30th Illegal Private Loan Response Pan-Government Task Force Meeting

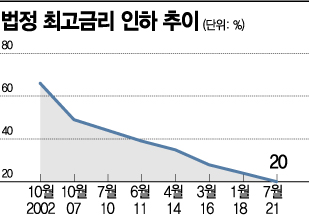

[Asia Economy Reporter Jin-ho Kim] Ahead of the statutory maximum interest rate reduction (from 24% to 20%) taking effect on the 7th of next month, financial authorities have declared war on illegal private loans. The intention is to significantly strengthen monitoring and supervision to ensure that no consumers are driven to illegal private loans due to the maximum interest rate reduction.

According to the financial sector on the 29th, the government will hold an inter-ministerial task force (TF) meeting to respond to illegal private loans on the 30th of this month. This meeting was organized to intensively crack down on the expansion of illegal private loans following the maximum interest rate reduction in the second half of the year and to strengthen inspections.

According to financial authorities, among the 980,000 existing credit loan users of licensed lenders, about 310,000 people (approximately 2 trillion KRW) are estimated to be driven to illegal private loans due to the impact of the maximum interest rate reduction. President Moon Jae-in also urged at the Cabinet meeting in March, "Please strive to improve a more equitable financial structure so that low-credit borrowers are not driven to illegal private loans."

Accordingly, the financial authorities will launch ‘Safety Net Loan II’ and ‘Hae-sal Loan 15’ for vulnerable groups on the 7th of next month, when the maximum interest rate reduction takes effect. The Safety Net Loan is a product that refinances high-interest loans (over 20% per annum) to 17-19%. Hae-sal Loan 15 is a restructured product that lowers the interest rate by 2 percentage points from the existing Hae-sal Loan 17 (17.9% per annum).

Additionally, they plan to provide guidance on new promotional methods of illegal private loans using social networking services (SNS) such as YouTube and prepare measures to minimize damages. They also intend to expand free legal support and the debtor representative system for ordinary citizens struggling with illegal debt collection.

Earlier, the Financial Services Commission submitted a revision bill of the Loan Business Act to the National Assembly, changing the term for unregistered lenders to ‘illegal private lenders’ and limiting the interest they can charge to 6%. According to the revision bill, unregistered operations are punishable by up to five years imprisonment or a fine of up to 100 million KRW, and violations of the maximum interest rate are punishable by up to three years imprisonment or a fine of up to 50 million KRW.

Meanwhile, illegal private loans are becoming more rampant ahead of the statutory maximum interest rate reduction. There are cases of illegal advertisements on SNS and portals, as well as cases of impersonating low-income financial institutions to recommend loans. According to the Financial Supervisory Service, a total of 298,937 illegal loan advertisements were collected over the past year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)