Financial Services Commission Announces Plan to Restructure Real-Expense Insurance Products

Premiums May Increase Up to 4 Times Based on Non-Covered Service Usage

Aimed at Preventing Excessive Medical Utilization

[Asia Economy Reporter Kim Jin-ho] The '4th generation indemnity insurance,' which increases premiums up to 4 times (a surcharge rate of 300%) based on the usage of non-reimbursable medical items, will be introduced on the 1st of next month. It was created with the intention of lowering premiums compared to existing insurance and charging higher premiums to frequent users to prevent excessive medical use.

The Financial Services Commission announced on the 29th that the 4th generation indemnity insurance will be launched from July 1st, according to the 'Indemnity Insurance Product Structure Reform Plan' announced in December last year.

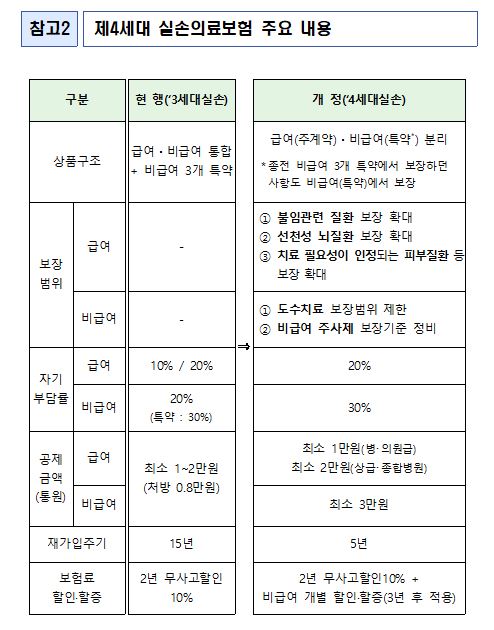

The 4th generation indemnity insurance is characterized by inducing rational medical use through equal adjustment of coverage, application of a differential system, and an increase in the deductible rate. When subscribing to both reimbursable (main contract) and non-reimbursable (special contract) coverage, the coverage range remains the same as before, covering treatment costs for most diseases and injuries. The annual coverage limit for hospitalization and outpatient treatment due to disease and injury is also set at a similar level to before, around 100 million KRW.

The coverage range has been expanded for reimbursable items and reduced for non-reimbursable items. Coverage has been expanded for infertility-related diseases, congenital brain diseases, and skin diseases, which have been raised as necessary due to social and environmental changes, while coverage is limited for some non-reimbursable items such as manual therapy and nutritional supplements, which have significant insurance payout leakage, to prevent overuse of medical services.

Specifically, for manual therapy, previously up to 50 sessions per year were covered if for disease treatment purposes, but going forward, the therapeutic effect must be confirmed every 10 sessions to receive coverage for up to 50 sessions annually. For nutritional supplements, coverage will only be provided if allowed under pharmaceutical laws when used for disease treatment purposes.

The core of the product structure is separating reimbursable (main contract) and non-reimbursable (special contract) items and applying premium discounts or surcharges based on the amount of non-reimbursable medical use. The premium discount/surcharge tiers are divided into five levels based on the amount of non-reimbursable insurance payouts in the previous year. If the previous year's non-reimbursable insurance payout is 0 KRW, a discount of about 5% is applied to the standard premium. The surcharge rates are ▲maintained for amounts exceeding 0 KRW but less than 1 million KRW ▲100% for amounts between 1 million KRW and less than 1.5 million KRW ▲200% for amounts between 1.5 million KRW and less than 3 million KRW ▲300% for amounts exceeding 3 million KRW.

The patient co-payment ratio will also increase. The current 10-20% co-payment rate for reimbursable items will be raised to 20%, and the 20-30% co-payment rate for non-reimbursable items will be increased to 30%.

However, for medically vulnerable groups who require continuous and sufficient treatment, such as for severe diseases like cancer, the differential premium application will be excluded to allow the use of various non-reimbursable medical services including new medical technologies.

Additionally, to appropriately respond to changes in the medical environment such as health insurance policies, the re-enrollment period will be shortened from the current 15 years to 5 years. Premium levels are about 10-70% cheaper compared to existing products. For example, for a 40-year-old male, the premium for 1st generation indemnity insurance is 40,749 KRW per month, whereas the 4th generation indemnity insurance requires only 11,982 KRW per month. Existing indemnity insurance subscribers can easily switch to the 4th generation indemnity insurance at a lower premium if they wish.

From the 1st of next month, 15 insurance companies (10 non-life insurance companies and 5 life insurance companies) will sell the 4th generation indemnity medical insurance. Insurance can be purchased by visiting the insurance companies, calling call centers, through Insurance Damoa, or insurance planners.

A Financial Services Commission official stated, "We will closely monitor the utilization status of the 4th generation indemnity insurance and trends in medical service use to ensure that the effect of reducing the premium burden on subscribers is properly realized," adding, "We will continuously strive to prevent overuse of medical services so that indemnity insurance subscribers are not burdened."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.