Life Insurers' CM Channel Initial Premiums Jan-Apr Increase 4x YoY

Surpassing TM Channel with Upward Trend

[Asia Economy Reporter Ki Ha-young] This year, the cyber marketing (CM) channels of life insurance companies have shown rapid growth. Although face-to-face sales still hold a large share, the initial insurance premiums from telemarketing (TM) channels have been surpassed, continuing the upward trend. This is attributed to the activation of non-face-to-face sales due to the impact of COVID-19 and the gradual success of each company's digital innovation.

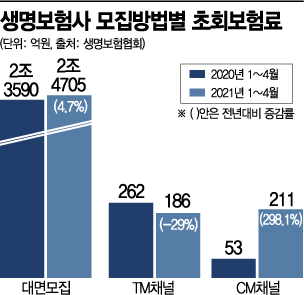

According to the Life Insurance Association on the 29th, the initial insurance premiums from life insurers' CM channels amounted to 21.1 billion KRW by April this year, a 298.1% increase compared to 5.3 billion KRW in April last year. This nearly fourfold increase reflects the accelerated growth as non-face-to-face sales expanded due to COVID-19.

By company, small and medium-sized firms showed remarkable results. KB Life Insurance recorded the highest performance among life insurers' CM channels. KB Life's initial insurance premiums from CM channels from January to April this year reached 12.3 billion KRW, about 40 times higher than the previous year. Following that, Kyobo Lifeplanet, Kyobo Life Insurance's digital insurance company, recorded 5.5 billion KRW, a 223.5% increase compared to the previous year. Samsung Life Insurance also recorded 1.56 billion KRW, a 7.6% increase from the previous year.

On the other hand, the initial insurance premiums from life insurers' TM channels from January to April decreased by 29% compared to the same period last year, totaling 18.6 billion KRW. In the case of TM channels, last year financial companies' call centers were highlighted as COVID-19 cluster infection sites, and from March this year, the implementation of the Financial Consumer Protection Act has made telephone sales more difficult, gradually reducing the scale. Accordingly, insurance companies are also closing or downsizing their TM organizations.

However, despite the remarkable growth of CM channels, face-to-face recruitment still overwhelmingly dominates life insurers. Since life insurance mainly deals with expensive and complex structured protection insurance products, insurance consumers prefer to subscribe through agents. In fact, as of April this year, face-to-face recruitment accounted for 98.42% of the total initial insurance premiums. This was followed by CM channels at 0.84% and TM channels at 0.74%. Although the share of CM channels nearly quadrupled from 0.2% in the same period last year, it still does not reach 1%.

An industry official said, "As COVID-19 prolongs, the agent channel has shrunk, while the growth of online and other non-face-to-face channels is accelerating," adding, "The implementation of the Financial Consumer Protection Act has also influenced the increase in online bancassurance and similar channels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.