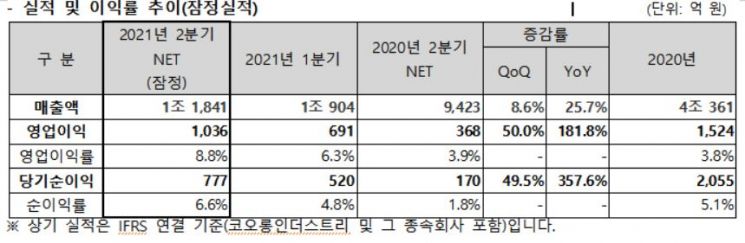

[Asia Economy Reporter Yoonju Hwang] Kolon Industries announced on the 3rd that its consolidated operating profit for the second quarter of this year reached 103.6 billion KRW, an increase of 181.78% compared to the same period last year. During the same period, sales increased by 25.6% to 1.1841 trillion KRW, according to preliminary estimates. Riding on the upward trend in performance, quarterly net profit also more than quadrupled compared to the same period last year, reaching 77.7 billion KRW.

Kolon Industries explained, "Sales significantly increased compared to the same period last year due to strengthened competitiveness in automotive materials, a boom in the epoxy market for electronic materials, and the advancement of casual and golf-related brands. Operating profit also continued to grow thanks to increased profits in the industrial materials and chemical sectors." In particular, operating profit exceeded 100 billion KRW on a quarterly basis for the first time in 10 years.

Looking in detail, the industrial materials division achieved high performance due to continued strong demand for aramid products used in 5G cables and ultra-high-performance tires (UHPT), as well as an overall increase in demand in the tire cord market, including high-value-added tire cords for electric vehicles. The company expects the positive performance trend to continue in the mid to long term, supported by rising results in new hydrogen fuel cell-based businesses such as PEM (polymer electrolyte membrane for hydrogen fuel cells) and moisture control devices, as well as improved performance of subsidiaries in the automotive materials business.

The chemical division's performance was driven by increased sales of petroleum resins for tires and sales growth in the waterborne resin business, supported by a solid customer network. The boom in the 5G-oriented epoxy resin business for electronic materials, which boasts world-class competitiveness, also continued, resulting in a significant increase in performance compared to the previous quarter.

Despite the impact of COVID-19, the fashion division saw golf and outdoor products lead the performance increase as consumer sentiment related to leisure activities recovered. The increase in the proportion of online sales improved the distribution cost structure, leading to operating profit more than doubling compared to the same period last year. Demand growth centered on casual and golf-related brands (WAAC, G/Fore, etc.) is expected to continue, accelerating the upward trend in performance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.