Securities Industry Index Falls 4.37% This Month

Outpaces KOSPI Decline Over Same Period

[Asia Economy Reporter Song Hwajeong] Despite better-than-expected earnings forecasts for securities stocks in the second quarter, their stock prices are showing sluggish trends.

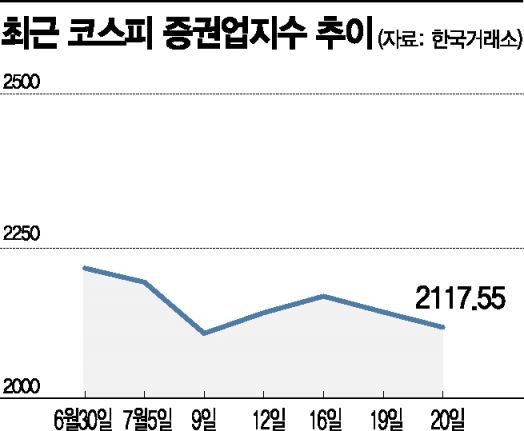

As of 9:10 a.m. on the 21st, the KOSPI Securities Industry Index rose 13.44 points (0.63%) from the previous day to 2130.99, marking a rebound after four days. The securities industry index has fallen 4.37% from the beginning of this month until the previous day, exceeding the KOSPI's (-1.94%) decline during the same period.

Mirae Asset Securities fell to the 8,000 won range yesterday. This is the first time this year that the stock price has dropped below the 9,000 won mark. Samsung Securities fell 2.45%, Korea Financial Group 1.46%, NH Investment & Securities 3.49%, and Kiwoom Securities 9.54% respectively this month.

Concerns about a decline in second-quarter earnings, coupled with the KOSPI's inability to maintain momentum after reaching a peak, are interpreted as reasons for the weak performance in the securities sector. While trading volume surged in the first quarter due to record-high trading volume in January, it decreased in the second quarter compared to the previous quarter, leading to expected earnings declines for securities firms. According to Daishin Securities, the average daily trading volume in the second quarter was 27.1 trillion won, down 18.8% from 33.3 trillion won in the first quarter. Accordingly, brokerage commission revenue is estimated to have decreased by 24.4% for Korea Financial Group and 22.5% for Mirae Asset Securities.

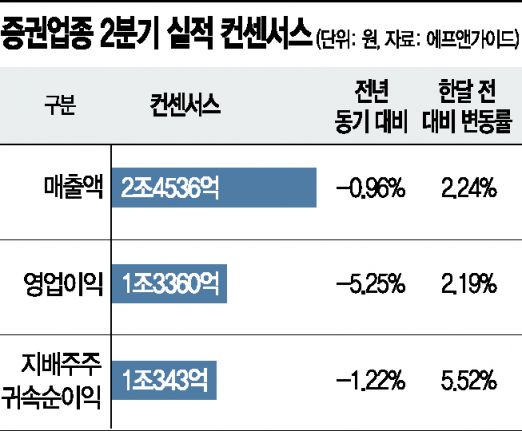

Although a decline in second-quarter earnings for the securities sector compared to the same period last year or the previous quarter seems inevitable, it is expected to be better than market consensus. While brokerage revenue will decrease, steady performance in corporate finance (IB) and other areas is expected to offset these concerns. Lee Hongjae, a researcher at Hana Financial Investment, said, "The combined second-quarter net income attributable to controlling shareholders of four companies?Mirae Asset Securities, Korea Financial Group, NH Investment & Securities, and Samsung Securities?is expected to be 958.1 billion won, down 22.7% from the previous quarter but slightly exceeding consensus." He added, "The 'peak out' of brokerage indicators in the first quarter was already sufficiently anticipated by the market, and although short-term interest rates rose significantly more than expected, creating a somewhat unfavorable trading environment, the expansion of IB income and recognition of investment asset income will help defend earnings relatively well."

Based on the solid performance of securities stocks this year, valuation recovery and price increases are also expected. Kim Jiyoung, a researcher at Kyobo Securities, said, "Customer deposits are maintaining a historic high of around 60 trillion won, and the average daily trading volume is expected to remain above 20 trillion won." She added, "With domestic time deposit interest rates still at low levels, the attractiveness of stock investment remains due to rising real estate prices and trading burdens caused by regulations, and the expansion of the IB sector is positive for long-term growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.