[Asia Economy Reporter Jeong Hyunjin] ASML, the world's largest semiconductor lithography equipment company based in the Netherlands, plans to expand its production of advanced extreme ultraviolet (EUV) lithography equipment to over 60 units in 2023. As EUV equipment is being increasingly introduced from foundry processes to D-RAM processes, production is being ramped up to meet the growing demand. Major semiconductor companies such as Samsung Electronics and SK Hynix are fiercely competing to secure EUV equipment, which has become essential for semiconductor manufacturing.

From 6 units in 2016 to over 60 units in 2023... 10-fold increase in production over 7 years

According to industry sources on the 22nd, Peter Wennink, CEO of ASML, stated at the Q2 earnings announcement the previous day that the company aims to produce more than 60 EUV machines in 2023. ASML gradually increased its EUV equipment production from just 4 units in 2016 to 31 units last year, about 40 units this year, and plans to produce 55 units next year. In the first half of this year, a total of 16 units were produced and sold.

EUV equipment is a key tool for ultra-fine semiconductor processes. During semiconductor chip production, a lithography process projects laser light onto a silicon wafer, the semiconductor substrate, to imprint circuit patterns. EUV equipment is the only tool capable of engraving ultra-fine circuits below 7 nanometers (nm; 1 nm equals one billionth of a meter).

The problem is that ASML is the only company in the world producing EUV equipment, and manufacturing one unit takes several months, resulting in supply shortages compared to demand. Despite the price per unit reaching 200 billion KRW, semiconductor manufacturers like Samsung Electronics and TSMC line up to purchase these machines for this reason.

CEO Wennink said, "We aim to produce 55 EUV machines next year, and already 80% of the production is booked by the end of Q2 this year," adding, "We expect significant growth over the coming years." He also noted, "Customers think they are buying EUV machines, but in reality, they are purchasing the wafer capacity handled by the machines," and that ASML is upgrading the EUV equipment itself to increase productivity.

EUV expands from foundry to D-RAM processes

The reason for the significant increase in EUV equipment production is the flood of orders from semiconductor manufacturers. Initially, EUV equipment was mainly used in foundry businesses where ultra-fine processes are critical, but recently it has expanded to memory semiconductor D-RAM processes. Global semiconductor manufacturers, including Samsung Electronics and SK Hynix, are continuously communicating with ASML to secure EUV equipment for this reason.

Currently, Samsung Electronics is known to possess about 20 EUV machines. In March last year, Samsung became the first in the industry to apply EUV processes to D-RAM, establishing a mass production system and supplying over one million units of 10-nanometer class 1st generation (1x) DDR4 D-RAM modules to customers. It is expected to start mass production of 10-nanometer class 4th generation (1a) D-RAM in the second half of this year. Following its foundry business competing with TSMC in advanced processes, Samsung is actively introducing EUV equipment into D-RAM production processes as well.

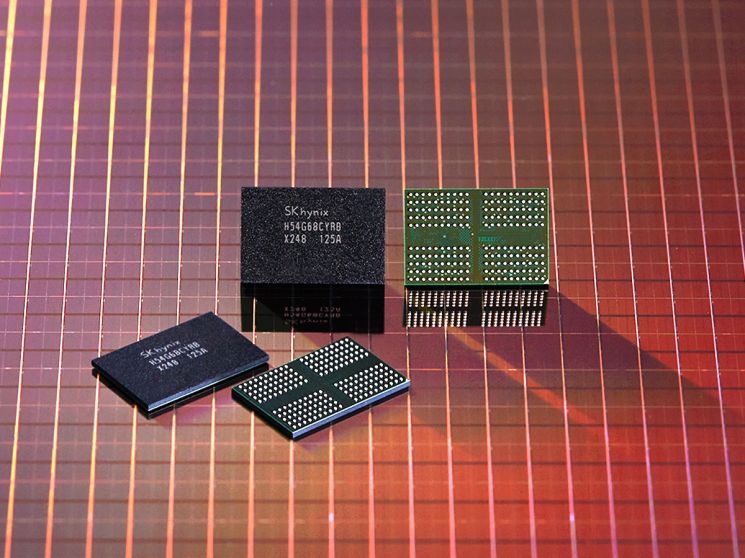

SK Hynix is also accelerating its efforts to secure EUV equipment. In February, SK Hynix signed a contract to purchase EUV equipment from ASML over five years with an investment of 4.75 trillion KRW. Recently, it began mass production of 10-nanometer class 4th generation (1a) D-RAM using EUV equipment. This is the first time EUV equipment has been applied to mass production of 10-nanometer class 4th generation D-RAM. Micron, which announced its first success in mass production of 10-nanometer class 4th generation D-RAM, uses argon fluoride (ArF) processes. SK Hynix plans to produce all 1a D-RAM products using EUV in the future.

Micron, ranked 3rd or 4th in the D-RAM industry, and Taiwan's Nanya have also declared plans to gradually introduce EUV equipment into their processes. Micron announced at its earnings conference call at the end of last month that it will adopt EUV equipment starting in 2024. Since EUV equipment production takes a long time, it emphasized the need to place orders early and included EUV equipment costs in this fiscal year. Nanya revealed plans in April to build a new factory equipped with production lines using EUV equipment. This factory is scheduled to begin construction by the end of this year, complete in 2023, and start mass production in 2024.

"No EUV introduction to China" - US blocks the Netherlands

As EUV equipment becomes central to semiconductor production, it has resurfaced as an issue in the US-China trade war. Following the Trump administration, the Biden administration is pressuring the Dutch government to prevent EUV equipment from being exported to China. According to the Wall Street Journal (WSJ) and others, the Dutch government has withheld approval for ASML's EUV equipment exports to China. Foreign media attribute this to pressure from the Biden administration citing national security concerns.

The semiconductor industry is closely monitoring the situation. As EUV processes become increasingly essential in semiconductor manufacturing, companies with factories in China must consider these developments.

Samsung Electronics currently produces NAND flash memory at its Xi'an factory in China but reportedly has no immediate plans to introduce EUV equipment in NAND manufacturing processes. SK Hynix produces D-RAM at its Wuxi factory in China and may consider introducing EUV equipment in the mid to long term, but for now, it plans to focus on domestic production. SK Hynix has currently deployed EUV equipment at its M16 plant in Icheon, Gyeonggi Province.

An industry insider said, "As semiconductor manufacturers advance ultra-fine processes, they are increasingly adopting EUV processes to overcome limitations," adding, "They will invest various efforts to secure and dominate EUV equipment first."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.