Korea Real Estate Board Announces 2021 Q2 Commercial Real Estate Leasing Market Trends

[Asia Economy Reporter Jo Gang-wook] The nationwide commercial real estate rental price index for the second quarter of this year was found to have declined across the board. On the other hand, investment returns increased compared to the previous quarter.

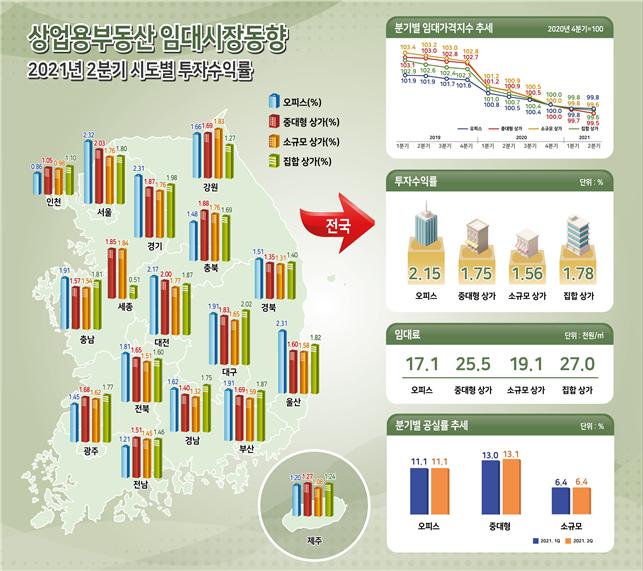

According to the Korea Real Estate Board's second quarter commercial real estate rental trend survey on the 28th, the rental price index for the second quarter of this year fell across the board, with offices down 0.09%, medium-to-large and small-scale/multi-tenant shopping centers down 0.21%, 0.21%, and 0.15%, respectively.

The national average rent was 17,100 KRW/㎡ for offices (average for 3rd floor and above), and for shopping centers (based on the 1st floor), 27,000 KRW/㎡ for multi-tenant, 25,500 KRW/㎡ for medium-to-large, and 19,100 KRW/㎡ for small-scale, in that order.

The Real Estate Board explained, "The office rental price index declined due to an increase in listings caused by decreased tenant demand and prolonged vacancies, mainly in aging offices in provincial areas with low preference. Shopping centers declined across all types due to prolonged social distancing measures such as capacity restrictions and operating hour limits, leading to commercial district stagnation and worsening perceived economic conditions."

On the other hand, investment returns, which indicate the performance of holding real estate for three months, were found to have increased. Investment returns are calculated by summing income yield and capital yield.

Office investment returns were 2.15%, medium-to-large shopping centers 1.75%, small-scale shopping centers 1.56%, and multi-tenant shopping centers 1.78%.

Income yields, representing rental income, were 0.99% for offices, 0.87% for medium-to-large shopping centers, 0.80% for small-scale shopping centers, and 1.04% for multi-tenant shopping centers. Capital yields, representing asset value changes, were 1.16% for offices, 0.88% for medium-to-large shopping centers, 0.76% for small-scale shopping centers, and 0.74% for multi-tenant shopping centers.

The Real Estate Board stated, "Although income yields declined due to reduced rental income amid the ongoing COVID-19 pandemic, investment returns increased across all types compared to the previous quarter due to asset value rises driven by abundant liquidity and a low-interest rate environment attracting investment demand."

The national average vacancy rates were 11.1% for offices, 13.1% for medium-to-large shopping centers, and 6.4% for small-scale shopping centers.

By region, in Seoul, amid expectations for economic recovery due to vaccination and concerns over commercial district stagnation caused by the prolonged COVID-19 pandemic, the rental price index for medium-to-large (down 0.05%) and small-scale shopping centers (down 0.12%) declined, while multi-tenant shopping centers (up 0.02%) showed a slight increase.

In Incheon, due to an increase in non-face-to-face business operations, tenant demand shifted from central commercial districts to rear shopping areas with lower rents, resulting in a decline in the rental price index (medium-to-large down 0.64%, small-scale down 0.72%, multi-tenant down 0.51%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.