Despite a Slight Increase in Import Volume, Import Value Surges 36%

Average Import Unit Price Also Jumps 35%

[Asia Economy Reporter Lim Hye-seon] As pent-up consumer demand due to the prolonged COVID-19 pandemic focused on luxury goods, bag imports surpassed 2 trillion won in the first half of this year. Imports of watches and overseas fashion apparel, including high-end brands, also surged.

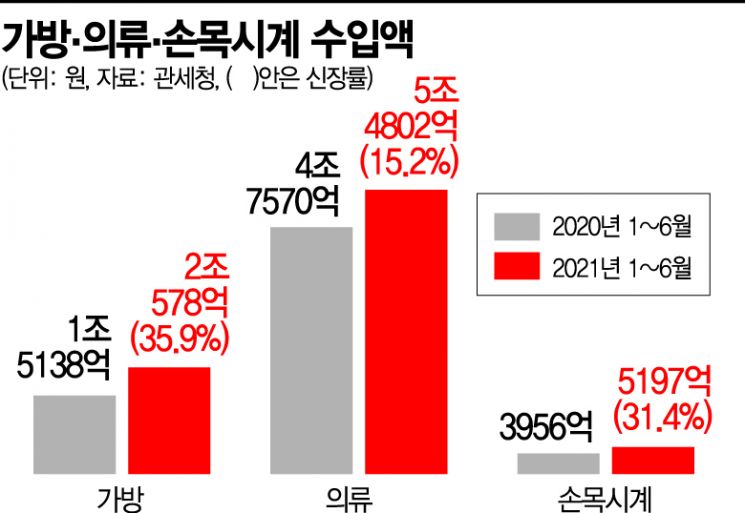

According to the Korea Customs Service on the 3rd, the domestic bag import value from January to June was approximately 2.0578 trillion won (about 1.78785 billion USD), a 36% increase compared to the same period last year (1.5138 trillion won, 1.31528 billion USD). The import share from the European Union (EU) region accounts for more than 60% of the total. Among these, imports from France and Italy, the home countries of luxury brands such as Hermes, Louis Vuitton, and Chanel, amounted to about 1.3358 trillion won (about 1.16059 billion USD).

On the other hand, the import volume showed little difference. Bag import volume slightly increased from 32,670 tons in the first half of last year to 33,101 tons this year. Despite similar import volumes, the increase in import value suggests that a larger quantity of high-priced products was imported. The average import unit price of bag products also rose by 35% within a year.

Watch imports also increased by 31%, from 395.6 billion won (about 343.77 million USD) in the first half of last year to 519.7 billion won (about 451.55 million USD). Apparel imports rose by 15%, from 4.757 trillion won (about 4.13295 billion USD) to 5.4802 trillion won (about 4.76128 billion USD).

The import values of these overseas bags, watches, and fashion items are expected to continue rising. Despite strengthened social distancing measures and COVID-19 cases occurring in luxury brand stores, the phenomenon of "open run" (lining up before the store opens) continues for top brands such as Chanel, Rolex, and Hermes. Luxury sales at the four major department stores (Shinsegae, Lotte, Hyundai, Galleria) surged by 50% in the January to July period compared to the same period last year.

The domestic luxury market is led by the MZ generation (Millennials + Generation Z). Last year, the proportion of customers in their 20s and 30s accounted for 50.7% of luxury sales at Shinsegae Department Store. The share of luxury buyers in their 20s and 30s at Lotte Department Store also grew from 38.1% in 2018 to 46% last year.

Perceiving "luxury purchases as investments" is also cited as one of the reasons for the rapid growth of the luxury market. The activation of the "resell" market, where popular luxury goods can be sold at a premium higher than the original purchase price, has increased preference for such items. Additionally, the rapid price increase of luxury goods in a short period has led to the creation of new terms such as "Shatech" (Chanel + investment) and "Roltech" (Rolex + investment).

The U.S. market research firm Global Industry Analysts (GIA) predicts that the global luxury market, which was about 224.8 billion USD (approximately 258.7223 trillion won) last year, will grow to 296.9 billion USD (approximately 341.7022 trillion won) by 2026. Unlike the 19% decrease in global luxury sales compared to 2019, Korea maintained a similar level at 14 trillion won (about 12.5 billion USD). A luxury industry official explained, "As the COVID-19 situation prolongs, overseas travel routes are blocked, and leisure activities and entertainment are restricted, revenge consumption centered on high-priced luxury goods is increasing," adding, "There is a strong tendency to prefer luxury goods, especially the highest-priced brands."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)