[Asia Economy Reporter Minji Lee] ArcelorMittal is expected to continue strong performance in the second quarter by reflecting the recovery in steel demand and the rise in selling prices.

According to Hana Financial Investment on the 10th, the company's sales and operating profit for the second quarter are projected to reach $18.57 billion and $4.03 billion, respectively. Compared to the same period last year, this represents an increase of 69.2% and a turnaround to profitability.

Considering the recovery in global steel demand and low inventory levels, along with the continued rise in steel prices in major countries excluding China in the second quarter, ArcelorMittal's steel spread is expected to further widen in Q2. In the first quarter, the price increase was not fully reflected due to contract timing differences, and additional reflection is expected in the second quarter.

Earlier, ArcelorMittal's sales and operating profit in the first quarter were $16.19 billion and $2.54 billion, respectively, marking increases of 9.1% and 1247.4% compared to the same period last year. This was influenced by the recovery in global economic conditions, which boosted demand in steel-related industries including the automotive sector, leading to increased steel shipments in major regions including Europe. The average selling price of steel products rose 17.8% quarter-on-quarter in Q1, driving sales growth. Although shipments in the mining sector decreased by 7% quarter-on-quarter due to seasonal off-season effects, iron ore export prices rose 25% during the same period, significantly increasing sales.

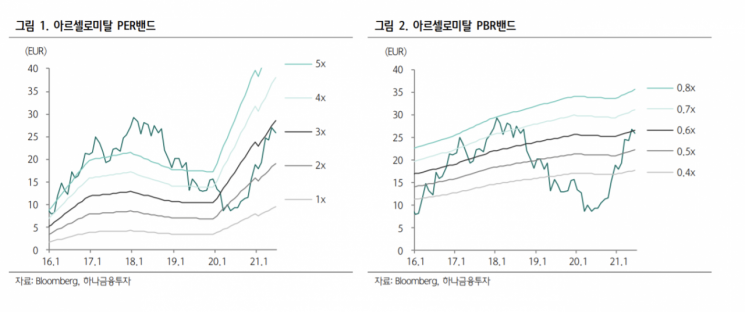

Seongbong Park, a researcher at Hana Financial Investment, said, “Since mid-May, steel distribution prices in China have been adjusted due to government policy responses to overheating raw material prices, but domestic prices in other countries excluding China continue to remain strong, so good operating results are expected in the third quarter as well.” He added that the EU’s safeguard on steel was extended for three years, alleviating concerns about supply-demand expansion due to increased imports, which is also positive. Park also noted, “The current stock price’s PBR is 0.6 times, so valuation pressure is limited.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.