Loan Brokerage Platform Eliminating 'Digital Legwork' Surpasses 176 Trillion Won in Cumulative Approvals

"Get a Loan from Finda"... Users Up 1200% and Revenue Up 6200% Last Year

Obtains Full MyData Business License... Countdown to In-House CSS Development

[Asia Economy Reporter Junhyung Lee] To get a loan under favorable conditions, “footwork” was essential. However, bank counters are not what they used to be. This is because many financial services have shifted to non-face-to-face channels along with fintech (finance + technology). Loan services are no exception. Through various platforms, it has become possible to quickly and easily check conditions and receive loan funds. With the advent of the MyData (personal credit information management) era, ‘hyper-personalized’ loan products are also emerging one after another.

The problem is that the inconvenience of having to do “digital footwork” remains. The hassle of having to check loan conditions by switching between multiple financial institutions’ applications and comparing them one by one has not disappeared.

Partnership with About 40 Financial Companies... Word of Mouth Drives Loans Up to 176 Trillion KRW

Fintech startup ‘Finda’ solved this problem. Finda is a ‘loan comparison brokerage platform’ that compares loan products from about 40 financial institutions to find the best conditions. There is no need to submit supporting documents containing personal credit information. Once signed up, it links user information with partnered financial companies and even recommends customized loan products. It takes just about one minute to compare the final confirmed interest rates and limit conditions by financial institution. Centered on office workers, it quickly gained popularity through word of mouth, and the cumulative approved loan amount recently exceeded 207.23 trillion KRW. Currently, the loan amount of Finda users is about 24 trillion KRW. This is the result achieved two years after being selected as the No. 1 service in the loan brokerage sector of the Financial Services Commission’s innovative financial services.

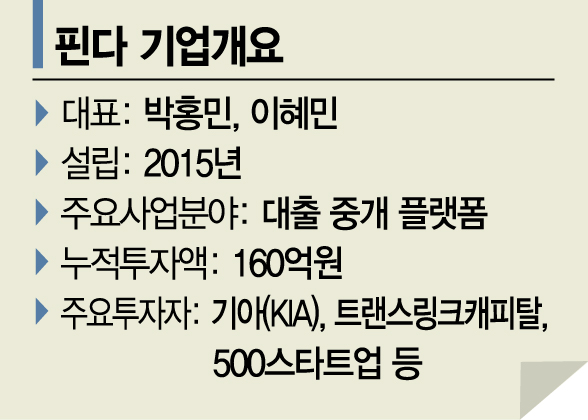

Finda grew significantly last year. This was thanks to the explosive increase in non-face-to-face demand due to COVID-19. In December last year, the number of Finda users increased by about 1200% compared to the same period the previous year. During the same period, sales increased by more than 6200%. Riding on these achievements, early this year, Finda was recognized with a corporate value exceeding 100 billion KRW and raised 11.5 billion KRW in Series B investment. Investors included KIA and Silicon Valley-based venture capital (VC) Translink Capital. Finda’s co-founder and CEO Hongmin Park said, “Loan services are a field with many pain points,” adding, “Creating a service that clearly solves the inconveniences experienced when taking out loans became the foundation for growth.” CEO Park added, “Finda minimizes the opportunity cost and emotional cost involved in getting a loan,” and “The goal of the service is to help users obtain the necessary cash loans in a timely manner.”

In fact, 70% of Finda users received loans at lower interest rates than before using the app. While significantly reducing the time spent obtaining loans, loan conditions were improved. Finda helps not only with ‘borrowing well’ but also with ‘repaying well.’ Users can check repayment amounts such as interest due dates for existing loan products through the Finda app and receive recommendations for refinancing products.

IT Companies Also Interested... Leap to ‘Hyper-Personalization’ with MyData

Finda attracted attention not only from individual users but also from IT companies in various fields. CEO Park explained, “In the early stages of the service, Daum and Toss developed loan and credit card recommendation services based on Finda’s modules,” adding, “We also discussed ways to utilize the financial database (DB) built by Finda with Ticket Monster.”

Earlier this year, Finda also obtained the full license as a MyData operator from the Financial Services Commission. MyData operators can collect and utilize a user’s financial information scattered across banks, insurance companies, and card companies in one place with the user’s consent. Until now, information was received in a limited way through credit rating agencies and partnered financial institutions, but through the MyData business, the accuracy of services can be significantly improved, according to CEO Park. The strategy is to process various types of detailed data and utilize it as big data.

CEO Park said, “We are also preparing to develop our own credit scoring system (CSS) that combines financial and non-financial data to advance the loan comparison service.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.