Enforcement of the Special Financial Transactions Act until September 24... Contract Maturity Likely to Be Delayed

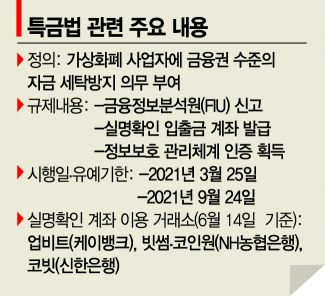

[Asia Economy Reporter Jin-ho Kim] Shinhan Bank and K Bank are seriously considering extending their real-name account contracts with cryptocurrency exchanges such as Upbit and Korbit. Similar to NH Nonghyup Bank, it is widely expected that the contract expiration will be postponed until September 24, when the Act on Reporting and Using Specified Financial Transaction Information (the Specified Financial Transactions Act, or Specified Act) comes into effect. The official decision on contract renewal is anticipated to depend on whether the Specified Act registration is approved.

According to the financial sector on the 1st, Shinhan Bank and K Bank have decided to continue providing real-name account services to Korbit and Upbit, respectively, until the Specified Act registration deadline. A source familiar with internal matters stated, "Both banks have agreed to provide existing services until the Specified Act registration deadline. If the registration is not approved, the contracts will naturally be terminated, so there will be no significant changes for now."

Real-name account partnerships are essential elements for the Specified Act registration, along with Information Security Management System (ISMS) certification. Earlier, on the 24th of last month, Nonghyup Bank agreed to extend contract expiration with Bithumb and Coinone until September 24. Although the original contract was set to expire at the end of this month, the extension was explained as allowing time for bank evaluations in line with the grace period for cryptocurrency operators under the Specified Act.

The short-term extension decisions by these banks were made based on managing existing contracts. After the Specified Act registration is approved, official contract renewals will involve more rigorous inspections based on strengthened criteria, including high-risk item checks for individual cryptocurrency exchanges, account segregation, and security systems.

A bank official involved in real-name account partnerships commented, "Until the Specified Act registration is completed, the current contractual relationships will inevitably continue. We are currently conducting thorough reviews to facilitate smooth registration under the Specified Act."

From the banks' perspective, the massive fee income earned from the cryptocurrency boom since the end of last year is a positive factor in evaluating partnerships with exchanges. The total cryptocurrency deposit and withdrawal amount for Shinhan Bank, Nonghyup Bank, and K Bank in the first quarter of this year (January to March) was 64.2 trillion KRW. Consequently, the fee income for these three banks in the first quarter reached 6.8 billion KRW. In particular, K Bank experienced explosive growth through its partnership with Upbit. As of the end of March, K Bank had 3.91 million customers, an increase of 1.72 million from the end of last year. This number exceeds the 1.57 million customers acquired over the past three years (2018?2020), thanks to the cryptocurrency craze.

Unlike the four major exchanges, most other exchanges reportedly have not even found banks to consult with or be evaluated for issuing real-name accounts. These three banks have no plans to consider new partnerships beyond the existing contracts with the four major exchanges. Other commercial banks, including KB Kookmin Bank, Hana Bank, Woori Bank, as well as regional banks like Busan Bank, remain skeptical about issuing real-name accounts due to anti-money laundering concerns.

In response, the Korea Federation of Banks has submitted a request to financial authorities, asking that banks be exempt from liability if money laundering incidents occur despite banks conducting due diligence in real-name account verification, provided there is no gross negligence or intentional misconduct by the banks. Although the financial authorities are expected to announce their stance within this month, the possibility of granting immunity related to money laundering is slim, as there is no precedent for such exemptions.

The Basel Committee on Banking Supervision, which sets global financial supervisory standards and discusses issues among regulatory authorities, is also skeptical. The Basel Committee recently pointed out that cryptocurrencies are being exploited for money laundering and terrorist financing, putting banks' anti-money laundering efforts at risk.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.