Samsung Electronics Investment Frowns, LG Electronics 'Smiles'

Kakao Over Naver, Kakao Games Over NC

[Asia Economy Reporter Lee Seon-ae] In the leading sectors driving the domestic stock market, second-tier stocks and below, so-called "younger siblings," are outperforming the top-tier stocks, or "older siblings." Since last year, liquidity has increased, focusing investors' attention on the market leaders, but in this year's environment of record-breaking index rallies, the younger siblings?second-tier and below stocks?are gaining attention as they are perceived to have greater potential for price appreciation than the market leaders.

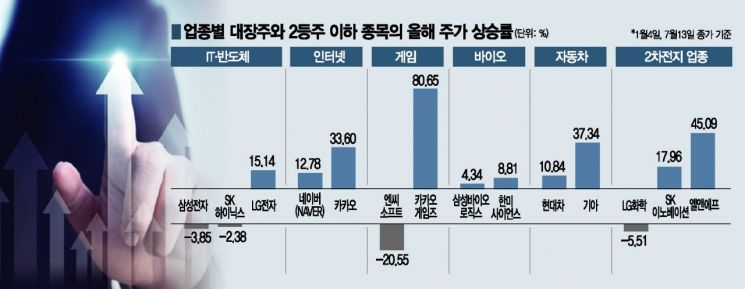

According to the Korea Exchange on the 14th, the year-to-date stock price increase rate of Samsung Electronics, the top stock in the IT sector (based on closing prices on January 4 and July 13), is -3.85%. The stock closed at 83,000 KRW on the first trading day of the year but has remained stuck in the 70,000 KRW range in July, closing at 79,800 KRW the previous day. In contrast, LG Electronics' stock price rose by 15.14%. The stock, which closed at 142,000 KRW on January 4, held up well even during recent market corrections and closed at 163,500 KRW, providing investors with a favorable return. The second-tier semiconductor stock SK Hynix recorded a stock price increase of -2.38%, which is better than Samsung Electronics' return.

The internet sector also shows a clear pattern. The fierce competition between the top stock NAVER and the second-tier stock Kakao is a key point of interest in the stock market. Especially after Kakao surpassed NAVER to become the third-largest by market capitalization, their rivalry has intensified. However, on the 13th, NAVER closed at 441,000 KRW, up 22,500 KRW (5.38%) from the previous trading day (market cap of 72.44 trillion KRW), reclaiming the third position after about a month. Kakao closed at 161,000 KRW, down 1,000 KRW (0.62%) from the previous day. Due to the price drop, Kakao's market capitalization fell to 71.56 trillion KRW.

How was the stock price increase this year? Based on Kakao's stock split (closing prices on April 15 and July 13), the stock price increase rate was 33.60%. During the same period, NAVER's stock price increase rate was 12.78%. Kakao was the star that brought broad smiles to investors.

In the gaming sector, only the market leader struggled. NCSoft hovered around 1 million KRW early this year but currently remains near 700,000 KRW. Its year-to-date stock price increase rate is -20.55%. In contrast, Kakao Games' stock price increase rate this year is a remarkable 80.65%.

In the bio sector, second-tier and below stocks outperformed the market leaders. While Samsung Biologics rose 4.34%, Hanmi Science increased by 8.81%. In the automotive sector, the second-tier stock Kia's stock price increase rate (37.34%) far exceeded Hyundai Motor's (10.84%).

In the secondary battery sector, second-tier and materials stocks outperformed the market leader LG Chem. While LG Chem recorded -5.51%, SK Innovation rose 17.96%, and the materials stock L&F jumped 45.09%.

In the securities industry, it is analyzed that as the price momentum of the market leaders that led the rise has slowed, investors are turning their attention to second-tier and below stocks that still have relatively more room to grow. These stocks have relatively lower valuations or higher expected returns than the market leaders. Jung Yong-taek, head of the IBK Investment & Securities Research Center, evaluated, "The stock prices of the top stocks, which rose significantly until early this year, are moving within a limited range and are unable to rise further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.