[Sejong=Asia Economy Reporter Kim Hyunjung] The government is tightening its grip on investigations into real estate market disruption and tax evasion allegations. The National Tax Service (NTS) has launched a third round of tax investigations this year alone into cases suspected of tax evasion, such as when the source of funds flowing into high-value real estate is not properly explained, investigating more than 800 individuals.

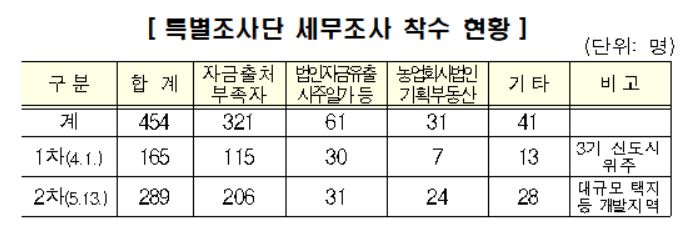

On the 29th, the NTS announced that it would conduct a high-intensity tax investigation on 374 suspects of real estate tax evasion in large-scale land development areas. This is the third investigation following the first (165 people) and second (289 people) rounds, making it the largest scale this year. Last year, the government conducted seven rounds of tax investigations on 1,543 individuals for real estate tax evasion and collected a total of 120.3 billion KRW in additional taxes.

This investigation mainly targets 225 individuals suspected of receiving acquisition funds through disguised gifts or omitting income from related businesses during the real estate acquisition process. Additionally, it includes 28 corporations that acquired development area real estate unrelated to their business using evaded funds, 28 family members of business owners suspected of improperly diverting corporate funds to acquire land for private use, 42 individuals including real estate developers, planned real estate companies, agricultural corporations, and brokers suspected of tax evasion during real estate transactions in development areas, and 51 individuals suspected of tax evasion based on data analyzed from the police’s ‘Government Joint Special Investigation Headquarters’ investigation.

In the previous second and third investigations, the NTS mainly targeted cases where the source of funds was not properly explained. In the first round, 115 out of 165 people fell into this category, and in the second round, 206 out of 289 people did. Unclear sources of funds are typically obtained through disguised gifts, income concealment, or tax evasion.

This investigation focuses on 44 large-scale development areas, targeting those who acquired land multiple times in two or more development areas, acquired multiple parcels of land, or family members who purchased land individually as if shopping.

In the upcoming tax investigation process, the flow of funds will be tracked precisely through transaction details between financial accounts and verification of information from the Financial Intelligence Unit (FIU) to determine whether the acquisition funds originated from reported income or if they are concealed income or gifted funds.

In cases where funds flowed in from related corporations or businesses or where loan agreements were made with relatives, the NTS will closely examine allegations of improper diversion of business funds or disguised loan agreements. If necessary, the scope of the investigation will be expanded to check the appropriateness of related declarations for the associated businesses, corporations, and relatives.

For planned real estate companies, agricultural corporations, real estate brokers, and other entities suspected of tax evasion during land transactions or acquiring land with evaded funds, the NTS plans to verify declaration details comprehensively, including whether income was omitted, whether fabricated expenses were recorded, and whether funds were improperly diverted.

If it is confirmed that taxes were evaded through fraudulent acts such as false evidence, fabrication and receipt of false documents, or use of nominee accounts, the offenders will be reported under the ‘Tax Crime Punishment Act.’ If violations of real estate transaction-related laws such as land name trusts are found, the relevant authorities will be notified.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.