[Asia Economy Reporter Lee Seon-ae] Defense industry companies are expected to enter a full-fledged improvement trend starting from the second quarter. The second half of the year is a seasonal peak period for orders, during which the Defense Acquisition Program Administration (DAPA) will accelerate budget execution. Additionally, following the securing of missile sovereignty, the mid-term defense plan will be announced in August, leading to increased investment execution related to defense capability enhancement, which is expected to benefit the sector.

According to the financial investment industry on the 17th, this year, a significant portion of the defense capability improvement budget will be executed in the second half, as in previous years, raising expectations for increased orders for related companies. In the first half of last year, the government demanded aggressive fiscal spending in response to the COVID-19 crisis, accelerating budget execution speed across major ministries. DAPA executed 49.0% of its budget cumulatively by May last year, whereas this year, it executed 27.7% by April.

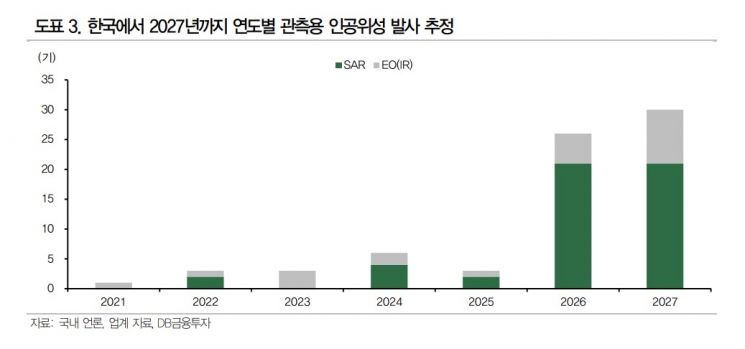

South Korea faces considerable geopolitical risks, making the demand outlook for observation satellites bright. The Korean government, in collaboration with the private sector, estimates a total of 72 satellites to be launched by 2027. The mission lifespan of satellites is five years for medium-sized and three years for microsatellites, generating periodic replacement demand. Although the launch period is concentrated between 2026 and 2027, the selection of related companies is expected to be finalized soon.

Kim Hong-gyun, a researcher at DB Financial Investment, stated, "Among Korean companies, LIG Nex1, Hanwha Systems, Korea Aerospace Industries, and Satrec Initiative are highly likely to directly benefit from the growth process of the observation satellite market."

LIG Nex1 is estimated to begin performance improvement from the second quarter based on a substantial order backlog. The order momentum is expanding not only in domestic and overseas defense but also in the satellite sector. Hanwha Aerospace is expected to lead performance improvement in the civilian sector in the first half and see a strong advance in defense business in the second half.

Accordingly, the general investment opinion is that defense stocks, which are defensive stocks, are more attractive than traditional machinery stocks such as excavators, factory machinery, and cutting tools in the machinery sector this year.

Meanwhile, in the plant sector, as of July, overseas plant order performance was $14.85 billion, down 31.3% from $21.61 billion in the same period last year. However, orders in the Middle East telecommunications sector reached $390 million, showing significant improvement compared to last year's annual order performance. In particular, orders for power transmission and substation facilities surged during the same period. As of July, orders for transmission facilities worth $220 million and substation facilities worth $70 million have been recognized in the Middle East, brightening the order outlook for Korean-related companies. Hyundai Electric is expected to drive qualitative growth with a time lag in improved business conditions in key sectors such as the Middle East, shipbuilding, and Korea Electric Power Corporation (KEPCO).

In the construction machinery sector, as of May this year, Belgium and the United States remain top export countries for Korean excavators, maintaining solid positions, and sales improvements continue in several countries including Russia. However, China’s government has intensified controls on mines and other areas through environmental regulations, affecting demand for medium and large excavators and causing a decline in market share for Korean excavator manufacturers. Hyundai Construction Equipment and Doosan Infracore are estimated to have recorded improved excavator sales in emerging and advanced markets other than China in the second quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.