SME Loan Market Share 23.1%

[Asia Economy Reporter Park Sun-mi] Thanks to the growth of loan assets through expanded support for small and medium-sized enterprises (SMEs) and small business owners, IBK Industrial Bank of Korea (IBK) surpassed 1 trillion KRW in net profit for the first half of this year.

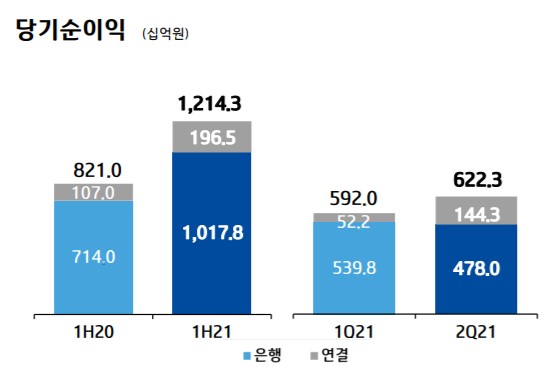

On the 26th, IBK announced that its consolidated net profit for the first half increased by 47.9% year-on-year to 1.2143 trillion KRW, while the bank's standalone net profit rose by 42.5% to 1.0178 trillion KRW.

IBK cited the main factors for the profit increase as loan asset growth through expanded support for SMEs and small business owners including ultra-low interest loans, improved performance of client companies mainly export firms, and favorable results from subsidiaries due to efforts to diversify income sources.

IBK’s SME loan balance increased by 10.4 trillion KRW (5.6%) compared to the end of last year, reaching 197.2 trillion KRW, close to 200 trillion KRW, achieving a record-high market share of 23.1%. The number of SME clients also reached 1.999 million, on the verge of hitting 2 million.

IBK’s interest income for the first half rose 3.6% year-on-year as interest-earning assets increased by 29.8 trillion KRW, and the net interest margin (NIM) for the second quarter rose 4 basis points from the previous quarter to 1.51%. The total loan balance at the end of the first half was 246.1 trillion KRW, up 12.3 trillion KRW (5.3%) from the end of last year.

Despite sufficiently setting aside additional loan loss provisions to prepare for future risks, the loan loss cost ratio reached a record low of 0.31% due to improved performance of SMEs. The ratio of non-performing loans (NPL) classified as substandard or below was 0.95%, and the total delinquency rate was 0.31%, both showing favorable asset quality with decreases of 0.23 percentage points and 0.13 percentage points respectively compared to the same period last year.

Subsidiaries recorded a net profit of 229.8 billion KRW, an 81.5% increase year-on-year, with IBK Capital (+97.2%), IBK Investment & Securities (+43.1%), and pension insurance (+51.8%) showing significant profit growth.

An IBK official stated, “We expect solid performance to continue in the second half as the effects of subsidiary investments made at the end of last year are fully realized,” adding, “We will further strengthen support for small business owners and SMEs struggling due to COVID-19 through various SME support programs and the newly introduced ‘Financial Care Program’ in the second half.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.