77 New Approvals and Changes in the First Half

Surge Due to Small Investments and Tax Benefits

84.4% Concentrated in the Capital Area

[Asia Economy Reporter Ryu Tae-min] Knowledge industry centers are gaining popularity as niche investment destinations that avoid government housing market regulations. With low initial investment costs and tax benefits, demand is increasing mainly among middle-aged and older people approaching retirement. Accordingly, the number of newly supplied knowledge industry centers nationwide is also on the rise, recording the highest number in the first half of the year.

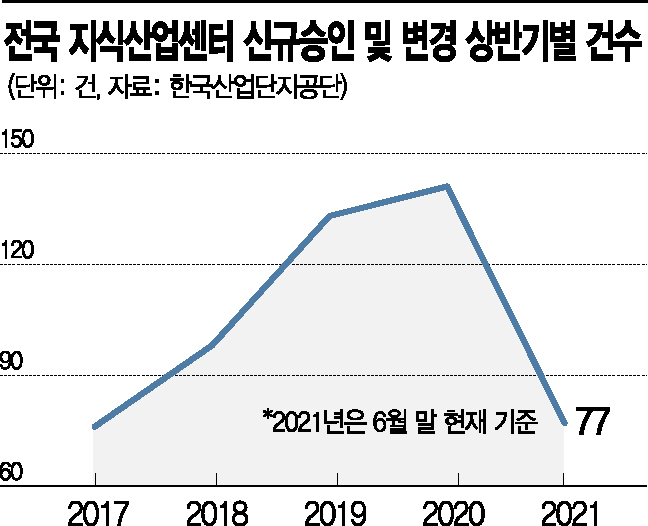

On the 29th, the Commercial Information Research Institute analyzed the number of new approvals and changes for knowledge industry centers nationwide by the Korea Industrial Complex Corporation, revealing a total of 77 cases in the first half of this year. This is 20 cases (35%) more than the 57 cases in the same period last year and about twice the 39 cases recorded three years ago in 2018. It is the highest number for the first half of the year since the Korea Industrial Complex Corporation began compiling the data in 1997.

Knowledge industry centers have shown a sharp increase in supply over the past 4 to 5 years. The number of new approvals and changes per year was 38 cases until 2014, but starting with a nearly twofold increase to 62 cases in 2015, it reached a record high of 141 cases in 2020, five years later.

Among the 77 newly approved or changed cases nationwide in the first half of this year, the metropolitan area accounted for the largest share with 65 cases (84.4%). Among these, Gyeonggi-do accounted for 44 cases (67.7%), more than two-thirds, followed by Seoul with 17 cases (26.1%) and Incheon with 4 cases (6.1%).

In Seoul, the Seoul Digital Industrial Complex showed the most active performance, recording 12 approved cases, the highest among complexes nationwide. The Seoul Digital Industrial Complex is also showing active movements in the sales market with various development news such as the Doosan-gil underpass scheduled for this year, the southern bridge of Cheolsan Bridge, and the Sinansan Line expected to be completed in 2024.

In the Gyeonggi region, Siheung City had the highest number of approvals with 10 cases. In particular, the industry explains that occupancy has explosively increased in recent years mainly in standalone knowledge industry centers around the Eungye District. This area, considered a representative work-residence proximity region, has further highlighted its geographical advantages following the announcement of the construction plan for the new road line connecting Mok-dong in Seoul and Daeya Station in Siheung last April. Outside the metropolitan area, 6 approvals and changes were made in Eumseong-gun, Chungcheongbuk-do, attracting attention.

Hwang Han-sol, a research fellow at Economy Manlab, said, “Knowledge industry centers can be invested in with relatively small amounts, and with government tax support reducing the burden, demand has greatly increased, leading to a trend of increasing supply.” However, he added, “Recently, oversupply has occurred in some areas, so it is necessary to thoroughly consider location and underlying demand to avoid premature investment.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.