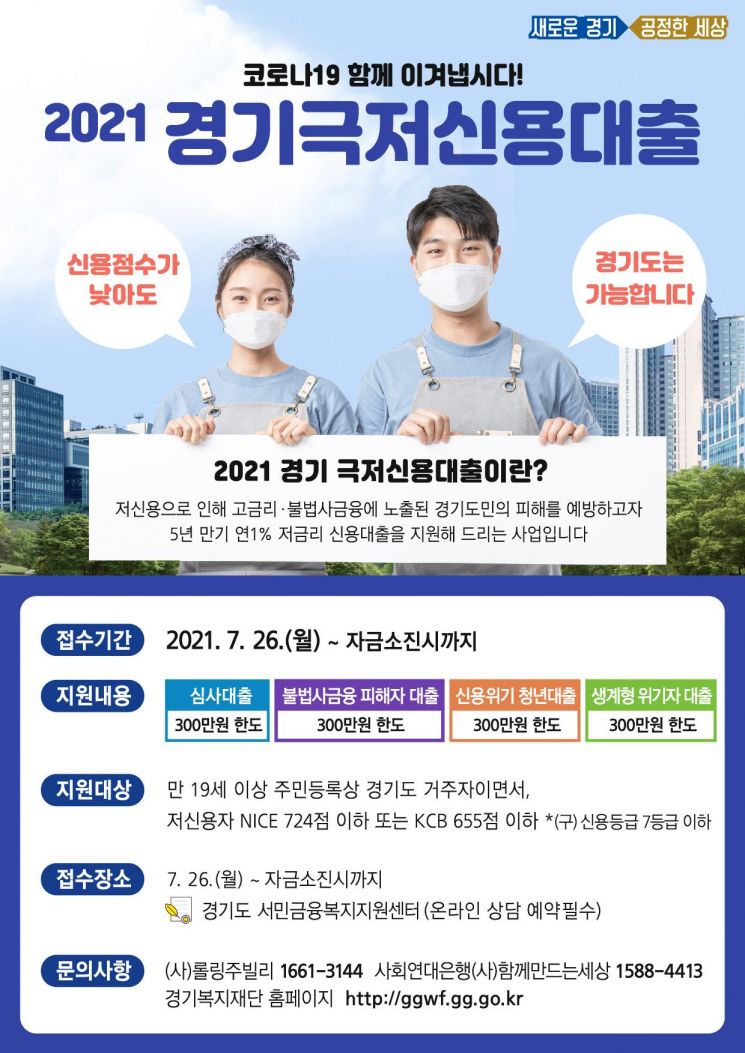

[Asia Economy (Suwon) = Reporter Lee Young-gyu] Gyeonggi Province will begin accepting applications for the 'Gyeonggi Ultra-Low Credit Loan,' which provides emergency living funds to low-credit individuals facing financial difficulties, starting from the 26th.

The Gyeonggi Ultra-Low Credit Loan is a program that supports low-credit residents with loans of up to 3 million KRW at a low interest rate of 1% per annum, with a 5-year maturity, after screening.

In the first half of this year (March), a total of 1,3102 people received loans amounting to 20.982 billion KRW.

Eligible applicants must be residents of Gyeonggi Province as of the application date, aged 19 or older, with a NICE credit score of 724 or below, or a KCB credit score of 655 or below.

According to the existing criteria, this corresponds to a credit grade of 7 or lower.

The province operates three additional loan programs alongside the screened loans based on credit scores: ▲ loans for victims of illegal private loans ▲ credit crisis youth loans ▲ livelihood crisis loans. The loan amounts and interest rates are the same as those for the screened loans.

Recently, due to an increase in cases of illegal private loan fraud impersonating government or public support, the province has established the 'Illegal Private Loan Victim Loan' to support victims.

Residents who have suffered from illegal private loan fraud can report their cases to the Gyeonggi Province Illegal Private Loan Victim Reporting Center and, after counseling, receive loan services up to a limit of 3 million KRW.

The 'Credit Crisis Youth Loan,' launched in the first half of this year, supports youth under 39 not only with loans but also with financial education to aid their independence.

From this application period, in addition to existing debt adjustment candidates under the Credit Recovery Committee, those who have delayed student loan payments to the Korea Student Aid Foundation for six months or more can also apply for loans.

Additionally, the province offers the 'Livelihood Crisis Loan' for low-income residents who are unable to pay fines due to financial hardship after receiving simple fines.

Applications can be made from the 26th of this month through prior reservation for financial counseling via the Gyeonggi Welfare Foundation (ggwf.gg.go.kr) and the Community Finance Welfare Support Center online (gcfwc.ggwf.or.kr).

Applications will close once the project budget is exhausted. For detailed inquiries about the loan application process and required documents, please contact the dedicated 'Gyeonggi Ultra-Low Credit Loan' call center (1661-3144, 1588-4413) or visit the Gyeonggi Welfare Foundation website (ggwf.gg.go.kr).

Moon Jeong-hee, Director of the Welfare Bureau of the province, emphasized, "We will do our best to strengthen the social safety net for financially vulnerable groups, whose economic difficulties have worsened due to COVID-19, and to eliminate financial blind spots."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.