Background of 10 Trillion Investment in New Growth Engines

Considering Climate Change and Carbon Emissions

Portfolio to Undergo Complete Transformation

6 Trillion Invested in Battery Materials Alone

Aiming to Become a Global Battery Materials Company

[Asia Economy Reporters Choi Dae-yeol, Hwang Yoon-joo] LG Chem holds the world's number one market share in high-performance plastic ABS used in home appliances and automobiles. It also ranks among the top domestic companies in PVC resin used in construction materials, low-density polyethylene (LDPE), and plasticizers. All of these are traditional petrochemical products. Although demand will not plummet immediately, the likelihood of steady use in the future is low. This is because environmental issues such as climate change and carbon emissions are driving the need to replace these with eco-friendly products or produce them through less harmful processes.

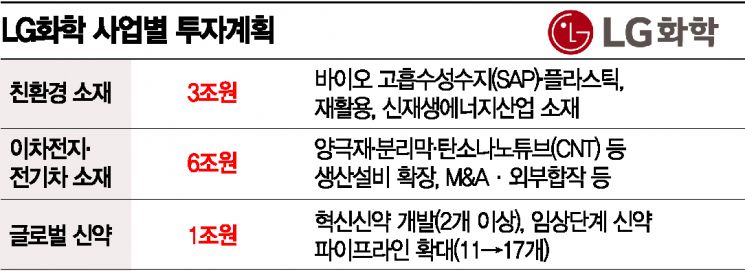

LG Chem's decision to invest 10 trillion won over the next five years in new growth engines is in the same context. During this period, the company plans to focus more than two-thirds of its total investment on new growth sectors such as eco-friendly materials, secondary battery materials, and new pharmaceuticals. The company aims to completely transform its business structure. Shin Hak-cheol, Vice Chairman of LG Chem, said, "Transitioning the business portfolio is essential to respond to rapidly changing markets and customers based on ESG (environment, social, governance). This will be the most innovative change since the company's founding, and visible results can be expected from the second half of this year," emphasizing the goal to enhance company value and sustainability.

Shin Hak-cheol, Vice Chairman of LG Chem, is presenting investment plans at an online meeting on the 14th. Photo by LG Chem

Shin Hak-cheol, Vice Chairman of LG Chem, is presenting investment plans at an online meeting on the 14th. Photo by LG Chem

"World's Largest Comprehensive Battery Materials" 6 Trillion Won Investment in Battery Materials

The largest investment area is battery materials. So far, only some materials like cathode materials and thermal adhesive have been handled, but the company plans to invest 6 trillion won to expand into various fields such as separators and anode binders. The goal is to leap forward as a global battery materials company by proactively concentrating R&D resources.

To this end, LG Chem plans to expand cathode material production capacity, which accounts for 40% of battery costs, sevenfold by 2016. For the separator business, the company is considering mergers and acquisitions (M&A) and joint ventures (JV) to quickly strengthen business capabilities. After acquiring companies with both technological prowess and established customer bases, overseas production bases will be established early.

The reason for LG Chem's aggressive investment in battery materials is the expectation that demand for batteries and battery materials will sharply increase as the electric vehicle market in the U.S. and Europe rapidly grows. Sales of electric vehicle manufacturers like Tesla are increasing annually, and traditional automakers such as Volkswagen and General Motors (GM) plan to cease internal combustion engine vehicle production within a few years, accelerating the spread of electric vehicles.

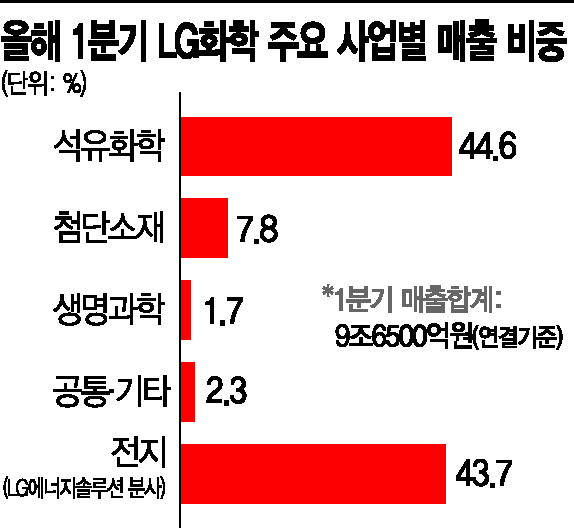

As the electric vehicle market expands, competition over core components such as batteries and battery materials and raw materials has intensified. The U.S. and China, the two major powers, are even engaged in strategic maneuvers over battery supply chains. The battery materials market is expected to grow from 39 trillion won this year to 100 trillion won by 2026. In battery cell manufacturing, Korean companies centered on LG Chem's subsidiary LG Energy Solution compete fiercely with Chinese and Japanese firms, but in the lower tiers of materials and raw material procurement, China and Japan are considered to be ahead.

LG Chem has accumulated over 30 years of battery R&D capabilities and has synergy potential with key affiliates within the group, so it is expected to maintain competitiveness in the market. By completing vertical integration of core battery materials through these investments, LG Chem will be able to supply all core battery materials except electrolyte to LG Energy Solution. Furthermore, it can attract major global battery companies as key clients.

Vice Chairman Shin said, "We plan to maximize synergy with our subsidiary LG Energy Solution through discovering new battery businesses and materials businesses. Since there are not many global companies that deeply understand batteries and simultaneously possess manufacturing capabilities for various materials such as cathode materials, we will grow with differentiated technology," he stated.

Leading Sustainable Business Models with Eco-Friendly Materials

The company is also expanding its eco-friendly materials business. It plans to spend 3 trillion won on bio-based materials, recycling, and renewable energy industries. Starting this month, LG Chem will begin full-scale production of the world's first BioBalance superabsorbent polymer (SAP) product certified with the international eco-friendly bio-product certification ISCC Plus, supplying it to the U.S. and Europe. This product, used in hygiene products such as diapers, is made from plant-based bio-renewable raw materials like waste cooking oil from Neste in Finland and fossil fuels. LG Chem has obtained certification across all processes including production, procurement, and sales for a total of nine products including SAP, PO, and PC.

Additionally, to quickly establish itself in the biodegradable polymer PBAT market used in agricultural and disposable films, the company plans to introduce external technology and start construction of a factory this year. As the bioplastic market is expected to grow rapidly from 12 trillion won last year to 31 trillion won by 2025, LG Chem will soon launch joint ventures with domestic and international raw material suppliers to secure stable supplies of PLA made from plant-based raw materials such as bio-naphtha and corn.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)