[Asia Economy Reporter Ji Yeon-jin] Domestic individual investors, known as ‘Donghak Ants,’ have net purchased more than 26 trillion won worth of Samsung Electronics shares this year. Despite foreign investors continuing to sell amid concerns over the peak of the semiconductor memory supercycle, leading to several months of sluggish stock performance, individual investors are expanding their net buying, viewing it as a low-price buying opportunity.

According to the Korea Exchange on the 30th, individual investors have net purchased Samsung Electronics shares worth 26.7538 trillion won (322.55 million shares) from the beginning of this year until the day before. In this month alone, they net purchased shares worth 2.7391 trillion won. Foreign investors have net sold shares worth 13.0478 trillion won this year, including 2.1538 trillion won sold just this month. In particular, foreign investors have continued a net selling streak for 10 consecutive trading days since the 16th, driving Samsung Electronics’ stock price decline. Even on the day before, when Samsung Electronics announced solid second-quarter earnings, foreign investors expanded their net selling by offloading more than 200 billion won worth of shares.

Samsung Electronics’ stock price surged to the threshold of ‘100,000 won electronics’ early this year on expectations of a semiconductor memory supercycle but has since steadily declined. Concerns over the ‘peak’ of the memory market have been reflected, and the ‘80,000 won electronics’ level was broken this month, retreating to the 78,000 won range.

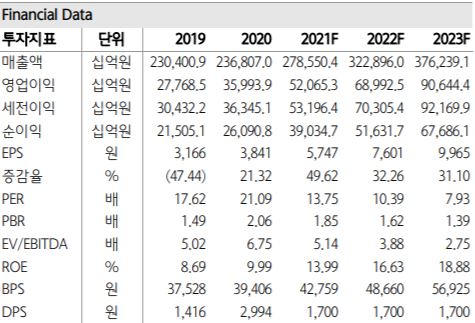

The market outlook for Samsung Electronics’ stock price is divided. Based on Samsung Electronics’ second-quarter earnings announced the day before, the ‘bottoming theory’ seems to be dominant, but concerns over weakening memory demand remain. Samsung Electronics recorded an operating profit of 12.568 trillion won in the second quarter, a 34% increase, with the semiconductor division’s profit more than doubling. Kim Kyung-min, a researcher at Hana Financial Investment, said, “The stock price, which had been sluggish since the beginning of the year, is expected not to fall further as it reflects the fundamental improvement in the semiconductor division,” and changed his top semiconductor pick from SK Hynix to Samsung Electronics.

On the other hand, Hwang Min-sung, a researcher at Samsung Securities, said, “It is judged that the possibility of weakening memory demand, resulting memory oversupply, and concerns over a downturn in the price environment have not been decisively resolved.” Mirae Asset Securities lowered Samsung Electronics’ target price from the previous 113,000 won to 100,000 won on the same day, reflecting the semiconductor sector’s stock price decline.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.