[Asia Economy Reporter Lee Seon-ae] The amount of funds processed related to registered and deposited securities in the first half of this year reached 2,631.3 trillion won, marking a 3.0% increase compared to the first half of last year. This means an average daily settlement amount of 214 trillion won. In particular, interest in investment has increased significantly since COVID-19, leading to a substantial rise in settlement amounts related to stocks and gold.

According to the Korea Securities Depository on the 29th, by category, the scale was as follows: over-the-counter settlement funds at 2,398.8 trillion won (91.2%), rights exercise funds at 117.3 trillion won (4.5%), collective investment securities funds at 64.3 trillion won (2.4%), market settlement funds at 47.7 trillion won (1.8%), and other funds at 3 trillion won (0.1%).

Among the over-the-counter settlement funds, the largest portion was the over-the-counter repo settlement funds, accounting for 87.1% of the total at 2,088.7 trillion won, followed by bond institution settlement funds at 285.2 trillion won (11.9%) and stock institution settlement funds at 24.7 trillion won (1.0%). Notably, stock institution settlement funds surged by 40.1% compared to the first half of last year.

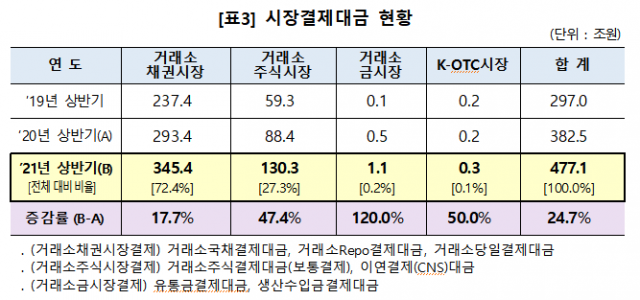

Within market settlement funds, the exchange bond market settlement funds (34.5 trillion won) accounted for the largest share at 72.4%. Exchange stock market settlement funds accounted for 13 trillion won (27.3%), exchange gold market settlement funds were 1 trillion won (0.2%), and K-OTC market settlement funds were 300 billion won (0.1%). Among these, exchange gold market settlement amounts increased by 120% compared to last year, and K-OTC market settlement amounts rose by 50.0%. Exchange stock market settlement funds also increased by 47.4%.

Rights exercise funds consisted of bond rights exercise funds at 112.6 trillion won (96.0%) and stock rights exercise funds at 4.7 trillion won (4.0%). Among stock rights exercise funds, dividends were the largest at 3.8 trillion won, followed by subscription payments (800 billion won), odd-lot payments (90 billion won), and purchase claim payments (30 billion won).

Collective investment securities funds included subscription and redemption funds at 62.7 trillion won (97.4%), collective investment securities distribution funds at 1.5 trillion won (2.5%), and others at 400 billion won (0.1%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.