Goldman Sachs Survey for Family Offices... 15% "Already Investing" · 45% "Interested in Investing"

[Photo by Reuters]

[Photo by Reuters]

[Asia Economy Reporter Park Byung-hee] It has been confirmed that a significant number of ultra-high-net-worth individuals holding assets in the trillions are interested in investing in cryptocurrencies.

According to Bloomberg on the 21st (local time), a survey conducted by Goldman Sachs targeting family offices that transact with them revealed that 15% have already invested in cryptocurrencies. Additionally, 45% expressed willingness to invest in cryptocurrencies in the future.

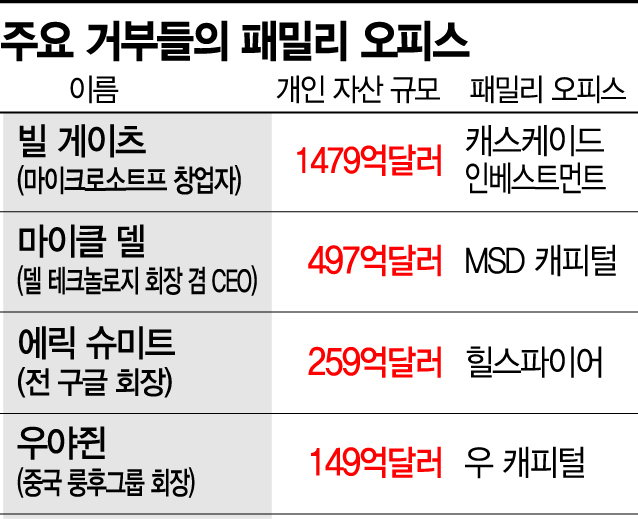

Family offices refer to asset management firms established by wealthy individuals to invest and manage their personal assets. Bill Gates, the founder of Microsoft, who has assets worth $150 billion (approximately 172.7 trillion KRW), owns a family office named Cascade Investment.

Goldman Sachs surveyed more than 150 family offices worldwide. Among them, 67% manage assets exceeding $1 billion, and 22% manage assets over $5 billion.

Goldman Sachs analyzed that family offices have recently diversified their investment assets. While family offices have long invested heavily in private equity and real estate, they have recently made significant investments in Special Purpose Acquisition Companies (SPACs) and are increasing their investments in the cryptocurrency market.

However, skepticism remains about whether cryptocurrencies can be stably integrated into the financial market in the future. In the Goldman Sachs family office survey, 40% responded that they are not interested in investing in cryptocurrencies.

With billionaires emerging rapidly in the IT industry sector, the number of family offices is increasing sharply. Accounting firm Ernst & Young analyzed that the number of family offices worldwide exceeds 10,000, with more than half established since 2000.

Family office analytics firm Camden Wealth estimated that as of 2019, the assets managed by family offices amounted to $6 trillion, making their market size larger than that of hedge funds.

Archegos Capital Management, the Korean-American fund manager Bill Hwang’s family office that shook Wall Street last March, was also a family office. Since family offices manage personal assets, they are subject to less regulatory oversight. However, as the market size expands and side effects affecting the market, such as the Archegos incident, have emerged, calls for stronger regulation are growing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.