Restriction on Financial Transactions for Unpaid Health Insurance Reimbursements

Cancellation of Agent Registration for Insurance Fraud Fines or Higher

[Asia Economy Reporter Oh Hyung-gil] Penalties for insurance and medical personnel involved in insurance fraud will be strengthened. Insurance planners whose registration is confirmed with a sentence of a fine or higher for insurance fraud will have their registration automatically canceled, and financial transactions of office-based hospitals that have been punished for insurance fraud but have not refunded health insurance medical benefits will be restricted, effectively preventing re-entry into the medical industry.

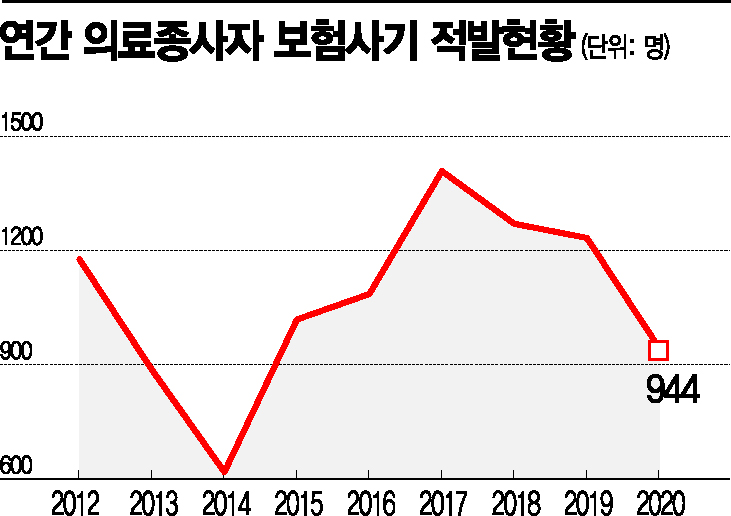

The insurance industry expects this to reduce consumer damage caused by the rapidly increasing insurance fraud and have a positive impact on loss ratio management.

On the 31st, according to the insurance industry, the 'Insurance Investigation Council,' which includes related organizations such as the Financial Services Commission, Ministry of Health and Welfare, and the National Police Agency, discussed measures to improve systems related to insurance fraud and the establishment of a cooperative system among related agencies.

First, sanctions against office-based hospitals will be strengthened. Currently, a collection fee is imposed to recover health insurance benefits already paid to those caught operating office-based hospitals. Information on collection fee defaulters will be disclosed to the Credit Information Agency starting this December.

As of February, it was estimated that there are 1,507 defaulters with arrears of 100 million won or more. This accounts for about 77% of the subjects for recovery. Defaulters who have been punished for opening office-based hospitals will face restrictions on financial transactions and will be blocked from re-entering the medical industry.

Also, insurance planners who have received a confirmed judgment for insurance fraud will have their registration automatically canceled. If they receive a punishment of a fine or higher for insurance fraud, their planner registration will be canceled without procedures such as investigation, sanctions, or hearings.

Lawsuits related to confirmed judgments of insurance fraud will be disclosed separately. Until now, the Insurance Association has included the number of unjust enrichment recovery lawsuits filed by insurers to reclaim insurance payments in the 'number of lawsuits related to insurance claim payments' for disclosure when there was a confirmed judgment of insurance fraud.

Going forward, the number of unjust enrichment recovery lawsuits filed to reclaim insurance payments will be disclosed separately from insurance claim and payment lawsuits.

In addition, to reduce insurance fraud, legislative support will be provided to expedite the passage of the 'Special Act on the Prevention of Insurance Fraud,' which is currently pending in the National Assembly. Through the establishment of a cooperative system among related agencies, the plan is to expand insurance fraud investigation capabilities and improve the investigation system.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.