Presidential Candidates and Lawmakers Mentioned... Carbon Tax Introduction Bill Proposed

Contrary to Carbon Reduction Tax Purpose... Concerns Over Decline in Domestic Companies' Competitiveness

[Sejong=Asia Economy Reporter Kwon Haeyoung] Concerns among companies are growing over carbon tax populism emerging from the political sphere. Following some members of the National Assembly proposing a bill to introduce a carbon tax that imposes taxes on domestic companies based on their carbon emissions, a leading ruling party presidential candidate recently joined the discussion on establishing a new carbon tax, increasing the likelihood that this issue will become a major point of contention ahead of next year’s presidential election. In particular, the related bill aims to support low-income groups rather than reduce carbon emissions, which contradicts the original purpose of introducing a purpose-specific tax. With the European Union (EU) announcing the introduction of the Carbon Border Adjustment Mechanism (CBAM) starting in 2026, if domestic discussions on the carbon tax intensify, criticism is emerging that it will only increase burdens on companies rather than support their carbon reduction efforts.

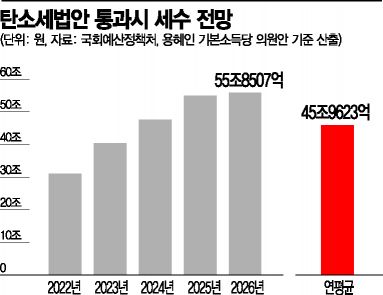

According to the National Assembly Budget Office on the 26th, if a carbon tax is introduced domestically starting next year, the related tax revenue over the next five years is expected to reach 229.8113 trillion won. Considering that this year’s expenditure scale is around 600 trillion won, this means collecting more than one-third from companies in addition to corporate tax.

This is based on an analysis of the 'Carbon Tax Bill' proposed by Representative Yong Hye-in of the Basic Income Party in March. The bill establishes a new carbon tax and sets the carbon tax rate imposed on companies to increase from 40,000 won per ton of CO2 equivalent this year to 80,000 won by 2025. Domestic greenhouse gas emissions were 650 million tons (provisional) as of last year. Based on this, the Budget Office expects the carbon tax collected from companies to reach an average of 4.59623 trillion won annually, approaching last year’s total corporate tax burden of 5.35714 trillion won.

The bill specifies that all carbon tax revenue should be paid in cash twice a year to residents of the Republic of Korea, both nationals and foreigners. Assuming the payment target is the domestic population of 50 million, this would allow for an annual distribution of 920,000 won per person.

However, this ignores the characteristic of a purpose-specific tax. The National Assembly’s Planning and Finance Committee pointed out in a review report that "special taxes among national taxes, such as transportation, energy, environmental taxes, education tax, and special rural tax, are all used for special accounts and projects linked to their respective taxation purposes," and added, "It is appropriate for the carbon tax to be used for purposes aligned with its taxation objective, such as greenhouse gas emission reduction and environmental improvement projects."

Although the bill has been submitted, there has been no discussion so far. However, the business community is expressing concern about the possibility of activation, noting that Lee Jae-myung, a leading ruling party presidential candidate and Governor of Gyeonggi Province, recently mentioned the establishment of a carbon tax.

A business official said, "Imposing a domestic carbon tax will lead to a decline in the competitiveness of our companies in other markets such as Southeast Asia, India, and the United States, and will bring windfall benefits to competing countries," adding, "The bill, which does not consider companies’ transition to carbon neutrality at all, is likely to only damage the competitiveness of domestic industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.