Top 4 Commercial Banks' Mid-Sized Business Loans Reach 570 Trillion Won by Mid-Year

Collateral Loans Account for 80-90%

[Asia Economy Reporters Park Sun-mi and Kim Hyo-jin] As commercial banks increase loans to small and medium-sized enterprises (SMEs), it has been revealed that they have been raising the proportion of safe secured and guaranteed loans instead of unsecured and non-guaranteed credit loans. Critics point out that the collateral-based lending practice is deepening, ignoring the difficulties faced by SMEs and sole proprietors (SOHO) amid the spread of COVID-19.

According to the banking sector on the 30th, loans to SMEs including SOHO by the four major commercial banks?KB Kookmin, Shinhan, Hana, and Woori?amounted to approximately 570.4 trillion KRW as of the end of June, an increase of about 44.1 trillion KRW (8.4%) compared to 526.3 trillion KRW at the end of last year. The government and authorities’ orders to banks to provide smooth funding support to SMEs amid the COVID-19 spread led to the growth in SME loans.

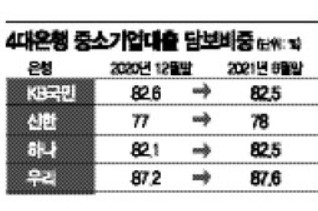

Notably, while banks significantly increased SME loans, they managed risks mainly through safe secured and guaranteed loans. The proportion of secured loans for SMEs and sole proprietors at the four major commercial banks stands at around 80-90%. In particular, Shinhan, Hana, and Woori banks have shown a continuous upward trend in the proportion of secured loans for SMEs.

As of the end of June, Shinhan Bank’s secured loan ratio for SMEs was 78%, and for sole proprietors, 85%. These figures rose by 1 percentage point from 77% and 84%, respectively, at the end of last year. Hana Bank’s secured loan ratios were 82.5% for SMEs and 85.5% for sole proprietors, up from 82.1% and 84.9% at the end of last year.

Woori Bank also recorded secured loan ratios of 87.6% for SMEs and 92.5% for sole proprietors in the first half of the year, up from 87.2% and 92.1% at the end of last year. Most of the secured loans by commercial banks are backed by real estate and guarantee certificates.

Even amid the COVID-19 crisis, the collateral-based lending practice for SMEs is deepening, meaning that the threshold for banks has become higher for companies lacking collateral.

Real Estate, Rental, and Manufacturing Loans Approach 60%

Wholesale, Retail, Accommodation, and Food Services at Around 20%

Given this situation, SME loans are mostly concentrated in sectors where providing collateral is easier, such as real estate, rental, and manufacturing, making it difficult for sectors classified as vulnerable to COVID-19?such as wholesale, retail, accommodation, and food services?to borrow money easily. According to the sectoral SME loan status by bank, the share of real estate, rental, and manufacturing sectors approaches 60%, while wholesale, retail, accommodation, and food services account for only about 20%.

The outlook for SMEs has worsened for three consecutive months due to the fourth wave of COVID-19. Especially with strengthened quarantine measures such as the implementation of Level 4 social distancing in the metropolitan area, accommodation and food service sectors are expected to be severely impacted, raising concerns that funding difficulties for some sectors due to collateral-based lending practices will continue.

According to a survey conducted by the Korea Federation of SMEs from August 15 to 22 targeting 3,150 domestic SMEs, the business outlook index for August was 73.6, down 5.3 points from the previous month. Among individual sectors, accommodation and food services plummeted by 32.1 points to 44.0, reflecting the impact of strengthened social distancing measures.

According to the Korea Federation of SMEs’ ‘Survey on SME Financial Use and Difficulties,’ SMEs cite insufficient loan limits (27%) and lack of real estate collateral (24.1%) as the top difficulties when raising funds through banks. For this reason, more than 30% of respondents identify improving the reliance on secured loans as a necessary financial support task for SMEs.

A representative from a commercial bank explained, "The number of targets that can be secured by collateral such as guarantee certificates has increased due to various COVID-19 support measures, and the value of assets such as real estate has also risen, leading to an increase in the scale of secured loans. Many self-employed individuals who have been hit hard by COVID-19 have taken out loans using personally owned apartments as collateral and then used the funds for business capital."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.