June. At that time, banks did not oppose the refinancing loan project rationale of "enhancing consumer benefits through free loan switching," but argued that if the refinancing loan platform were created according to the government plan, it would inevitably be subordinated to private big tech and fintech such as KakaoPay and Toss. They were also burdened by the many fees that must be paid to private platforms. In particular, the voices of the secondary financial sector, such as savings banks, were strong. However, since there was no change in the authorities' stance, the plan to conceive an independent platform had been on hold for over a month.

However, the atmosphere has changed recently through meetings between financial authorities and banks. On the 15th of last month, the Financial Services Commission officially expressed that it does not oppose the banking sector’s independent platform during a meeting with deputy general manager-level officials from banks. Since then, the Korea Federation of Banks has recently asked banks again about their willingness to participate in the public platform over the past two weeks, and it is known that a majority of banks supported the independent establishment of the public platform.

Commercial banks are expected to push forward with the construction of the "Interest Rate Comparison and Refinancing Loan Platform" operated by the Korea Federation of Banks, while individual banks will also be free to participate in refinancing loan platforms being prepared by big tech and fintech companies.

A representative of a commercial bank said, "Nothing has been clearly finalized yet, but detailed discussions are underway," adding, "I believe more discussions will need to take place before a conclusion is reached."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.