Grace Period for On-Chain Law Enforcement Ending Soon

Deadline for Cryptocurrency Exchange Business Registration Also in September

Concerns Over Scam Damage if Mass Closures Occur

[Asia Economy Reporters Sunmi Park, Hyojin Kim] As the business registration deadline for online investment-linked (P2P) companies and cryptocurrency operators approaches, concerns are growing that victims of 'eat-and-run' scams?where investors lose their funds due to business closures?will surge.

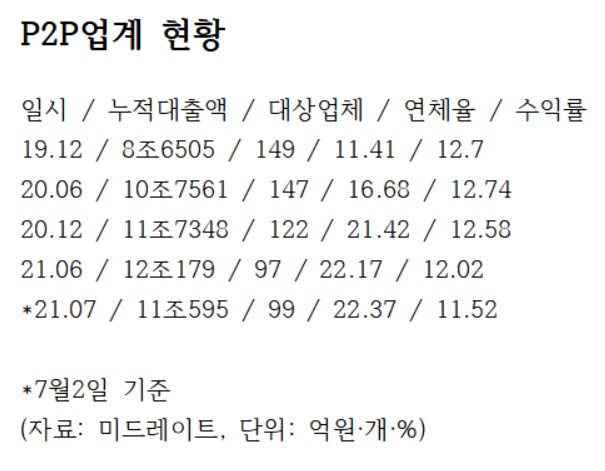

According to the financial sector on the 5th, only about 40 companies have applied for registration ahead of the expiration of the grace period for the enforcement of the Online Investment-Linked Finance Business Act (OnTu Act), which brings P2P finance under regulatory oversight next month. Currently, around 100 P2P companies are operating, and those that fail to register with authorities by the 26th of next month must shut down.

Considering that the registration review by authorities typically takes about three months, it is practically impossible for companies that have not yet applied to complete the process within the deadline. The market expects many companies to either degrade into loan businesses or close down operations in large numbers.

This raises issues regarding the recovery of a significant portion of the 1.7 trillion KRW investment funds. Although loan claim recovery is supposed to be outsourced to law firms for collection, there is no legal binding force.

A P2P company official said, "It is difficult to expect companies forced into an 'unregistered' status and having to cease operations to make efforts to return investment funds to investors," adding, "Many companies are likely to follow the 'eat-and-run' path, leaving investors to bear the losses entirely."

Cryptocurrency Market Also Faces Major Turmoil in September

The cryptocurrency market, where many in their 20s and 30s have invested using borrowed money, is also expected to face major turmoil in September. According to the amended Act on Reporting and Using Specified Financial Transaction Information (Special Financial Transactions Act), cryptocurrency exchanges must complete business registration with the Financial Intelligence Unit (FIU) of the Financial Services Commission by September 24, meeting requirements such as real-name verified deposit and withdrawal account opening and Information Security Management System (ISMS) certification.

As the Financial Services Commission is wrapping up consulting for cryptocurrency exchanges by the end of this month to support their business registration, the possibility of closures is increasing for companies that did not participate in the consulting, excluding about 30 companies that did.

An FIU official stated, "We cannot be certain that all consulting participants will register their businesses by September 24, but participation itself indicates an intention to continue operations, so we expect these companies to prepare for registration by September," adding, "However, even though more than 10 exchanges currently meet ISMS certification requirements, only a few have secured real-name bank accounts, so while registration may prevent closure, many exchanges will likely be unable to operate KRW markets."

Currently, except for four companies?Upbit, Bithumb, Coinone, and Korbit?that have contracts with banks for deposit and withdrawal accounts, the possibility of other companies securing new real-name accounts is slim. Banks have requested indemnity from financial authorities due to concerns about future financial accidents, but Financial Services Commission Chairman Eun Sung-soo has publicly rejected this.

Market Impact Inevitable if Exchanges Close in Droves

The problem is that without indemnity, banks are reluctant to actively issue real-name accounts, making the mass closure of exchanges inevitable. Consequently, there are concerns that many victims will emerge who cannot recover their funds.

A financial industry insider said, "A 'coin run'?where users simultaneously attempt to withdraw funds?could occur around September, and some operators who managed funds in a 'Ponzi-like' manner will be unable to return money," adding, "Various lawsuits will erupt, and investors are likely to rush to banks demanding withdrawals instead of the closed exchanges."

In response to growing demands for enhanced notifications to minimize investor losses ahead of the wave of closures of P2P companies and cryptocurrency exchanges in August and September, financial authorities have begun reviewing measures. The Financial Services Commission stated, "We believe it is necessary to provide sufficient information so that investors using unregistered cryptocurrency exchanges can withdraw funds or transfer virtual assets to registered operators before September 24," adding, "Details regarding the schedule and scope of information provision will be reviewed through legal examination and consultations with related agencies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.