Mirae Asset Joins 1 Trillion Club This Year Along with 4 Others

Record High Performance Expected from Korea, NH, Samsung, Kiwoom, and More

5 Companies with Low Valuations "Increase Weight on Correction"

[Asia Economy Reporter Lee Seon-ae] Riding on the stock market boom, domestic securities firms are expected to continue their streak of earnings surprises. As a result, many securities firms are anticipated to join the 'Operating Profit 1 Trillion Won Club,' which currently only includes Mirae Asset Securities, this year. However, despite these surprising earnings, securities stocks have generally been on a downward trend. Experts have offered a positive outlook, suggesting that the correction that began after peaking in May is actually an opportunity to increase holdings, and that the market will enter an upward trend again in the second half of the year.

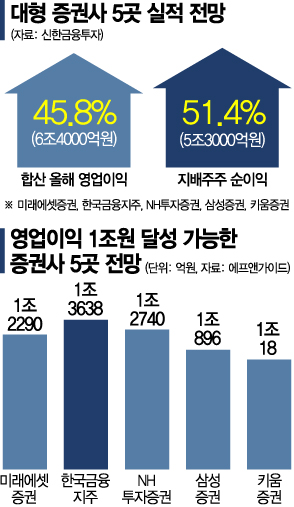

According to financial information provider FnGuide on the 30th, securities firms likely to enter the 1 trillion won club this year include Mirae Asset Securities (1.229 trillion won), Korea Financial Group (1.3638 trillion won), NH Investment & Securities (1.274 trillion won), Samsung Securities (1.0896 trillion won), and Kiwoom Securities (1.0018 trillion won). Excluding Mirae Asset Securities, which was the first domestic securities firm to enter the 1 trillion won club last year, four new firms are expected to join this year.

Shinhan Investment Corp. forecasted that the combined consolidated operating profit of these five firms for the second quarter will be 1.8 trillion won, and the net income attributable to controlling shareholders will be 1.3 trillion won, representing an earnings surprise exceeding market consensus (1.1 trillion won) by 29.4%. Researcher Lim Hee-yeon of Shinhan Investment said, "Confidence in earnings growth this year is increasing, and some securities firms have already achieved last year's full-year results during the first half," adding, "Their combined operating profit for this year is expected to reach 6.4 trillion won (a 45.8% increase), and net income attributable to controlling shareholders is projected at 5.3 trillion won (a 51.4% increase)."

NH Investment & Securities achieved an operating profit of 767.4 billion won in the first half alone, more than double the same period last year, marking an earnings surprise level. Its operating profit for this year is projected at 1.274 trillion won. Mirae Asset Securities is expected to surpass 1 trillion won in operating profit for the second consecutive year, confidently securing its place in the 1 trillion won club again this year following last year. Daishin Securities commented, "Despite the COVID-19 shock, Mirae Asset Securities has recorded profits for 10 consecutive quarters," and added, "Although bond management income is inevitably decreasing, trading income is expected to approach 200 billion won."

The provisional operating profit of Korea Financial Group, the parent company of Korea Investment & Securities, for the first half is projected at 798.7 billion won, an increase of over 240% compared to the same period last year. If the operating profit for the second half meets market expectations (565.1 billion won), entry into the 1 trillion won club will be easily achieved.

Samsung Securities and Kiwoom Securities are also considered strong candidates. Samsung Securities is estimated to record a provisional operating profit of 666 billion won for the first half, a 235.5% increase compared to the same period last year, making it likely to reach 1 trillion won in operating profit within the year. Kiwoom Securities, which posted record-high results last year, is expected to enter the 1 trillion won club for the first time in its 20 years since establishment. With favorable prospects for commission income and interest income this year, net income attributable to controlling shareholders is also expected to rise 20.1% year-on-year to 833.5 billion won, continuing its record performance.

Meanwhile, despite this favorable earnings environment, securities stocks have recently shown lackluster performance. According to the Korea Exchange, the KRX Securities Index closed at 835.03 on the 29th. The index started at 739.06 on January 4, the first trading day of the year, peaked at 926.12 on May 10, but has since declined and remained around the 830 level. The KRX Securities Index is calculated by the Korea Exchange based on securities stocks and consists of 13 securities stocks including Mirae Asset Securities, Korea Financial Group, NH Investment & Securities, Samsung Securities, Kiwoom Securities, Hanwha Investment & Securities, and Daishin Securities.

However, the dominant view is that the market will enter an upward trend again in the second half. The trading volume by individual investors is increasing again, and the stock market excitement is rising once more due to large-scale initial public offerings (IPOs). Researcher Lim said, "Due to the continued record-breaking business environment and earnings, we maintain an 'overweight' investment opinion on securities stocks," adding, "Although the average daily trading value has steadily decreased since January, it remains at a high level compared to last year's annual average of 23 trillion won, and the average 2021 price-to-book ratio (PBR) and price-to-earnings ratio (PER) for the five covered firms are only 0.68 and 4.2 times respectively, representing an unreasonably low valuation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman with 50 Million Won Debt Clutches a Stolen Dior Bag and Jumps... A Monster Is Born [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)