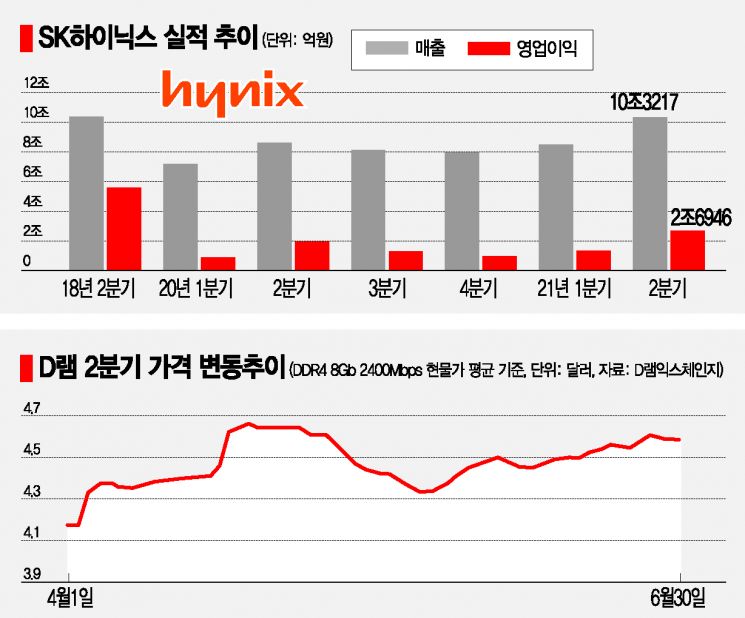

Quarterly Sales Recover to 10 Trillion Won After 3 Years

Operating Profit Highest Since Q4 2018

Annual Sales Expected to Reach 40 Trillion Won, Operating Profit 10 Trillion Won

Experts Say "DRAM Price Peak Still Far Away"

[Asia Economy Reporters Kim Hyewon and Woo Suyeon] SK Hynix has recovered quarterly sales of 10 trillion won for the first time in three years, thanks to the improvement in the memory semiconductor market. Amid rising expectations for a semiconductor supercycle (long-term boom), there are forecasts that solid demand and price increases in the second half of this year will enable annual sales of 40 trillion won and operating profit of 10 trillion won.

SK Hynix announced on the 27th that it recorded sales of 10.3217 trillion won and operating profit of 2.6946 trillion won in the second quarter. These figures represent increases of 19.91% and 38.3%, respectively, compared to the same period last year. The operating profit is the highest since the fourth quarter of 2018 (4.43 trillion won) and increased by 103% compared to the previous quarter. SK Hynix explained, "The demand for PC, graphics, and consumer memory increased significantly, and server memory demand also recovered, leading to improved performance," adding, "Sales of advanced process products such as 10nm-class 2nd generation (1y) and 3rd generation (1z) DRAM and 128-layer NAND flash increased, enhancing cost competitiveness."

DRAM prices, which had been fluctuating since the beginning of this year, rose sharply in the second quarter. The fixed transaction price of DRAM (PC DDR4 8Gb basis) in the second quarter increased by 26% compared to the first quarter. A fixed price increase of more than 20% in a short period is the first in over four years since the first quarter of 2017 (38%). The price increase trend was quickly reflected in the spot market. While the spot price (DDR4 8Gb basis) remained at $4.1 until the end of March, it rose to about $4.5 by the end of June, increasing by more than 10%.

Experts expect DRAM prices to continue rising steadily in the second half, including the third quarter. Although the rate or speed of increase may slow compared to the first half, it is generally considered too early to discuss a peak. Choi Doyeon, a researcher at Shinhan Financial Investment, said, "Although some customers' inventories are somewhat high, manufacturers' inventories are tight, and server demand is expected to continue increasing, so concerns about a peak are premature."

SK Hynix plans to maintain technological competitiveness in DRAM and focus on improving profitability in NAND flash during the seasonal peak in the second half. First, for DRAM, it will increase sales of high-capacity server DRAMs of 64GB or more and supply customers with 10nm-class 4th generation (1a) DRAM, which has started mass production using extreme ultraviolet (EUV) technology.

The next-generation semiconductor DDR5 will begin mass production in the second half. For NAND flash, the company aims to expand sales of 128-layer-based mobile solutions and enterprise solid-state drive (SSD) products, turning profitable in the third quarter and starting mass production of 176-layer NAND from the end of the year.

No Jongwon, Vice President (CFO) of SK Hynix, said, "We expect the NAND division to turn profitable not only in the third quarter but also for the full year," adding, "Although one-time costs may occur from the acquisition of Intel's NAND flash division, scheduled to be completed by the end of this year, these will likely be offset by cost synergy effects from improved market share."

SK Hynix also announced the results of its ESG (Environmental, Social, and Governance) management activities. SK Hynix has maintained its place in the Hall of Fame for eight consecutive years in the 'Carbon Management' category from the Carbon Disclosure Project (CDP) Korea Committee, recognizing its response to climate change and water resource management capabilities, and was selected as the best company in the 'Water Management' category this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.