Increase the Proportion of Reward Points in 8 out of 11 Locations

[Asia Economy Reporter Park Jihwan] It has been revealed that domestic securities firms are increasingly relying on their affiliates for retirement pension funds. Among the 11 major retirement pension operators in the securities industry, 8 have increased the proportion of affiliate reserves compared to the previous year. Despite criticism that financial companies’ preferential treatment of their affiliates may limit consumers’ (workers’) choices, some securities firms appear to be expanding this practice of favoring their own group.

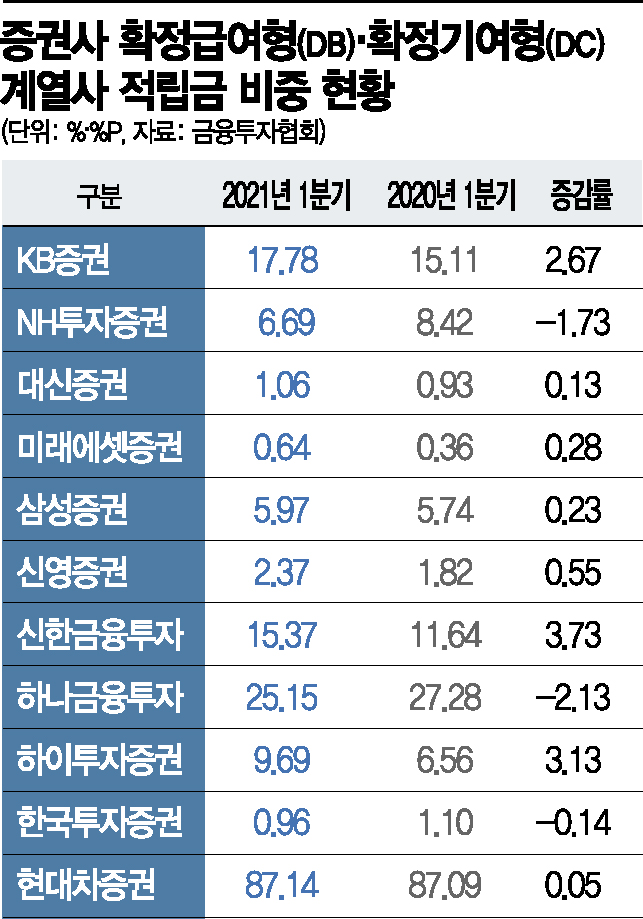

According to the Korea Financial Investment Association on the 29th, among 11 securities firms with combined defined benefit (DB) and defined contribution (DC) reserves exceeding 100 billion KRW in the first quarter of this year, 8 showed an increase in the proportion of affiliate transactions compared to the first quarter of last year. In the first quarter of last year, 7 securities firms increased their affiliate reserve proportions compared to the previous year, but this year, one more firm showed an increase.

Shinhan Financial Investment (3.73 percentage points), Hi Investment & Securities (3.13 percentage points), and KB Securities (2.67 percentage points) showed an increase of more than 2 percentage points in the proportion of affiliate reserves compared to the previous year. These firms also showed the largest increases in the industry last year, with affiliate reserve proportions rising by 1.11, 2.99, and 5.84 percentage points respectively compared to the previous year. Conversely, Korea Investment & Securities (-0.14 percentage points), NH Investment & Securities (-1.73 percentage points), and Hana Financial Investment (-2.13 percentage points) saw decreases in affiliate reserve proportions despite overall reserve growth. These firms had also experienced declines of -0.03, -0.002, and -1.93 percentage points respectively in affiliate reserve proportions the previous year.

The securities firm with the highest proportion of affiliate reserves in retirement pension funds was Hyundai Motor Securities. Out of total reserves of 12.4787 trillion KRW, 87.14% came from affiliates. The next highest affiliate dependency was Hana Financial Investment, with 12.59 billion KRW out of total reserves of 500.5 billion KRW coming from affiliates, representing 25.15%. This was followed by KB Securities (17.78%), Shinhan Financial Investment (15.37%), Hi Investment & Securities (9.69%), NH Investment & Securities (6.69%), Samsung Securities (5.97%), Shin Young Securities (2.37%), Daishin Securities (1.06%), Korea Investment & Securities (0.96%), and Mirae Asset Securities (0.64%).

A higher proportion of own affiliates in retirement pension reserves results in a limitation of workers’ choices. Cho Namhee, head of the Financial Consumer Agency, pointed out, “An increase in the proportion of own affiliates is more likely to prioritize the company’s profits rather than the actual benefits to subscribers,” adding, “At retirement, workers may receive returns far from their expectations, significantly undermining retirement stability.”

The financial sector had resolved by 2015 to reduce the proportion of affiliate reserves to below 50% of total retirement pension reserves, but so far, there are no separate sanctions for violations. A Financial Supervisory Service official stated, “The proportion of affiliate reserves is subject to self-regulation, making it difficult to enforce participation,” but added, “However, compliance is continuously monitored through disclosures and other means.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.