[Asia Economy Reporter Ji Yeon-jin] As global solar companies have met all conditions for corporate value reassessment and stock price increases, there is a recent outlook that the impact of U.S. solar regulations will be minimal.

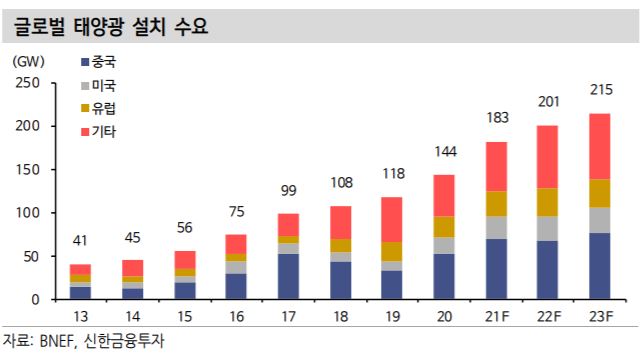

According to Shinhan Financial Investment on the 1st, global solar installations reached 144GW last year, showing a robust growth trend with a 22% increase compared to the previous year despite the COVID-19 pandemic. This year, installations are expected to increase by 27% to 183GW. This trend is attributed to rising solar demand aligned with worldwide green investment efforts that have continued since last year.

Solar power plants take 6 months to 1 year to install, and the benefits of policy funding are being quickly reflected. Since solar projects typically see funding disbursed early in the year and installations in the second half, profits are also expected to gradually improve in the latter half of the year.

This year, due to the impact of rising raw material prices, the installation volume in the first half is estimated to have been lower, so the installation growth rate in the second half is expected to be steeper than usual.

Researcher Ham Hyung-do of Shinhan Financial Investment said, "All conditions for stock price increases are met as solar companies’ earnings improve and valuation rerating becomes possible," adding, "Valuations are already at levels cheaper than before COVID-19. Last year, stock prices rose while companies’ earnings declined, and the resulting valuation burden was reflected in stock price adjustments in the first half of this year." The expected price-to-earnings ratio (PER) for solar companies next year is 22.7 times, which is cheaper than 24.7 times in 2019.

Solar companies are expected to see earnings improvements as cost burdens ease. The rise in solar polysilicon prices that began in June last year started to calm down last month. Polysilicon price increases were caused by supply disruptions from China and temporary supply-demand imbalances due to downstream wafer manufacturers’ capacity expansions. Polysilicon prices rose from $6 to $30 per kilogram, worsening solar companies’ earnings. The average EPS (earnings per share) of companies began to decline from the third quarter of last year when the polysilicon price increase started to be reflected in earnings. Since June, when the polysilicon price increase slowed, a rebound has been successful. With continuous declines in polysilicon and wafer prices, the burden on solar module manufacturers and installers is expected to ease.

However, U.S. regulations on Xinjiang could pose a risk. The U.S. has announced regulations on products produced in the Xinjiang Uyghur Autonomous Region of China, citing human rights issues. Prohibited items include tomatoes, cotton, wind power equipment, and solar raw materials. Since the global solar industry is concentrated in China, such regulations could pose risks to the entire solar industry.

Nonetheless, it is assessed that the U.S. regulatory issues have already been reflected in raw material prices and stock prices. Researcher Ham said, "Silicon prices are stabilizing, and module companies’ stock price recovery has begun," adding, "It is time to focus on companies’ earnings rather than excessive concerns about U.S. regulations."

He advised focusing on module companies within the solar value chain where cost improvements have been confirmed due to falling polysilicon prices. Shinhan Financial Investment recommended increasing weights on U.S.-listed Chinese module companies Canadian Solar and JinkoSolar, and recommended the U.S. module company First Solar.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.