Financial Services Commission Takes a Step Back... Adjusts Reduction Scope of Loan Brokerage Fees

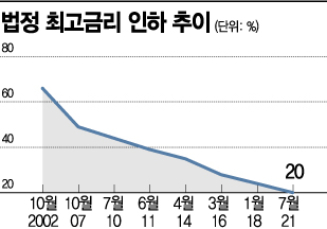

[Asia Economy Reporter Lee Kwang-ho] The upper limit of loan brokerage fees received by intermediaries recruiting customers for loan companies has been finalized at 3% for loan amounts up to 5 million KRW and 2.25% for amounts exceeding 5 million KRW. Initially, the plan was to uniformly reduce the fee cap by 1 percentage point across all brackets, but the financial authorities appear to have aimed to ease the burden on loan companies following the statutory maximum interest rate cut (from 24% to 20%) to prevent a shift to illegal private loans.

According to the financial authorities on the 22nd, the Financial Services Commission approved the amendment to the Enforcement Decree of the Act on Registration of Loan Business and Protection of Financial Consumers (Loan Business Act Enforcement Decree) containing these details at its regular meeting the previous day.

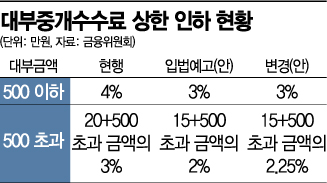

In April, the FSC announced a plan to reduce the upper limit of loan brokerage fees by 1 percentage point each to improve reckless loan solicitation behaviors caused by high brokerage fees and to secure loan capacity for low-credit borrowers in high-interest sectors. Currently, for loans up to 5 million KRW, the fee is 4%, and for amounts exceeding 5 million KRW, it is 200,000 KRW plus 3% of the amount exceeding 5 million KRW. The proposal was to lower these to 3% for loans up to 5 million KRW and 150,000 KRW plus 2% of the amount exceeding 5 million KRW, a 1 percentage point reduction.

However, during the public notice period (May 21 to June 30), opinions were submitted both supporting the fee reduction and opposing or requesting adjustment, arguing that the reduction scope was excessive. After reviewing the feedback and the Regulatory Reform Committee's deliberation results, the FSC decided to somewhat ease the reduction for the bracket exceeding 5 million KRW. According to the revised plan, the fee cap for loans up to 5 million KRW will be reduced by 1 percentage point to 3%, but for amounts exceeding 5 million KRW, a fee of 150,000 KRW plus 2.25% of the excess amount will apply.

An FSC official explained, "We accepted the opinion that it is reasonable to set the reduction rate at 25% compared to the existing cap regardless of the amount," adding, "We plan to promulgate and enforce the amendment next month after review by the Ministry of Government Legislation and the State Council." The official also added, "This measure will increase the number of low-credit borrowers who can access high-interest sector loans."

The FSC estimates that about 310,000 out of approximately 980,000 users of loan company credit loans will be excluded due to the statutory maximum interest rate cut. Among them, it is estimated that 30,000 to 40,000 users will be driven to illegal private loans. Accordingly, supplementary measures such as safety net loans and the Sunshine Loan 17 program are being prepared.

Top 10 Loan Companies Account for 60% of Loans Exceeding 5 Million KRW

Loan companies are relieved by the FSC's recent decision. According to the top 10 loan companies, loans exceeding 5 million KRW account for 60% of their total credit.

An official from a loan company said, "Most loan approvals are divided between amounts under 3 million KRW and those exceeding 5 million KRW, with the latter being more frequent," adding, "There were many complaints from brokerage firms, but at least this gives them some breathing room."

Another official stated, "Although the financial authorities decided to ease brokerage fees for the high-amount bracket, some loan companies are already complaining about deteriorating profitability, withdrawing from the business, or raising loan standards," expressing frustration, "The political circles are fueling demands for further cuts to the statutory maximum interest rate, which is disheartening."

Meanwhile, the FSC has formed a ‘Maximum Interest Rate Reduction Implementation Task Force’ with the Financial Supervisory Service, the Korea Inclusive Finance Agency, the Credit Counseling & Recovery Service, and related financial associations to monitor market conditions amid concerns following the statutory maximum interest rate cut.

A task force official stated, "More than two weeks have passed since the statutory maximum interest rate was lowered, but no unusual trends such as the 'low-credit borrower loan cliff' feared by some have appeared."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)