"Customers Are Subject to DSR 40% from Today... Less Credit Loan Available"

[Asia Economy Reporters Sunmi Park, Kiho Sung, Seungseop Song] "With the enforcement of the Financial Consumer Protection Act (FCPA), loan procedures have become more complicated, and since the strengthened loan regulations took effect today, we've been overwhelmed with inquiry calls for the past few days." (Loan officer at Bank A in Jung-gu, Seoul)

“The detailed regulations related to the new rules were created on such a tight schedule that we are also struggling to keep up.” (Credit officer at Bank B in Jongno-gu, Seoul)

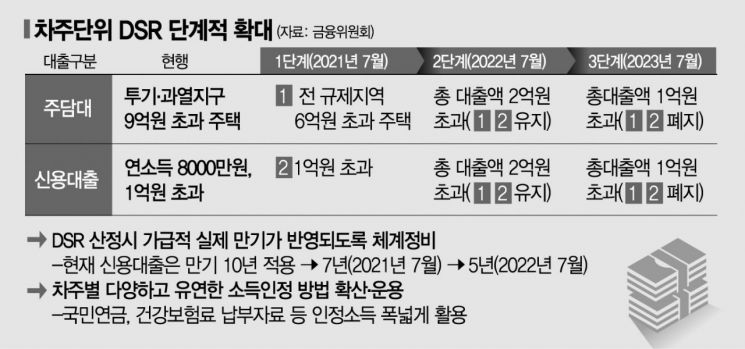

On the first day of the new household debt management plan, which expands the application of the debt service ratio (DSR) on a borrower basis, on the 1st, major commercial bank branches were flooded with calls inquiring about the changed loan regulations from the morning. Most inquiries were about how much the loan limit would be reduced when applying the regulations, whether retroactive application would apply to pre-signed contracts for mortgage loans, and similar concerns.

The core of this regulation is applying a 40% DSR to mortgage loans exceeding 600 million KRW and unsecured loans exceeding 100 million KRW. Given the ultra-strong regulation, questions poured in not only about loan limit reductions but also about whether DSR would apply when extending unsecured loans and whether additional jeonse (key money deposit) loans would be allowed. Many calls were about whether existing borrowers could obtain new unsecured loans.

An employee in charge of credit at Bank C in Mapo-gu said, "Since home purchases are planned months in advance, many people had consultations beforehand for mortgage loans, but since it is the first day of the new regulation, many people whose contract dates fall after July are inquiring about the possible loan limits under the changed regulations." A teller at Bank D's Yeouido branch said, "Before coming to work, I received a call on my mobile phone from an existing mortgage loan customer," adding, "It was an inquiry about an unsecured loan, but since retroactive application is not allowed, the possible loan amount will be significantly reduced."

Since the new regulations aim to lend only as much as the borrower can repay, customers worried about reduced loan limits continued to voice their concerns. A representative from Bank E's Gangnam branch explained, "Most of the customers inquiring are facing reduced limits," adding, "We inform customers who need additional funds that financing through secondary financial institutions is possible, but many are concerned about the relatively high interest rates."

In fact, savings banks are preparing for loan demand and inquiries shifting from commercial banks. A representative from a savings bank branch said, "When new regulations are implemented, the secondary financial sector is quiet at first, but gradually the number of people asking about limits and eligibility starts to increase."

From FCPA to New Loan Regulations... Increased Work Fatigue Among Bank Employees

With the enforcement of the FCPA increasing bank employees' workload, the application of new loan regulations has led to a surge in complaints about work fatigue. In particular, regulations used to change once every two to three years, but now new real estate measures and loan regulations come out almost monthly, making customer service more exhausting.

One branch employee said, "The loan limit under the changed system can be calculated by inputting data into the computer, but the most burdensome part is the complaints from customers whose loan limits have been reduced," adding, "Since mortgage loans are often part of a long-term plan, if the limit is reduced more than expected, customers tend to blame the bank employees."

Another branch official revealed, "Every time new regulations come out, the detailed internal application rules and documents change, but since official notices arrive just before the enforcement date, there are many cases where sufficient guidance was not provided to existing clients," adding, "In fact, many bank employees only understand the contents after seeing the official notices late."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.