Holding Meetings and Signing Project Agreements in the Metaverse

Effective Promotion to the Predominant MZ Generation

Possibility of Metaverse Financial Branches with Technological Advancement

On the 21st, Chairman Kim Tae-o and representatives of DGB Financial Group affiliates held a group management agenda meeting on the metaverse platform 'Zepeto' produced by Naver Z. Photo by DGB Financial Group

On the 21st, Chairman Kim Tae-o and representatives of DGB Financial Group affiliates held a group management agenda meeting on the metaverse platform 'Zepeto' produced by Naver Z. Photo by DGB Financial Group

[Asia Economy Reporter Song Seung-seop] The financial sector has begun accelerating preparations to enter the metaverse. They are conducting executive meetings in the metaverse and exploring utilization methods through related research. This is interpreted as a strategy to capture the ‘MZ (Millennial + Generation Z)’ generation, the mainstream of the metaverse world and a major customer base for the financial sector, as a future growth engine.

According to the financial sector on the 28th, recently Kim Tae-oh, Chairman of DGB Financial Group, held a management meeting in ‘Zepeto,’ a virtual world created by Naver Z, with five CEOs of affiliated companies. Chairman Kim and each CEO created their own avatars and accessed a virtual conference room set up on a map exclusive to the financial holding company. This meeting was the second, following last month’s management meeting held by DGB Financial Holding executives in Zepeto.

The metaverse is a compound word of ‘meta,’ meaning virtual or transcendence, and ‘universe,’ meaning world or cosmos. It refers to a kind of three-dimensional virtual world and was first introduced by Neal Stephenson in his 1992 novel ‘Snow Crash.’ It is characterized by a space where people can live similarly to reality across politics, economy, society, and culture. In 2019, the market value of the metaverse was only 50 trillion won, but it is expected to increase to 1,700 trillion won by 2030.

Kwon Jun-hak, President of NH Nonghyup Bank (third from the left), is attending the 'D-Talk' seminar held on the 18th at the NH Digital Innovation Campus in Seocho-gu, Seoul, communicating with employees of the Digital R&D Center. Photo by NH Nonghyup Bank

Kwon Jun-hak, President of NH Nonghyup Bank (third from the left), is attending the 'D-Talk' seminar held on the 18th at the NH Digital Innovation Campus in Seocho-gu, Seoul, communicating with employees of the Digital R&D Center. Photo by NH Nonghyup Bank

Last month, Kwon Joon-hak, President of NongHyup Bank, listened to a presentation on the metaverse with employees of the Digital R&D Center and directly ordered the utilization of digital technology. The presentation covered the forms and implementation technologies of the metaverse, key cases, application fields, and expected effects. President Kwon emphasized, “Digital innovation is a survival task on which the future of the bank depends,” and urged, “Please focus all efforts on securing customer-centered platform competitiveness.”

In the case of Shinhan Card, on the 15th, President Lim Young-jin personally met Professor Kim Sang-gyun of Kangwon National University to sign a project agreement to explore metaverse utilization methods. Professor Kim is the author of the books ‘Metaverse’ and ‘Metaverse: New Opportunities.’ A Shinhan Card official explained, “Shinhan Card in the metaverse will be an opportunity to break away from the traditional rigid image of the financial sector for Generation Z and customers, providing new value and experiences.”

The financial sector’s metaverse strategy is analyzed as part of a promotional strategy targeting the MZ generation rather than an immediate profit-making tool. Zepeto has 200 million users (as of last February), with 80% under the age of 18, making the MZ generation the overwhelming majority. The U.S. metaverse platform Roblox has 50% of users under 16 years old, with an average daily user count of 40 million. Hana Financial Research Institute also released a study stating, “Pilot-level introduction of metaverse technology and development of metaverse financial content for the MZ generation are necessary.”

Currently, global giant companies outside the financial sector have already entered the metaverse to target the MZ generation. The global luxury brand Gucci celebrated its 100th anniversary by unveiling a virtual store of its Florence, Italy location inside Roblox on the 17th of last month. In February this year, Gucci attracted attention by releasing over 60 types of clothing, shoes, and bags in Zepeto. Louis Vuitton and Burberry are also showcasing their products in virtual reality through game companies.

Financial Sector Metaverse Boom... Will It Evolve from Simple Promotion to Opening ‘Virtual Branches’?

If technological development and user influx continue, it may be possible to install virtual branches in the metaverse or conduct product introductions and promotions for customers, replacing on-site operations. Global financial companies are introducing metaverse technology into on-site operations at a basic level. Toronto-Dominion Bank in Canada shows investment portfolios through augmented reality (AR) devices when VIP customers request investment consultations. Commonwealth Bank of Australia replaced offline real estate services with AR devices that scan surrounding properties.

KB Financial Group Management Research Institute even proposed opening digital branches and operating digital training centers within Zepeto. On the 7th, Senior Researcher Lee Dong-hoon emphasized, “In the new world called the metaverse, people can experience new knowledge, meaning, and enjoyment through experiences impossible in reality,” adding, “If KB Kookmin Bank opens a branch in Zepeto where its advertising model BTS works as employees, it can build a brand image as a financial group leading digital finance among its main users, Generation Z.”

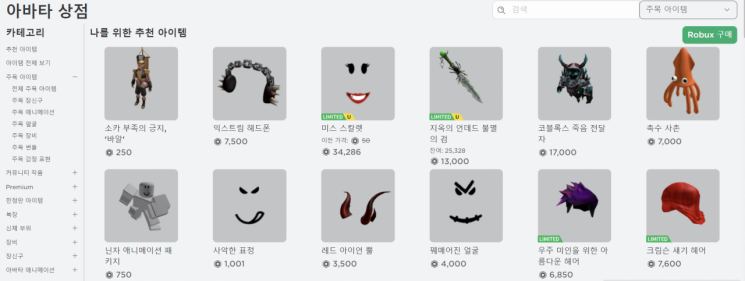

Avatar items sold on Roblox. The virtual currency Robux can be exchanged for cash. Photo by Roblox website

Avatar items sold on Roblox. The virtual currency Robux can be exchanged for cash. Photo by Roblox website

There is also potential to penetrate the asset management market. Roblox already allows virtual currency (Robux) earned in the metaverse to be used as cash. Using mobile financial services like PayPal, 100,000 Robux can be exchanged for about 350 dollars. Although domestic law currently prohibits cashing out game assets, if officially recognized in the future, it would open another financial market in the virtual world.

Meanwhile, fueled by the growth of the metaverse, products investing in related devices or companies have also begun to appear. KB Asset Management has launched a fund investing in representative metaverse stocks listed on global stock markets. Shinhan Financial Group raised a 300 billion won fund in March aimed at strengthening the group’s core digital capabilities by investing in metaverse and gaming sectors. IBK Investment & Securities signed a business agreement with Metacity Forum and plans to cooperate in providing metaverse-related financial services, including branch openings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.