Banking Sector's Tepid Response... No One Steps Forward First

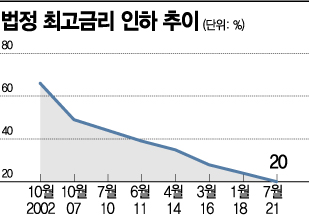

[Asia Economy Reporter Kwangho Lee] The financial authorities plan to create a 'Loan Business Premier League' that selects excellent loan businesses to enable them to raise funds from banks as a supplementary measure following the reduction of the statutory maximum interest rate (from 24% per annum to 20% per annum). However, due to lukewarm responses from the banking sector, doubts have been raised about its effectiveness.

According to the financial sector on the 10th, the financial authorities will accept applications from excellent loan businesses until August 15 and plan to select them around the end of August to launch the Loan Business Premier League. The authorities intend to select excellent loan businesses twice a year (February and August).

To be selected as an excellent loan business, the company must have no violations of financial-related laws such as the Loan Business Act and the Financial Consumer Protection Act during the past three years of operation, have a credit loan performance ratio of about 70% or more or at least 10 billion KRW, and have a plan to maintain existing users after the maximum interest rate reduction.

Once selected as an excellent loan business, the restrictions on fundraising, which were limited to the secondary financial sector such as savings banks or capital companies, will be relaxed, allowing them to raise funds from banks at lower interest rates than before.

However, banks have shown a lukewarm response. Since banks with sufficient loan demand have no reason to endure losses such as reputational damage through transactions with loan businesses.

Therefore, although the selection of excellent loan businesses is just a month away, both commercial banks and regional banks say they will wait and see at that time.

Moreover, even if loans are actually possible, there is a possibility that loan supply through loan businesses may decrease as it concentrates on some loan businesses with excellent soundness.

A bank official said, "We are internally considering it," and added, "There are no specific plans yet." In this regard, a financial authority official said, "Loan execution is at the bank's autonomous discretion and cannot be forced, but if some banks participate, it will gradually expand."

In the market, there are criticisms that if the loan business shrinks despite various measures, the damage will ultimately fall on low-credit borrowers. Currently, the loan approval rate for loan businesses is around 10%, meaning 9 out of 10 people are rejected for loans. Vulnerable groups who need urgent funds but find it difficult to get loans are highly likely to turn to illegal private loans.

According to a recent study released by the Korea Inclusive Finance Agency, 69.9% of those rejected by loan businesses took out loans from illegal private lenders at rates exceeding the statutory interest rate. It is estimated that 30% of borrowers pay interest exceeding the principal, and 12.3% of vulnerable groups pay interest rates exceeding 240% per annum.

An official from the Korea Inclusive Finance Agency emphasized, "The interest costs borne by illegal private loan users are not only economic costs but also social costs," and added, "There is a need to introduce a method to apply the maximum interest rate flexibly according to economic conditions, rather than unilaterally lowering it."

Meanwhile, the financial authorities announced on the 7th that they checked the loan market and the supply situation of policy-based inclusive finance in line with the interest rate reduction implementation, but there were no unusual trends at financial company counters. The authorities plan to continuously monitor market trends and share field situations through the Maximum Interest Rate Reduction Implementation Situation Room. In particular, they will continue to promote the maximum interest rate reduction and government support projects and actively respond to concerns about the spread of illegal private loans through the four-month operation of the government-wide 'Special Eradication Period for Illegal Private Loans.'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)