Thanks to success in yoga wear and leggings,

sales grew sixfold in 2 years

SG&A expenses cut, profitability expected to improve

Stable financial structure also an advantage

The 'athleisure' craze is sweeping mainly among the MZ generation. Athleisure is a portmanteau of athletic and leisure, referring to sportswear that can be worn as everyday clothing. The domestic athleisure market size grew from 1.5 trillion KRW in 2016 to 3 trillion KRW last year, doubling in five years. As personal workouts such as home training have become established due to the spread of COVID-19, the athleisure market for yoga wear, leggings, and the like is also expanding. In response, Asia Economy analyzed Brand X Corporation and Eco Marketing, which operate 'Jeximix' and 'Andar,' leading brands in the athleisure industry.

[Asia Economy Reporter Lim Jeong-su] Brand X Corporation (hereafter Brand X), which succeeded with yoga wear brand Jeximix, can be said to be a pioneering company leading the athleisure look trend. It stood at the center of the leggings boom, which became everyday hiking wear in addition to yoga wear. Recently, based on the success of the Jeximix brand, it has expanded its product lines to include Jeximix Cosmetics (cosmetics), Jexiwear (streetwear), Mens (menswear), swimwear, and nails, accelerating its growth.

◇ Sixfold Sales Growth in Two Years... Rapid Growth Amid COVID-19

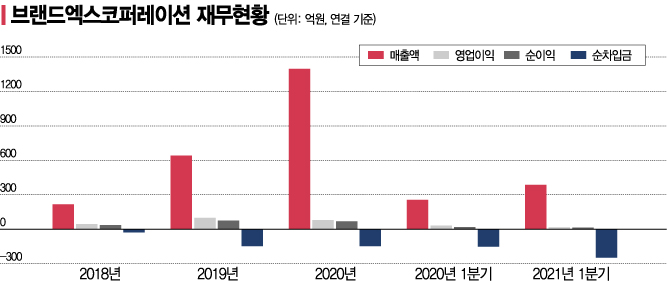

Brand X has continued its record sales even amid COVID-19. Sales, which were only 21.7 billion KRW in 2018, reached 139.7 billion KRW last year, growing sixfold in two years. In the first quarter of this year, sales amounted to 38.6 billion KRW, showing a sales growth rate of over 50% compared to the same period last year (25.7 billion KRW). The cumulative number of subscribers to Brand X's own mall exceeded 1 million in 2020, up from 30,000 in 2017, and has maintained its growth trajectory this year as well.

Thanks to this steep growth, in May, the Korea Exchange (KRX) KOSDAQ Market Headquarters changed Brand X's classification from the mid-sized enterprise division to the excellent enterprise division. This designation came only nine months after its listing on the KOSDAQ market in August last year, marking it as one of the most excellent and representative companies among KOSDAQ firms.

This is due to the rapid growth of Jeximix, an athleisure brand representing yoga wear and leggings. Jeximix accounts for 93% of Brand X's total sales. Other brands such as streetwear brand Mix to Mix and hygiene habit brand Huia contribute the remaining 7%, with relatively low sales contribution so far.

By channel, as a media commerce company, D2C (Direct to Consumer) accounts for 90%, with sales through its own mall overwhelmingly large at 76%. Offline stores account for 12.7%, and overseas exports 4.4%. Sales through offline and overseas exports also include sales via the D2C method.

With an expansion strategy into other fields following leggings, the growth trend is expected to accelerate. Recently, product line expansions into cosmetics, nail products, and menswear, as well as channel expansions beyond its own mall to offline and overseas export sectors, have increased growth potential. Park Chan-sol, an SK Securities researcher, analyzed, "Brand X signed an export contract worth 8.4 billion KRW with China's Tianma Group in December last year," adding, "We can expect sales and profitability expansion due to export growth."

◇ Possibility of Improving 'Poor Profitability'... High Financial Stability = Despite rapid growth, Brand X's profitability remains somewhat low. This is because selling and administrative expenses increased during the product line expansion into menswear, cosmetics, and daily necessities. Recently, competition has intensified as large corporations have entered the athleisure apparel market in addition to existing competing brands, leading to increased selling and administrative expense burdens.

As of last year, among sales of 139.7 billion KRW, the cost of goods sold was 54.1 billion KRW, with a cost ratio below 40%, but selling and administrative expenses amounted to 77.5 billion KRW, exceeding the cost of goods sold. As a result, annual operating profit did not exceed 9 billion KRW.

However, from the third quarter of this year, profitability is expected to improve due to price increases in athleisure apparel and easing competition intensity. Park Eun-kyung, an analyst at Samsung Securities, said, "Discount competition is easing due to the deteriorating financial condition of competitors," adding, "Brand X itself is expected to focus more on reducing marketing costs rather than expanding product categories, which will improve profitability."

Another differentiating factor is that Brand X has a stable financial structure compared to other competitors. Brand X has maintained a virtually debt-free policy for a long time. As of the end of the first quarter this year, total borrowings were only 7.1 billion KRW. It holds cash equivalents of 31.8 billion KRW, resulting in a net cash position of 24.7 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.