A craze for ‘athleisure’ is sweeping mainly among the MZ generation (Millennials + Generation Z). Athleisure is a compound word of athletic and leisure, referring to sportswear that can be worn as everyday clothing. The domestic athleisure market size has doubled in five years, growing from 1.5 trillion KRW in 2016 to 3 trillion KRW last year. As personal exercise such as home training has become established due to the spread of COVID-19, the athleisure market for yoga wear, leggings, and the like is also expanding. Accordingly, Asia Economy analyzed Brand X Corporation and Eco Marketing, which operate ‘Jeximix’ and ‘Andar,’ leading brands in the athleisure industry.

[Asia Economy Reporter Jang Hyowon] Online integrated advertising agency Eco Marketing has laid the foundation for growth by acquiring ‘Andar,’ which sells yoga wear, leggings, and more. Andar had recorded severe losses until last year and was in poor condition, but attention is focused on whether it can take off again after meeting Eco Marketing.

Experts Growing Brands through Marketing

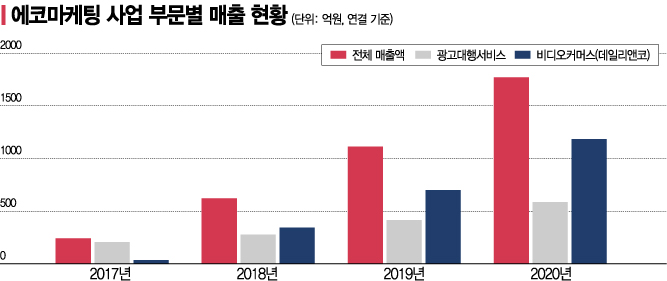

Eco Marketing is an online integrated advertising agency that performs both advertising production and media agency services. Recently, it has been expanding its presence in e-commerce using direct-to-consumer (D2C) methods and video commerce. Its major subsidiary is Daily&Co, which succeeded with the ‘Clock Mini Massager.’ Eco Marketing’s performance has been rapidly growing since 2018. Consolidated sales increased 158% from 24.1 billion KRW in 2017 to 62.1 billion KRW in 2018, then to 111.4 billion KRW in 2019, and 177 billion KRW last year, recording an average annual sales growth rate of 98.7% over three years.

At the center of this significant sales growth is the subsidiary Daily&Co. In August 2017, Eco Marketing acquired a 51% stake in Daily&Co (formerly Yurica Cosmetic) for 10.6 billion KRW. At the end of 2016, Daily&Co recorded sales of 5.2 billion KRW and net income of 1 billion KRW. However, after being acquired by Eco Marketing, sales increased rapidly to 34.3 billion KRW in 2018, 70 billion KRW in 2019, and 121 billion KRW last year. The proportion of Daily&Co’s sales in Eco Marketing’s total sales also rose from about 55.2% in 2018 to 68.4% last year.

Daily&Co’s media commerce capability, which sells products by exposing short video advertisements on various media, is analyzed to have created synergy after meeting the advertising agency specialist Eco Marketing.

The rapid growth in performance has brought financial stability. As of the end of last year, Eco Marketing’s debt ratio was 27.8%, and the current ratio was 371%. Most of the debt is accounts payable, with total borrowings around 5.1 billion KRW. With cash and cash equivalents of about 100 billion KRW, it is effectively operating with no borrowings.

With such abundant cash, Eco Marketing is focusing on mergers and acquisitions (M&A) and brand development investments. At the end of last year, it acquired a 34% stake in pet supplies company Mipet, and in May this year, it also purchased a 56% stake in athleisure company Andar. It has also formed strategic alliances, such as exchanging shares with underwear company Gritty.

However, there is a forecast that operating profit in the second quarter of this year will slightly decline compared to the same period last year due to increased marketing expenses for new brands. Shin Eunjung, a researcher at DB Financial Investment, predicted, “Operating profit is expected to be sluggish due to increased marketing expenses for Daily&Co’s Mongje and Vanity Table, as well as Andar.”

Driving Andar’s Growth through Intensive Restructuring

The market expects Eco Marketing’s performance to hit bottom in the second quarter and rebound from the third quarter. So far, it has been a process of investing in brands and marketing expenses, and it is analyzed that profits can be generated once the brands grow. Glu, a gel nail sticker company in which Eco Marketing acquired a 20% stake for 20 billion KRW in 2019, went through the same process.

Currently, the main brand Eco Marketing is focusing on is Andar. Andar started as Korea’s first athleisure brand and led the industry as number one, but it has experienced stagnation in recent years and was overtaken by ‘Jeximix’ last year. As of last year, it recorded sales of 76 billion KRW and an operating loss of 8.9 billion KRW.

At the end of last year, Kim Cheolwoong, CEO of Eco Marketing, exchanged shares with Shin Aeryeon, CEO of Andar, acquiring about 22% stake first, and appointed Park Hyoyoung, a joint CEO from Eco Marketing, to actively engage in management.

Eco Marketing is raising Andar’s corporate value through intensive restructuring and aggressive marketing. The marketing division is strengthening sales based on experience and know-how that appealed to female customers in their 20s and 30s through Yurica and Glu.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.