[Asia Economy Reporter Jeong Hyunjin] Samsung Electronics has reclaimed the throne as the 'world's No.1 semiconductor sales leader,' surpassing Intel, largely thanks to the favorable memory semiconductor market conditions. With memory semiconductors accounting for 80% of its semiconductor business, Samsung Electronics has significantly increased related sales as the semiconductor supercycle (long-term boom) has fully kicked in this year, overwhelming Intel.

It is expected that Samsung Electronics' dominance will continue in the second half of this year due to strong demand and rising prices for memory semiconductors. However, concerns have also been raised about Samsung Electronics' competitiveness in the system semiconductor business, including foundry (semiconductor contract manufacturing), which accounts for 70% of the overall semiconductor market and is relatively less affected by market conditions.

Reclaimed after 3 years... Samsung with a large memory share

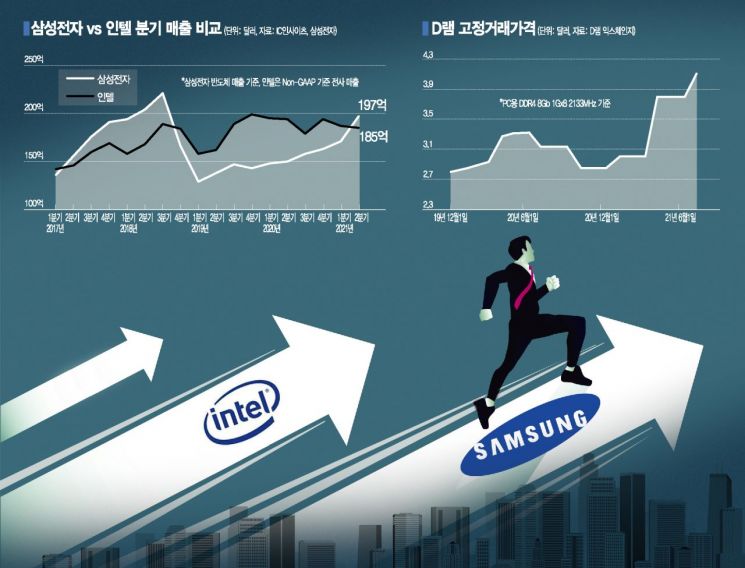

This is not the first time Samsung Electronics has topped the global semiconductor sales rankings. During the semiconductor supercycle in 2017-2018, as the memory semiconductor market revived, Samsung Electronics recorded sales of $15.6 billion (about 17.58 trillion KRW) in Q2 2017, surpassing Intel, which had been the industry leader since 1993 with $14.6 billion. Samsung Electronics continued to outperform Intel in sales for six consecutive quarters until Q3 2018. In Q1-Q2 2018, the sales gap between Samsung Electronics and Intel exceeded $3.6 billion.

The reason Samsung Electronics' performance improves during every supercycle is that its main product, memory semiconductors, is directly influenced by market conditions. Samsung Electronics holds an overwhelming No.1 market share in the memory semiconductor market, with 41.2% in DRAM and 33.4% in NAND flash (Q1, according to Omdia).

In particular, the proportion of memory semiconductors within Samsung Electronics' semiconductor division is large. In Q2 this year, memory semiconductors accounted for 78.6% of Samsung Electronics' total semiconductor sales, nearly 3 percentage points higher than the previous quarter. Prices of representative memory semiconductors like DRAM rose about 27% based on the fixed transaction price of DDR4 8Gb, leading to a 24% increase in Samsung Electronics' memory semiconductor sales. Looking back at Q3 2018, when the previous supercycle was at its peak, Samsung Electronics' memory semiconductor share expanded to about 85%. At that time, DRAM prices reached $8.19 based on the fixed transaction price of DDR4 8Gb, roughly twice last month’s price ($4.10).

Intel's main business is system semiconductors such as central processing units (CPUs), and the related market is relatively less growing, so it has not benefited much from the semiconductor supercycle. Intel's quarterly sales have been declining from $19.4 billion in Q4 last year (Non-GAAP basis, excluding one-time costs) to $18.7 billion in Q1 this year and $18.5 billion in Q2. An industry insider said, "The market expects the memory semiconductor market to remain strong in the second half, so Samsung is likely to maintain its position as the world's No.1 semiconductor sales leader on an annual basis."

Will the system semiconductor share expand... Investment expectations

While maintaining its No.1 position in memory semiconductors, Samsung Electronics is also strengthening related businesses such as foundry under its 'System Semiconductor 2030' vision. System semiconductors account for 70% of the total semiconductor market, more than twice the 30% share of memory semiconductors, and Samsung is expanding its business with an eye on future growth potential. Since system semiconductor performance is less affected by market conditions, the larger the system semiconductor segment within Samsung Electronics' semiconductor business becomes, the less volatile its earnings will be due to semiconductor price fluctuations.

Ultimately, massive mid- to long-term investments in foundry and other areas are expected to influence the sales rankings of leading semiconductor groups. The Wall Street Journal (WSJ) commented, "Samsung has taken the semiconductor sales crown from Intel, but a bigger 'showdown' is approaching," adding, "As both companies seek to aggressively expand investments in advanced process technologies, cash is more important than ever."

Samsung Electronics has announced plans to invest 171 trillion KRW in the system semiconductor sector, including foundry process development, by 2030. Intel has announced investments of $20 billion for a factory in Arizona and $3.5 billion for a semiconductor plant in New Mexico, while TSMC, the No.1 foundry company, has officially declared plans to invest $100 billion over the next three years. Governments worldwide are also extending support to semiconductor companies.

An industry insider said, "For Samsung Electronics to get ahead of competitors, an environment that allows mid- to long-term investment decisions must be created," adding, "The risk of the absence of a group head must be resolved quickly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.