Kyobo Securities and Hantoo Securities Preliminary Approval Granted... Kiwoom and Hyundai Motor Securities to Apply for Final Approval

[Asia Economy Reporter Park Jihwan] The securities industry’s entry into the MyData (personal credit information management) business is steadily becoming visible.

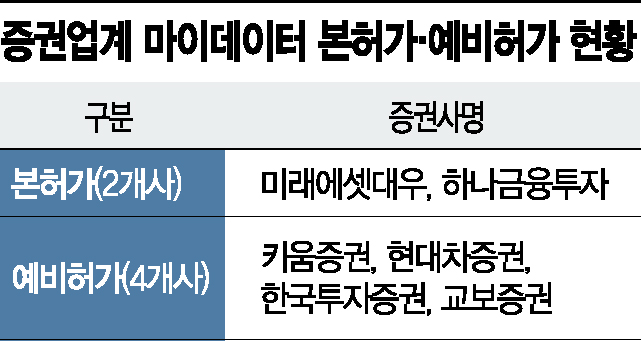

According to financial authorities on the 22nd, the Financial Services Commission approved preliminary permits for Kyobo Securities and Korea Investment & Securities the day before. Kiwoom Securities and Hyundai Motor Securities, which received preliminary permits last month, are expected to soon apply for full permits. Mirae Asset Securities and Hana Financial Investment have already obtained full permits and are preparing to launch their services.

Securities firms have designated the MyData business as a future growth engine and are accelerating efforts to start operations within the year. The MyData business is a service that, with customer consent, aggregates customer information scattered across various financial companies and public institutions to provide personalized financial services. Based on customers’ individual financial information, expansion into areas such as investment advisory and discretionary investment management is anticipated. By combining financial information like card payments with non-financial data such as consumption patterns and lifestyle habits, it becomes possible to expand into personalized asset management services.

An industry insider said, "Previously, if a customer had 100 million KRW in stock balance and 1 billion KRW in bank deposits, securities firms would classify them as an aggressive investor and recommend only high-risk products, but in fact, recommending stable products suited the customer’s preference better. Until now, walls between industries blocked customer information, leading to incorrect judgments about customer tendencies, but now it will be possible to provide customized recommended products and services that match customer information."

Currently, securities firms are busy securing an advantage in the hyper-personalized asset management business through memorandums of understanding (MOUs) with various companies that can create synergy. Mirae Asset Securities plans to provide personalized asset management services recommending savings products, loans, insurance, and credit cards by signing MOUs with Woori Bank, Woori Card, Kyobo Life Insurance, Hanwha General Insurance, and NICE Credit Information Service.

Kyobo Securities also signed an MOU with robo-advisor company ‘Quantec’ to precisely analyze and process individual past investment information and provide customized investment portfolios. Hyundai Motor Securities selected key cooperation areas for hyper-personalized financial services and digital business with the robo-advisor ‘Fount’ and plans to officially launch related services and products starting in the second half of the year.

Competition in hyper-personalized asset management services within the securities industry is expected to accelerate further. Currently, NH Investment & Securities, Shinhan Financial Investment, KB Securities, Daishin Securities, and Hanwha Investment & Securities have applied for preliminary permits and are preparing to enter the MyData market. An industry official stated, "Until the MyData service business opens at the end of the year, specific service details are being strictly kept as trade secrets," adding, "We will present a big picture of services specialized in personalized asset management for each customer."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.